A $300M addition for Ethereum Classic [ETC] is a sign of…

![A $300M addition for Ethereum Classic [ETC] is a sign of...](https://ambcrypto.com/wp-content/uploads/2022/11/etc-e1669293336924.png)

- Ethereum Classic whales are back, but momentum is off to a slow start

Ethereum Classic [ETC] briefly joined the list of the market’s top gainers in the last 24 hours. Many altcoins have found favor with the bulls this week, with quite a few enjoying a bit of an upside too. This rally was backed by a sizeable hike in its market cap too. Now, while that may not seem very important, here’s why it is quite the contrary.

Read Ethereum Classic [ETC] Price Prediction 2023-2024

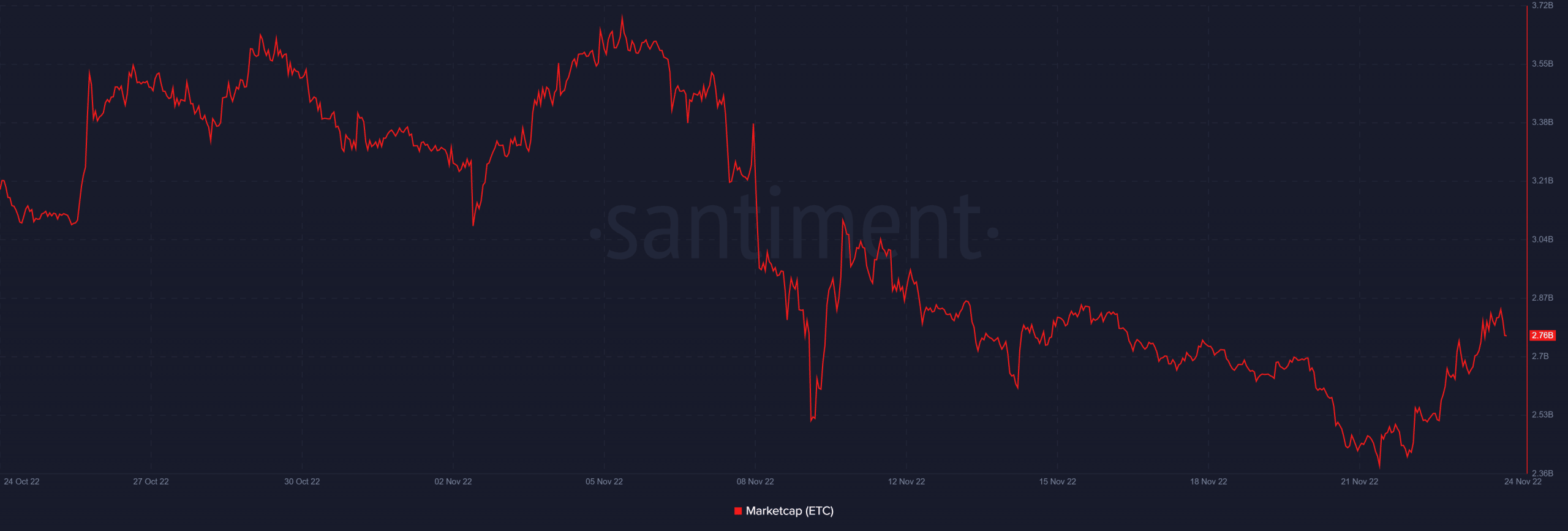

Consider this – A look at ETC’s market cap revealed that it recently dropped to a new 4-month low.

However, it is the subsequent action that is of particular interest. ETC’s market cap bounced back by as much as $320 million over the last 4 days.

Why is this important for the Ethereum Classic network?

Well, aside from ETC being among the market’s top gainers over the last 24 hours, it underscores strong investor interest. The fact that ETC can command an >$300 million hike in market cap is confirmation of strong incoming demand. Especially considering the short time frame.

