Why BTC outflows persist despite renewed hopes for crypto comeback

- BTC’s outflows continue to grow despite renewed hope in the crypto ecosystem.

- As Shanghai Upgrade draws nearer, investors shy away from Ether products.

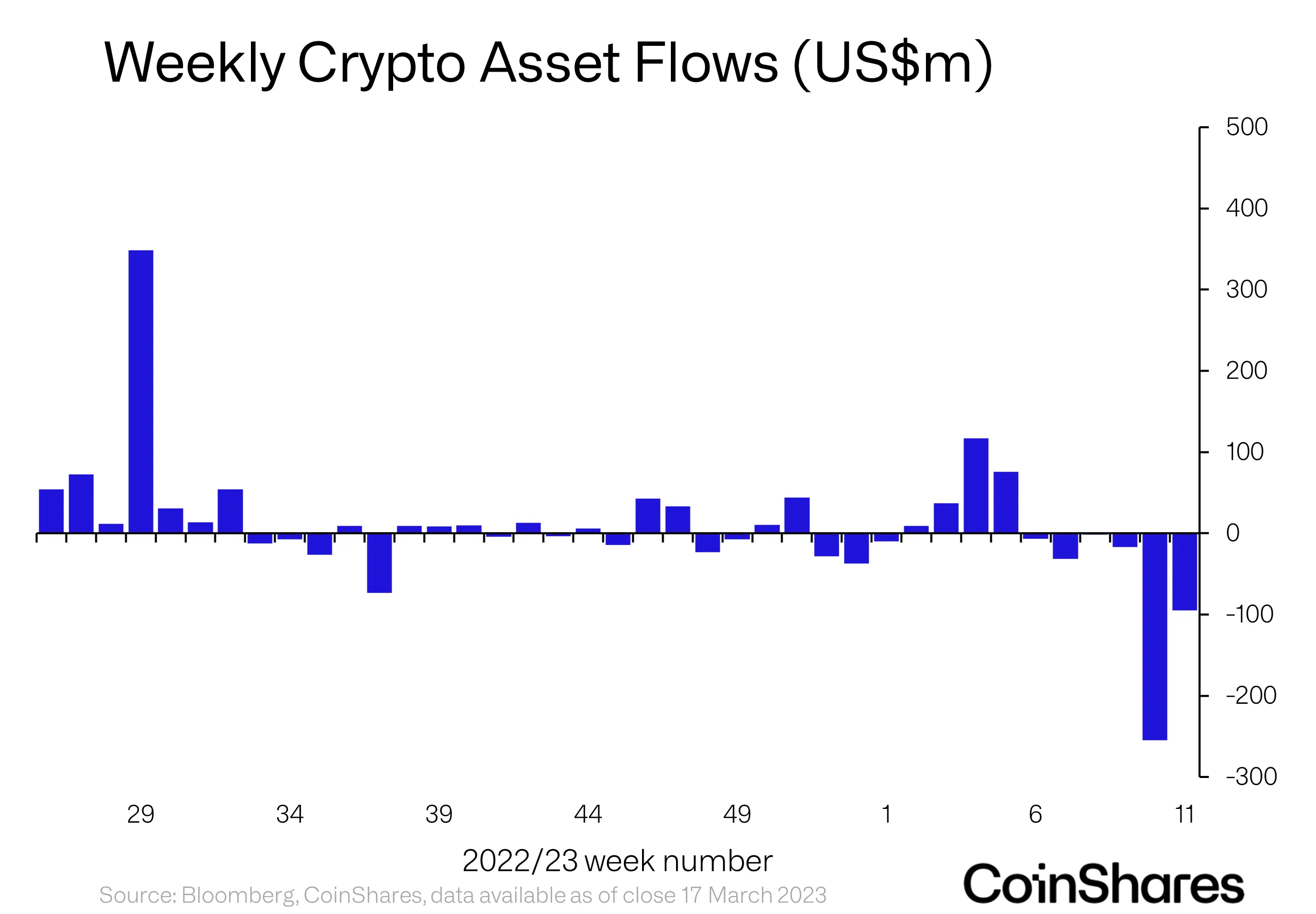

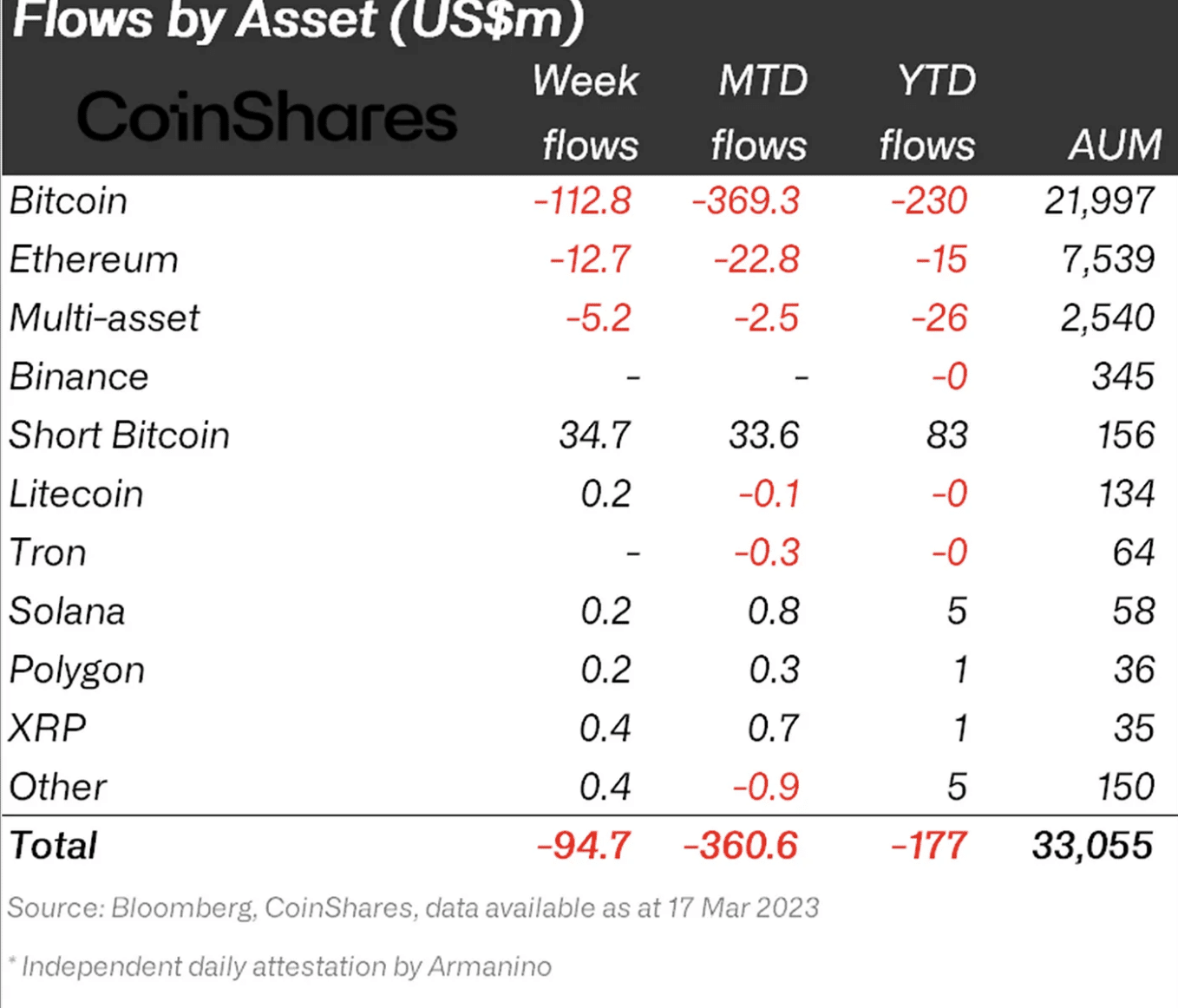

According to a new report by CoinShares digital asset investment products recorded six consecutive weeks of outflows totaling $95 million. Over the last five weeks, there has been $406 million in outflows from investment products, with a notable portion of those outflows being related to Bitcoin [BTC].

The digital asset investment firm CoinShares found that the $406 million outflows registered in the past five weeks represented 1.2% of total assets under management (AuM). Despite the outflows in the last week, AuM rose by 26% to reach $33 billion. This is the highest AuM since the collapse of Three Arrows Capital in June 2022.

This meant that while there has been a trend of outflows in digital asset investment products, the AuM still rose significantly over the last week. This could indicate that investors were still interested in digital assets despite concerns and volatility in the market.

The report further found:

“Trading volumes in investment products were double the average at US$2.6bn.”

The high trading volumes recorded last week indicated that there was still significant activity in the market, which could signal increased confidence among investors.

