Why Bitcoin is not threatened by a rising dollar

- The U.S. dollar index reached its highest level since November 2022.

- BTC’s correlation with DXY was just around 0.11 at the time of publication.

The U.S. dollar index (DXY) has risen a few notches higher, boosted by the Federal Reserve’s signals that one more interest rate hike was imminent before 2023-end.

How much are 1,10,100 BTCs worth today?

In fact, according to a TradingView chart, the rally has been going on for the past two months. The index, which measures USD’s strength against a basket of six foreign currencies, hit its highest level in the last ten months at the time of writing.

Bitcoin immune to USD’s rise

Historically, the USD, considered a safe haven, has had an inverse correlation with supposedly risky assets like stocks and cryptocurrencies. However, recent developments appeared to contradict this pattern. At least, partially.

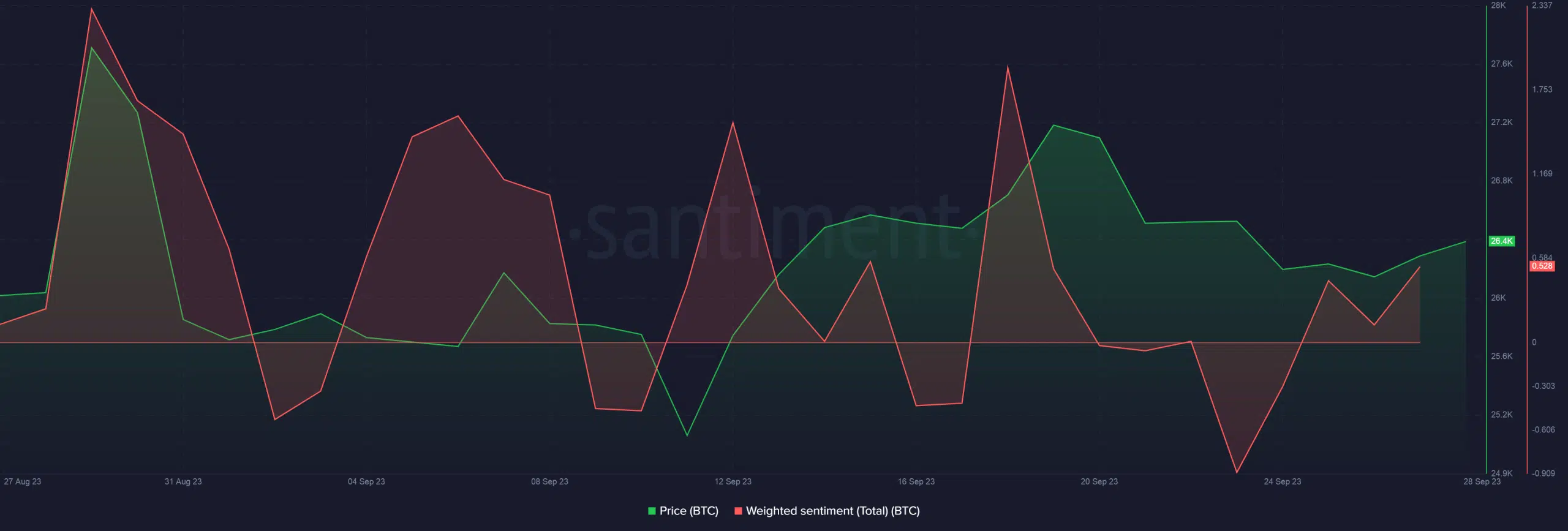

According to on-chain analytics platform Santiment, while the USD has shot up, Bitcoin [BTC] has held steady in the recent weeks. The king coin has wiggled in and around the $26,000-level for most parts, as shown below.

To the contrary, major stock indices like the S&P 500 experienced a significant drop, thereby staying true to the historical tendencies.

Spotting Bitcoin’s resilience in a worsening macroeconomic environment, Santiment heightened the possibility of BTC breaking out of ongoing tight trading ranges once DXY’s rally fades.

Decoupling from TradFi markets

As per another popular on-chain research firm IntoTheBlock, Bitcoin’s relation with traditional finance indicators flipped drastically in recent weeks

BTC’s correlation with DXY was just around 0.11 at the time of publication. In fact, a week ago, it was zero. Needless to say, the decoupling played a part in insulating BTC from DXY’s rally.

Moreover, BTC’s relation with bellwethers of the U.S. financial market—Nasdaq 100 and S&P 500—turned negative. This implied that if the price of one asset rallies, the other one falls and vice versa.

Is your portfolio green? Check out the BTC Profit Calculator

Now, for most parts of its existence, BTC has been labeled as a “risky asset” and clubbed with the stock market. However, the negative correlation could effectively project it as a safe haven, akin to Gold.

At the time of writing, BTC exchanged hands at $26,411, per Santiment. Given its stability in the face of a rising dollar, investors’ sentiment swung from negative to positive for the king coin.