Why Bitcoin’s bull run makes this cohort quite unhappy

- Bitcoin saw over $160 million in short-position liquidations.

- As the uptrend continued, Bitcoin rose above $34,000.

Bitcoin [BTC] has experienced a substantial price surge over the past few days. As a result, traders who had adopted short positions are now grappling with significant losses. How substantial are these losses, and how have long-position traders responded to this situation?

How much are 1,10,100 BTCs worth today?

Bitcoin short traders see massive losses

The recent surge in Bitcoin’s price generated excitement among its holders and the broader cryptocurrency community, as many anticipated that this spike would have a ripple effect on other cryptocurrencies.

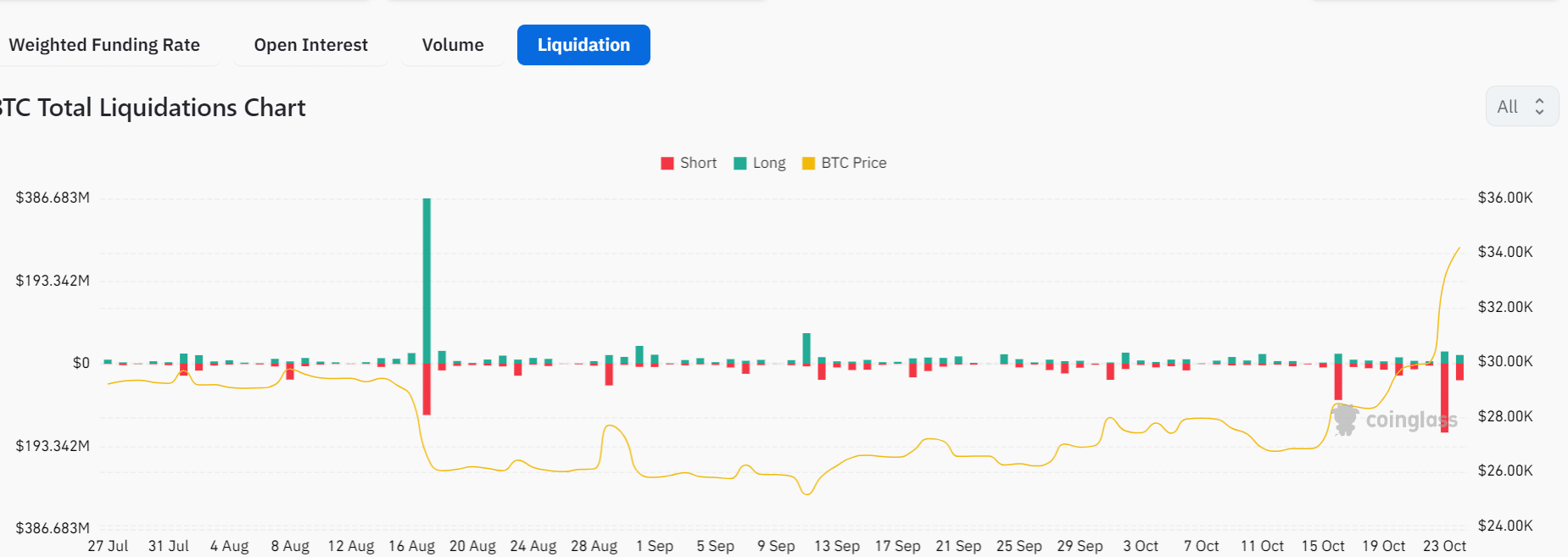

However, not everyone shared this enthusiasm, particularly traders who had bet on a price decline. According to data from Coinglass, this surge resulted in the highest volume of Bitcoin short liquidations seen all year.

A closer analysis of the liquidation chart revealed that on 23 October, short liquidations amounted to over $161 million.

Furthermore, as of the time of this writing, short positions still dominated in terms of the most significant liquidations. Additionally, the Coinglass report noted that the spike had wiped out over $1 billion in Open Interest.

