Why Bitcoin is unable to rise above $28k

- A focus on short-term profit taking has had a negative impact on Bitcoin.

- Bitcoin might still not be out of limbo, despite the resurgence of some bullish momentum.

There has been a psychological barrier to the movement of Bitcoin [BTC] in recent weeks. 27 May’s Glassnode data offered some insights into the impact of long-term holder transfer volumes on prices.

Read about Bitcoin’s [BTC] Price Prediction 2023-24

The Glassnode analysis revealed that transfer volumes by long-term holders in profit have been on the rise. In other words, there has been an increase in sell pressure by Bitcoin holders in profit for the last few months.

Transfer Volume sent by Long-Term Holders in Profit has recorded a significant ascent YTD, increasing from $25M to $489M, a near 2000% increase.

However, profitable transfer volume remains $1.24B (-71.4%) below the peak of $1.74B, experienced across the 2021 Bull Market. ? pic.twitter.com/bAoPzsIgdo

— glassnode (@glassnode) May 27, 2023

The sharp increase confirmed that Bitcoin holders have been taking profits. This explains why it has been harder for Bitcoin to sustain its upside above the $28,000 price level. The analysis further looked into the demography contributing to the above observation.

The Glassnode data also disclosed that holders that bought BTC in the last 6 to 12 months have been contributing the most to the sell pressure. These findings reflect previous market observations, which revealed a shift from long-term profits to short-term profits.

How long until another transition to a long-term focus?

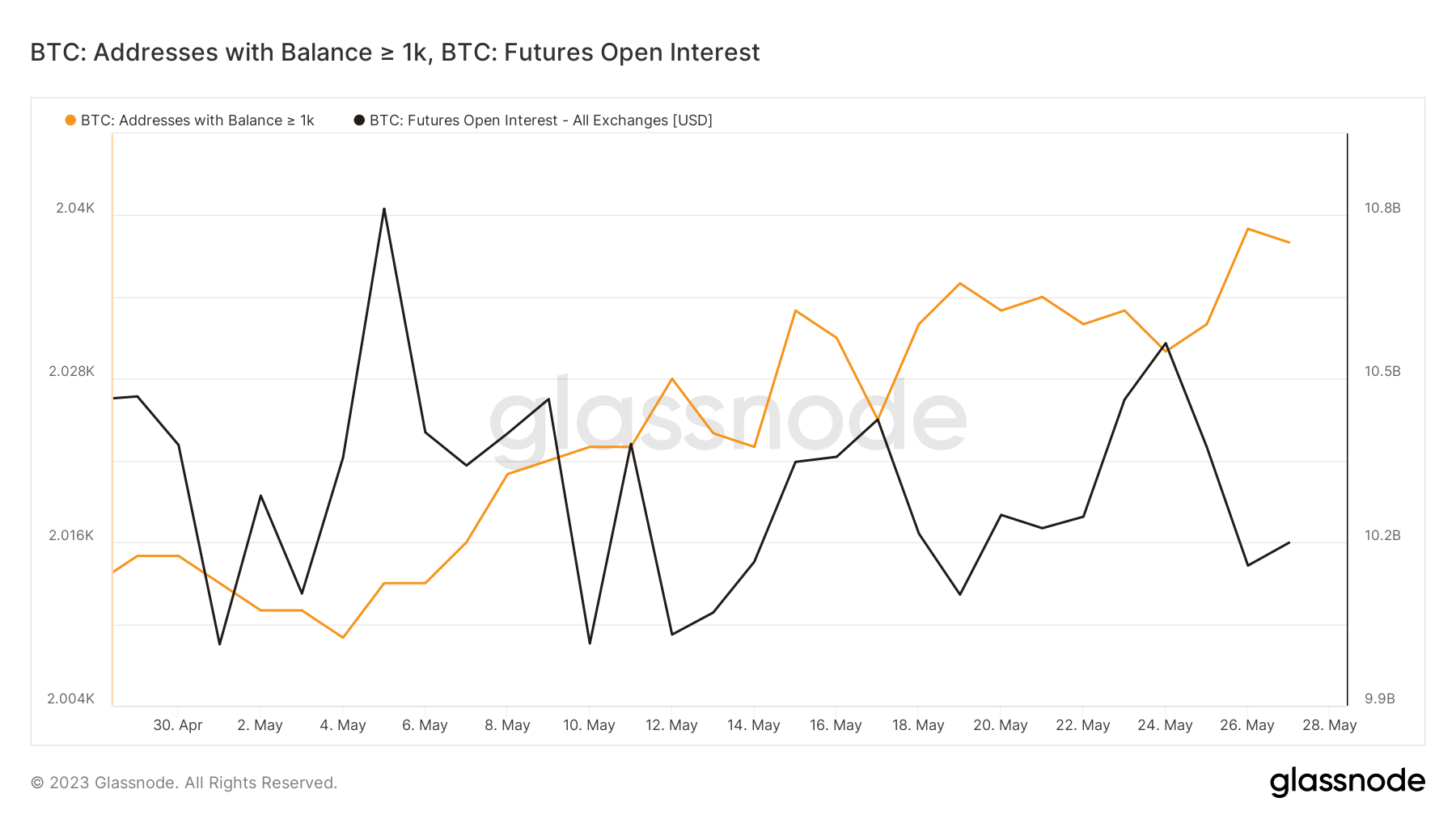

Interestingly, some on-chain data indicated that whales have been buying despite the surge in profit-taking. The key point to note is the timing of their accumulation. Addresses with at least 1000 BTC have been buying after short-term sell pressure and offloading after minor gains.

A comparison with futures’ Open Interest revealed an inverse relationship. It appears that whales have been accumulating every time Open Interest starts falling and selling when Open Interest starts soaring.

A potential explanation is that whales have been buying in low leverage conditions and selling when derivatives demand soars. Such instances are usually underpinned by higher leverage and potential liquidations.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Where is Bitcoin headed?

Bitcoin’s press time price is also noteworthy because it was on its third consecutive day of moving in one direction. The bullish performance in the last three days suggested that the bulls have gotten stronger during the weekend. But could this outcome be a sign of what to expect this week?

BTC exchanged hands at $27,161 at the time of writing. However, it was still trading within the narrow range in which it has been restricted for the last two weeks. This meant that the latest upside was not a clear indicator that a breakout was in the works. In fact, a resurgence of sell pressure seemed more likely, now that the RSI was approaching its mid-point.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)