Bitcoin products saw liquidity exit despite improved sentiment

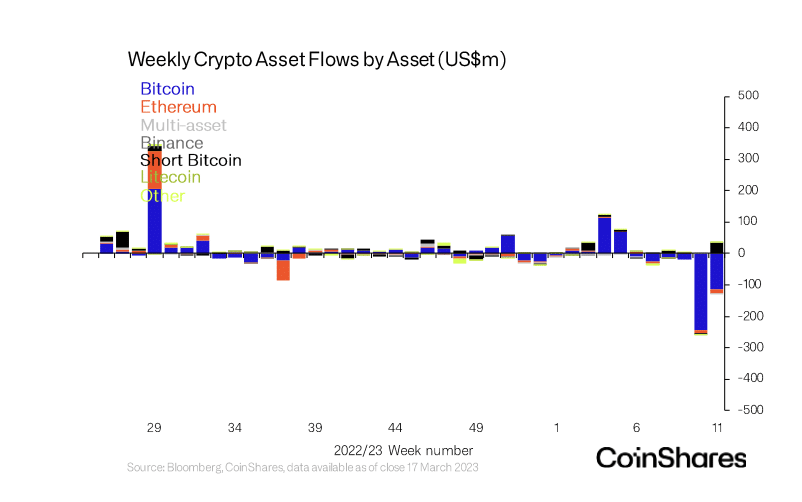

Despite the positive crypto market sentiment last week, BTC saw outflows from investment products totaling $113 million. According to CoinShares, the negative sentiment towards the king coin was in “stark contrast to the broader crypto market,” which performed relatively well during the same period. Interestingly, despite last week’s outflows, BTC’s AuM jumped by 32%.

On the other hand, Short-Bitcoin products saw record inflows of $35 million last week. However, its AuM dropped by 13% during the same period.

Opining on why the positive sentiment in the market failed to impact BTC, CoinShares said:

“It is evident this sentiment is contrarian relative to the rest of the crypto market, but it may be driven, in part, by the need for liquidity during this banking crisis, a similar situation was seen when the COVID panic first hit in March 2020.”

Ether continues to see outflows

Also failing to benefit from last week’s bullish sentiment, leading alt Ethereum [ETH] recorded outflows of $13 million. This brought its month-to-date outflows to $23 million, per CoinShares report.

As for other altcoins, they:

“Bucked the trend, seeing only inflows which totaled US$1.3m last week.”

The Ethereum Investment products’ outflows can be attributed to the uncertainty around ETH’s price once the Shanghai upgrade is implemented. With the upgrade scheduled to take place in April, investors have a prevailing sense of caution.