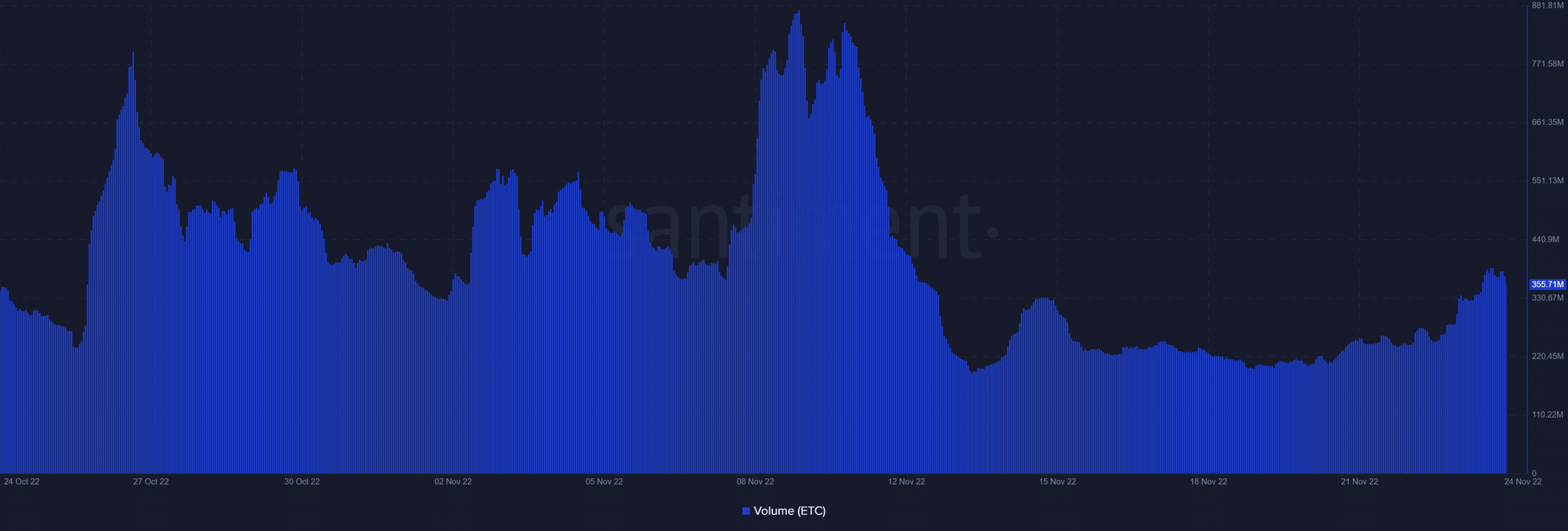

ETC’s market cap surge was backed by a hike in volume during the same period of time. Here, it is worth noting, however, that the volume uptick was rather limited. This is a sign that there was low retail accumulation to support the rally. In other words, the rally was backed by significant whale activity.

Can ETC maintain its prevailing momentum?

Investors should note that the latest upside is largely correlated across the crypto-market. In other words, Ethereum Classic’s ability to continue delivering bullish momentum will depend on the overall market sentiment.

