North America’s crypto investments falter, but is the worst behind?

- North America accounted for more than 24% of global cryptocurrency volumes.

- The region saw a steady decline in DeFi and stablecoin usage.

There is little doubt that cryptocurrencies have extended beyond their typical hotspots to most countries and continents around the world in recent years.

However, their growth trajectory and adoption patterns are still significantly influenced by the world’s largest cryptocurrency market – North America.

North America: The global crypto powerhouse

Consisting of powerhouses like the U.S. and Canada, the prosperous region clocked $1.2 trillion in crypto transactions for the period between Q3 2021 and Q2 2023, per a 2023 Geography of Cryptocurrency Report by Chainalysis. This represented a dominant 24.4% share in global volumes.

Having said that, transaction activity in the region has steadily declined over the past year, as a combination of implosions and external factors bogged down the wider market.

The descent was precipitated by the collapse of FTX [FTT] exchange last fall, which led many institutional investors to walk away.

The situation compounded in March 2023 when a flurry of crypto-friendly banks in the U.S., including Silicon Valley Bank, declared bankruptcy, causing ripples in the broader crypto market.

The second-largest stablecoin in the market, USD Coin [USDC], being exposed to these unfortunate incidents, depegged from its $1 value. The financial ramifications were severe and investors had to pull out

However, as things stabilized through the second and third quarters, the crypto volumes picked up.

North America relies on DeFi

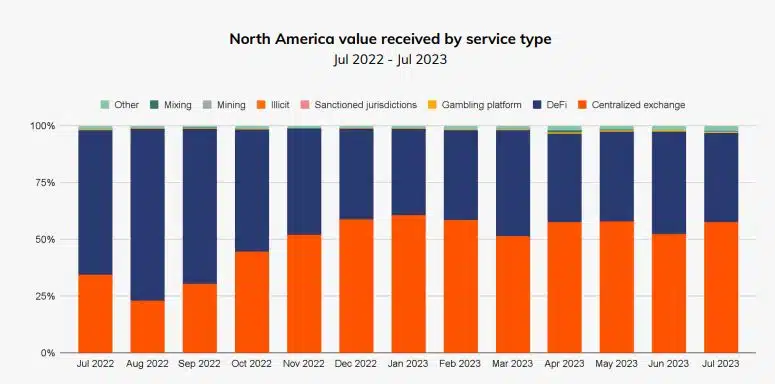

By virtue of being home to some of the most disruptive Web3 companies and a society receptive to new technology, North America has historically relied more on decentralized finance (DeFi) to buy and sell cryptos.

In fact, the region was still the global leader in DeFi usage as per raw volumes. This was in sharp contrast to the adoption trends of Latin America, wherein centralized exchanges (CEXes) were the most favored platforms for crypto trading.

However, due to the aforementioned events and regulators’ increasingly hawkish approach in 2023, DeFi expansion has been significantly restricted in major markets like the U.S.

Indeed, there were concerns over a proposed bill that aimed to bring significantly more oversight to the Web3 vertical. If passed, the legislation could bring DeFi under the purview of anti-money laundering and economic sanctions compliance requirements.

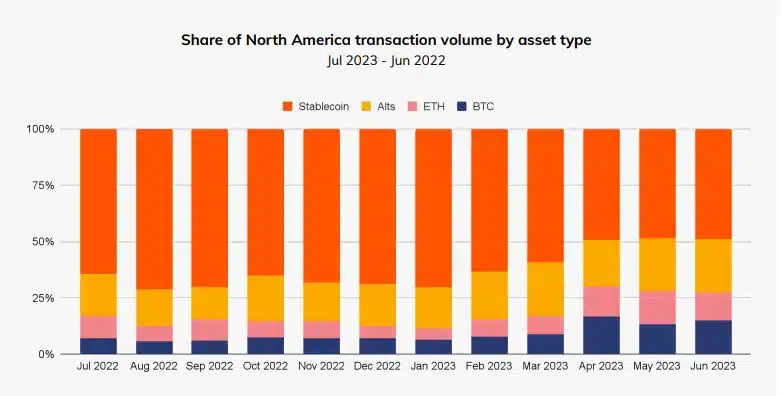

Drastic fall in stablecoin trading

Another intriguing pattern highlighted in the research was the gradual shift away from stablecoins. Prior to the March banking crisis, stablecoins, or crypto derivatives of the U.S. Dollar (USD), accounted for more than half of total crypto volumes in the region.

However, depeggings of leading stablecoins, such as USDC and DAI, shook investors’ faith in this class of digital assets.

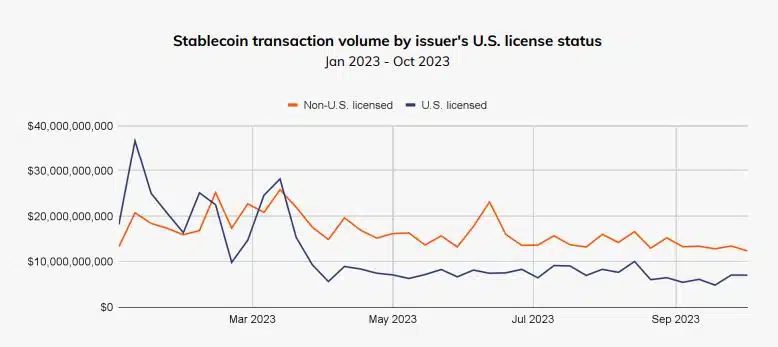

Moreover, data revealed that much of the stablecoin activity was happening on non-U.S. licensed crypto exchanges. Since Q2 2023, more than 54% of overall stablecoin inflows to top 50 crypto services were amassed by entities based outside of America.

Interestingly, nearly all stablecoin trading activity takes place in stablecoins pegged to the USD. Therefore, U.S.-based regulators had an incentive in expanding their oversight to stablecoins.

This was done not just to limit their abuse by unfriendly states like North Korea, but also to influence USD’s usage globally. However, with the bulk of the activity happening outside U.S. jurisdictions, the government was being denied the right to exercise control.

Jason Somensatto, Head of North America Public Policy at Chainalysis was quoted in the report as saying,

“There continue to be important debates around the regulation of stablecoins, such as the appropriate role of state regulators in registering and supervising stablecoin issuers. These debates are resolvable and should be solved soon in

the interest of global competition and necessary regulation.”

Light at the end of the tunnel?

There was glaring evidence of institutional investors in North America becoming conservative following a series of market headwinds. However, expectations of a spot Bitcoin [BTC] ETF approval was keeping them afloat.

This was reflected in the listing of BlackRock’s iShares spot Bitcoin ETF on the Depository Trust & Clearing Corporation (DTCC). The king coin blasted past $35,000 for the first time since May 2022, renewing hopes for future investments.

Richard Gardner, CEO of trading technology developer Modulus, told AMB Crypto,

“Whether it’s because they don’t believe they have the technological expertise, or whether they’re waiting for the government to deem it safe for investment, a spot Bitcoin ETF will help this market expand far beyond its current borders. Institutional investors are already there and in place to make that a reality.”