Binance Coin shows strong bullish momentum, but buyers can wait for…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The bullish pattern saw a spectacular failure.

- The push below $300 was quickly reversed despite the recent Binance FUD.

There was some fear around Binance Coin in recent days. The order from the New York regulator to Paxos to stop minting BUSD tokens was accompanied by a plunge in BNB prices on 13 February.

Read Binance Coin’s Price Prediction 2023-24

Since then, Binance Coin was able to push itself back above $300. Bitcoin was also bullish and noted large gains over the past couple of hours, which helped sway market sentiment in favor of the buyers.

The imbalance to the south showed Binance Coin is set to retrace some gains

On the 4-hour chart, Binance Coin had been firmly bearish until very recently. This was because of its failure to hold on to $320 as support a week ago. Back then, an ascending triangle pattern (orange) was spotted after a steady uptrend for Binance Coin.

The inference was that a breakout above $330 could propel BNB to $360. However, the selling pressure ramped up and prices crashed from $320 to $290 in the span of five days. The drop below $320 showed the market structure flip to bearish.

Is your portfolio green? Check the Binance Coin Profit Calculator

The recovery since that drop broke that bearish structure. The lower high at $320 was defeated, and it was likely that BNB will set a higher low and continue upward. But where will this higher low be? On the 4-hour chart, a large imbalance was spotted and marked in white.

This FVG is likely to be filled over the next day or two. The $300-$315 area has been strong support since 21 January, and another move upward could commence after a retest of this zone.

More ideally, buyers would want to see a revisit to the bullish order block at $288-$294 to buy BNB, with a stop-loss below $286. More aggressive buyers in the $300 area can set stop-losses at $297.4, targeting $350-$360 to take profit.

Mean coin age on the rise while dormant circulation stayed flat

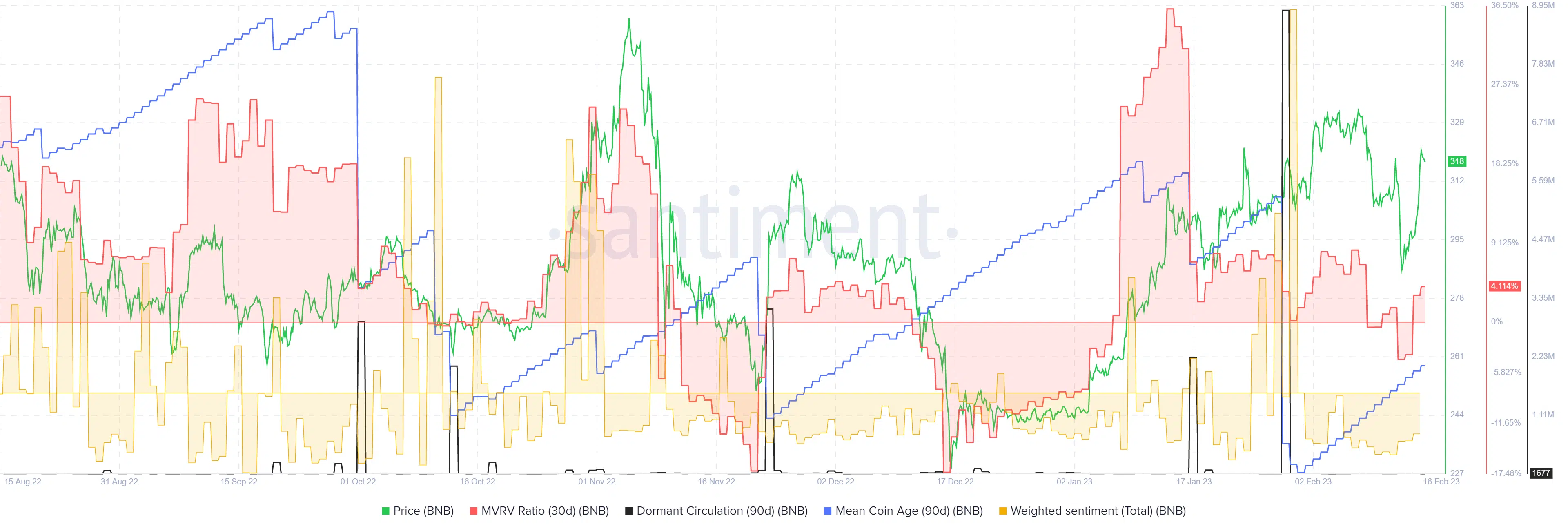

Source: Santiment

The 30-day MVRV slumped from mid-Jan to early February even though the price pushed higher. This suggested that near-term holders had taken a profit. In early February, a large spike in the 90-day dormant circulation was witnessed.

At this time, the mean coin age also fell dramatically. Together they highlighted a large number of BNB tokens had been moved, which can presage intense selling pressure. The price action of the past few days vindicated this. Weighted sentiment remained in negative territory at press time.

However, the mean coin age began to trend upward, which outlined a phase of accumulation was in progress. With the MVRV ratio also close to zero, it is possible that there was space for another rally.