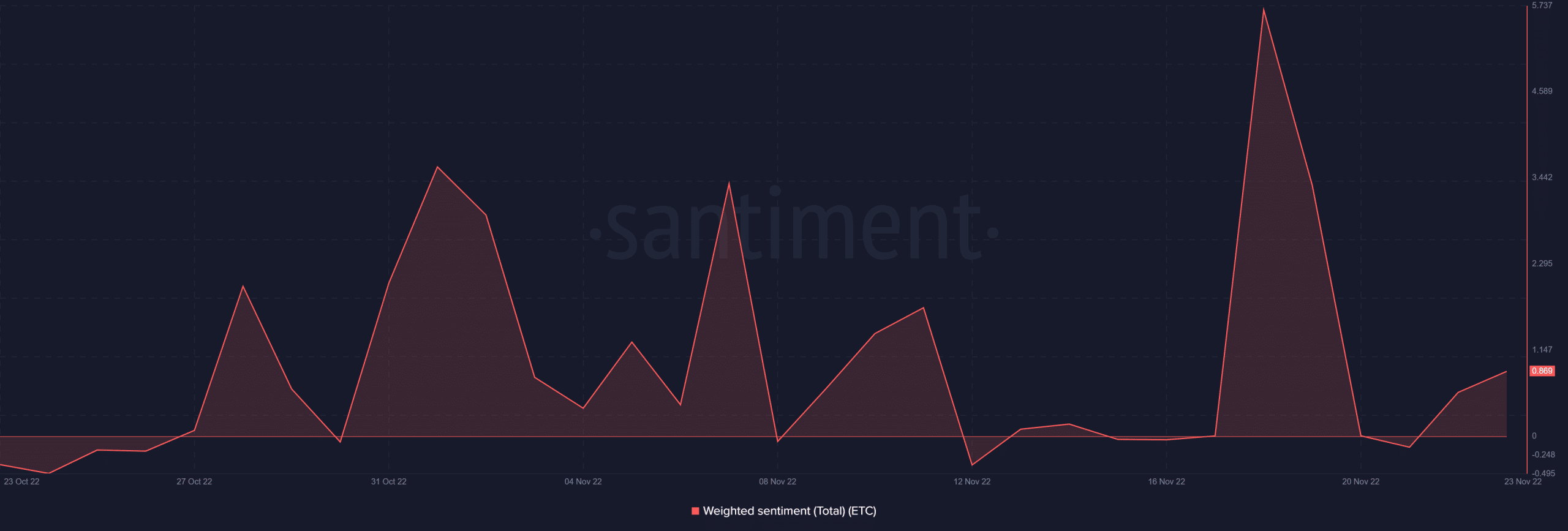

Nevertheless, ETC’s latest upside was supported by a significant shift in sentiment. Its weighted sentiment registered an uptick over the last 3 days, confirming a bullish outlook among investors.

It did not have as much vigor, compared to its previous sentiment bounce. This might be because most investors are still uncertain about the state of the market, especially after the events that caused the recent crash.

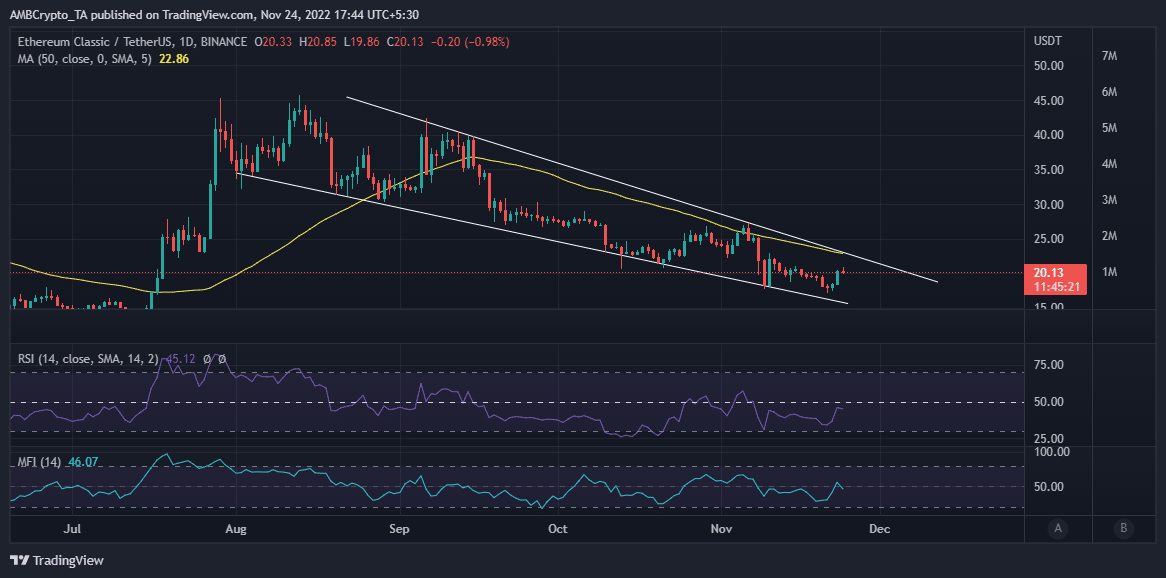

Even so, here’s what investors should note about Ethereum Classic’s price action. Whale activity has been relatively lacking for most of November. The return of whale activity is thus a good sign, confirming that the sentiment is shifting favourably.

The price point at which the whales are buying back is also worth noting. Ethereum Classic has been trading within a downward support and resistance channel since August. As the pattern continues to extend, the probability of a pattern break is higher.

The prevailing momentum has been slow. However, if the market continues to recover, then there is a chance that it will break below its descending resistance line.