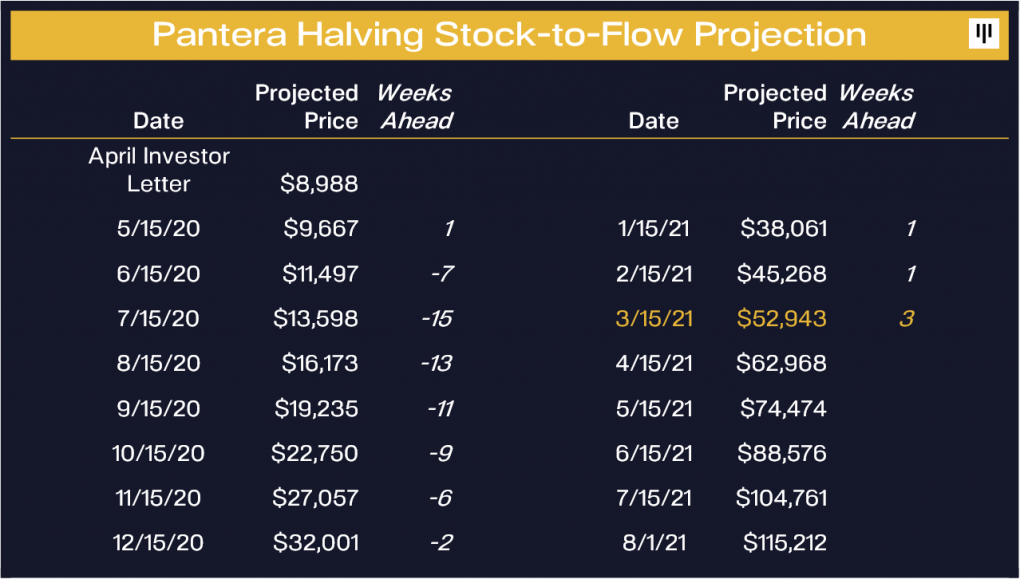

Why Bitcoin’s price is three weeks ahead of its April target of $62968

Bitcoin’s price hit yet another ATH, above $56421 based on data from coinmarketcap.com. The market capitalization of the asset is well above $1 Trillion and the 24-hour trade volume on exchanges is up 26.64 percent. While on-chain analysis of Bitcoin points towards a bearish sentiment, Panteral Capital has a bullish projection and perspective on the current price rally. Pantera Capital’s Bitcoin fund is the best-performing one by far, followed closely by Grayscale, and the performance of their Bitcoin fund signals that Bitcoin’s price is 3 weeks ahead of their projected target for February 2021.

Source: Twitter

To put things in perspective, based on the above chart of Pantera’s S2F projections, Bitcoin’s price was predicted to hit $52943 in March of 2021, precisely in the second week. However, with the asset trading at $55600 currently, it is clearly 3 weeks ahead of schedule, heading towards the target for April, $62968.

Based on Pantera’s S2F projections, Bitcoin’s price is 3 weeks ahead of schedule for April’s target of $62968. If Bitcoin’s price continues its onward rally, towards April’s target, it may hit that sooner than expected. Bitcoin’s volatility is a critical factor in this. Currently, the volatility is 19.7% and asset classes like emerging currencies have higher volatility. However, with the rising price, and increasing open interest from institutional investors in CME, there may be a direct impact on Bitcoin’s volatility pushing the price target further ahead of schedule. Apart from institutional investors, retail traders also have a key role to play as increased trading on spot exchanges will contribute to the trade volume and volatility. If active supply drops, it could boost the price, along with increased demand and trade volume on spot exchanges.

Source: Cryptoquant

Bitcoin inflow to exchanges is currently around 55700, lower than the inflow level in January 2021 and the last quarter of 2020. Combined with low inflow, in emerging markets on spot exchanges with fiat-crypto, Bitcoin’s demand has increased, and that is reflected in the increasing trade volume. At the same time, Bitcoin’s reserve risk has increased, and hit a two-year all-time high based on data from Glassnode. This is a metric to watch, for retail traders. Whether Bitcoin’s price rally will continue upwards depends on volatility, risk, and trade volume across spot and derivative exchanges.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)