The spike that led to the Bitcoin liquidations

Bitcoin had been on an upward trajectory, reaching double-digit gains on 24 October, as indicated by its daily timeframe chart. The chart revealed a 10.17% increase in BTC’s price, closing at over $30,000 at press time.

This spike was the major reason short positions saw a massive liquidation.

Furthermore, the uptrend persisted, with BTC trading at over $34,000. Notably, the Relative Strength Index (RSI) line was residing in the overbought zone, suggesting a potential price correction.

This situation might encourage more traders to take short positions, especially in light of recent losses. Now, what was the dominant Funding Rate at press time?

Positive Funding Rate spikes

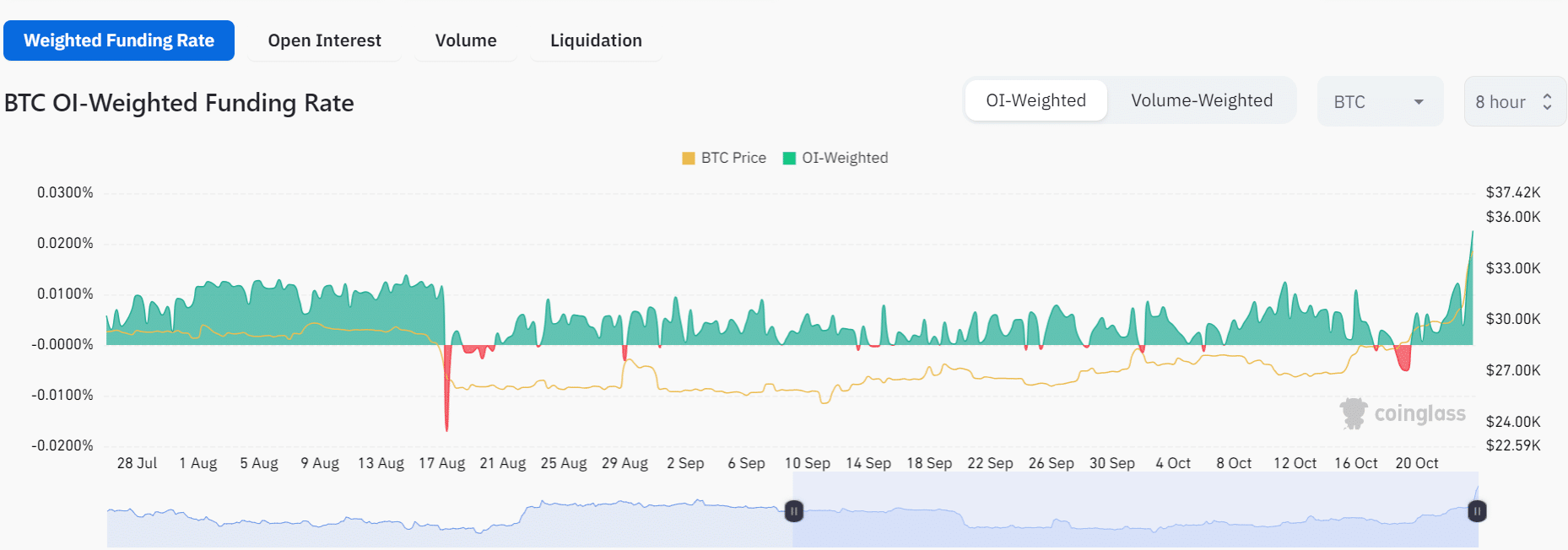

According to data from Coinglass, Bitcoin boasted its most optimistic Funding Rate in over two months, standing at approximately 0.02% at the time of this report.

Is your portfolio green? Check out the BTC Profit Calculator

This indicated that, despite the ongoing upward trend in price and the overbought status of its RSI, traders were still expressing confidence in the potential for further price increases.

This optimism was understandable given the sustained price surge, even in the wake of the 10% spike witnessed on 23 October.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)