Why BNB’s escape from danger zone is crucial for long-term investors

- BNB was undervalued as it sat deep in the opportunity zone.

- Long-term holders have a shot at potential profits.

Many altcoins recently enjoyed a spell of upticks, but Binance Coin [BNB], which has been around some controversy, hardly joined the party. An assessment of crypto prices in the last seven days showed that the coin’s performance was almost neutral despite rising above $300.

How much are 1,10,100 BNBs worth today?

But what advantage does this offer holders loyal to the BNB cause? Well, Santiment’s mid-month report highlighted BNB as one of the few altcoins that were not in an overvalued area.

Out of danger is a chance to…

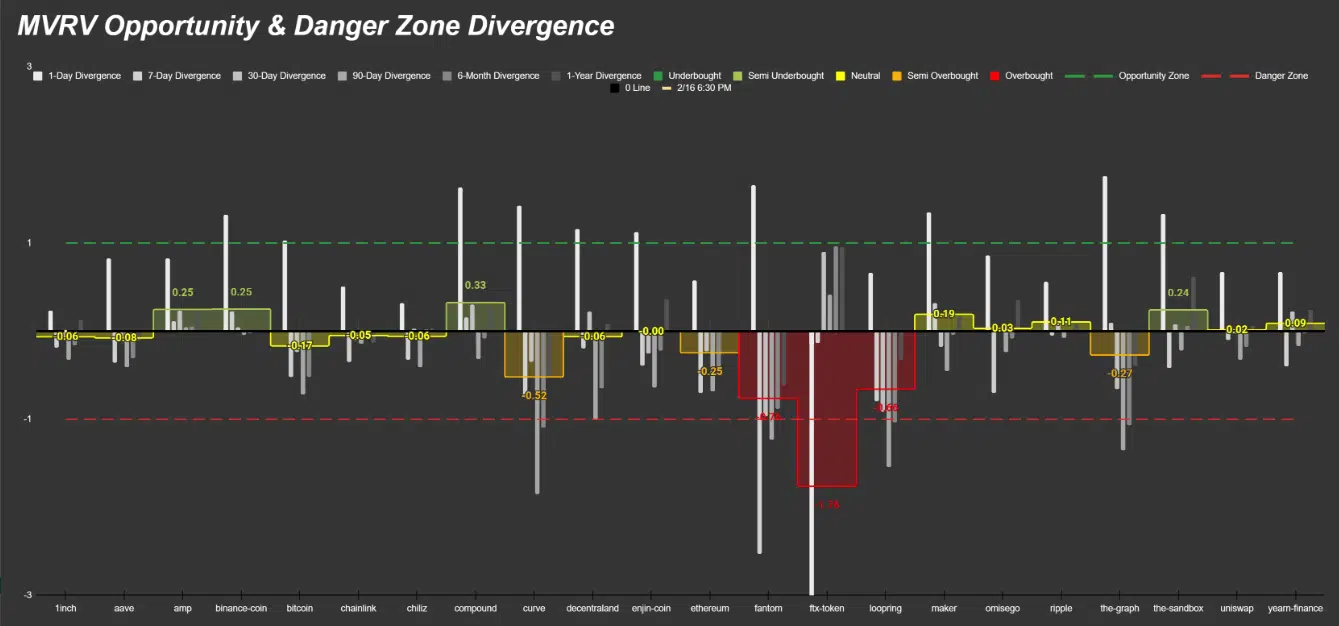

According to the 16 February market insight, other altcoins like Compound Finance [COMP] and The Sandbox [SAND] were in the same boat as BNB.

At the time of writing, the Market Value to Realized Value (MVRV) and danger zone divergence showed that BNB was close to being underbought and in an opportunity region.

For the on-chain climate, the MVRV acts as a metric to measure the fair value condition of an asset. Since BNB was around the zone mentioned above, it could present a chance to accumulate more.

Interestingly, it might seem that the crypto community had gotten wind of the coin’s current state. This was because the 24-hour active addresses increased to 4924 after a notable decrease on 15 February.

The active addresses serve as an indicator of daily users on a particular blockchain. Hence, this increase means more participants on the BNB chain over the previous day. However, it was a different tale with social activity.

At press time, Santiment data revealed that the BNB social dominance was down to 2.079%. The metric measures the hype a project receives per the crypto sector discussion.

Additionally, it gauged possible market tops and bottoms. But since the BNB price was down 5.24% in the last 24 hours, and social dominance was far from the crest, it offered a chance at long-term gains.

Is your portfolio green? Check out the Binance Coin Profit Calculator

BNB: Neutral in the shorts, upturn in long

As per the BNB volatility, the Bollinger Bands (BB) showed it was heading toward extreme zones. On the daily chart, traders had oversold BNB around 14 and 15 February. But the BB indication showed that the momentum was now neutral since the price was no longer touching the lower band.

Meanwhile, the Exponential Moving Average (EMA) indicated that BNB had bullish potential in the long term. This was because the 50 EMA (cyan) crossed the 200 EMA (cyan). A situation like this inferred the potential to establish a new uptrend in the long term.