Why Chainlink gaining whale attention was bad for Synthetix

- SNX was down by 8% in the last 24 hours, and indicators were bearish.

- Whales bought LINK while its price rallied by over 15% over the past week.

The crypto market has been acting strange of late as some cryptos managed to paint their charts green while the rest were bleeding red. Among the gainers, Chainlink [LINK] was one of the assets that surged over the last few days. While LINK investors rejoiced, Synthetix [SNX] whales were losing confidence in the token.

Read Chainlink’s [LINK] Price Prediction 2023-24

Selling pressure on Synthetix is high

Lookonchain’s recent tweet highlighted that a whale was dumping its SNX holdings. As per the tweet, a whale sold over 2 million SNX, worth around $4 million, on Binance at a loss of nearly $785K.

The whale had spent 4.9 million USDT to buy the SNX tokens at a price of $2.44 on 18 May, 2023.

A whale dumped 2,015,264 $SNX ($4M) on #Binance at a loss of ~$785K an hour ago.

The whale spent 4.9M $USDT to buy 2,015,264 $SNX at a price of $2.44 on May 18.https://t.co/ADsVsNcCYb pic.twitter.com/TtJhyNanWZ

— Lookonchain (@lookonchain) September 23, 2023

This episode clearly suggested that whales were losing faith in Synthetix as they expected the token’s price to plummet in the days to come.

In fact, the plummet has already begun, as in the last 24 hours alone the token’s price dropped by nearly 8%. The downtrend was accompanied by a more than 100% rise in SNX’s trading volume, further legitimizing the price plunge.

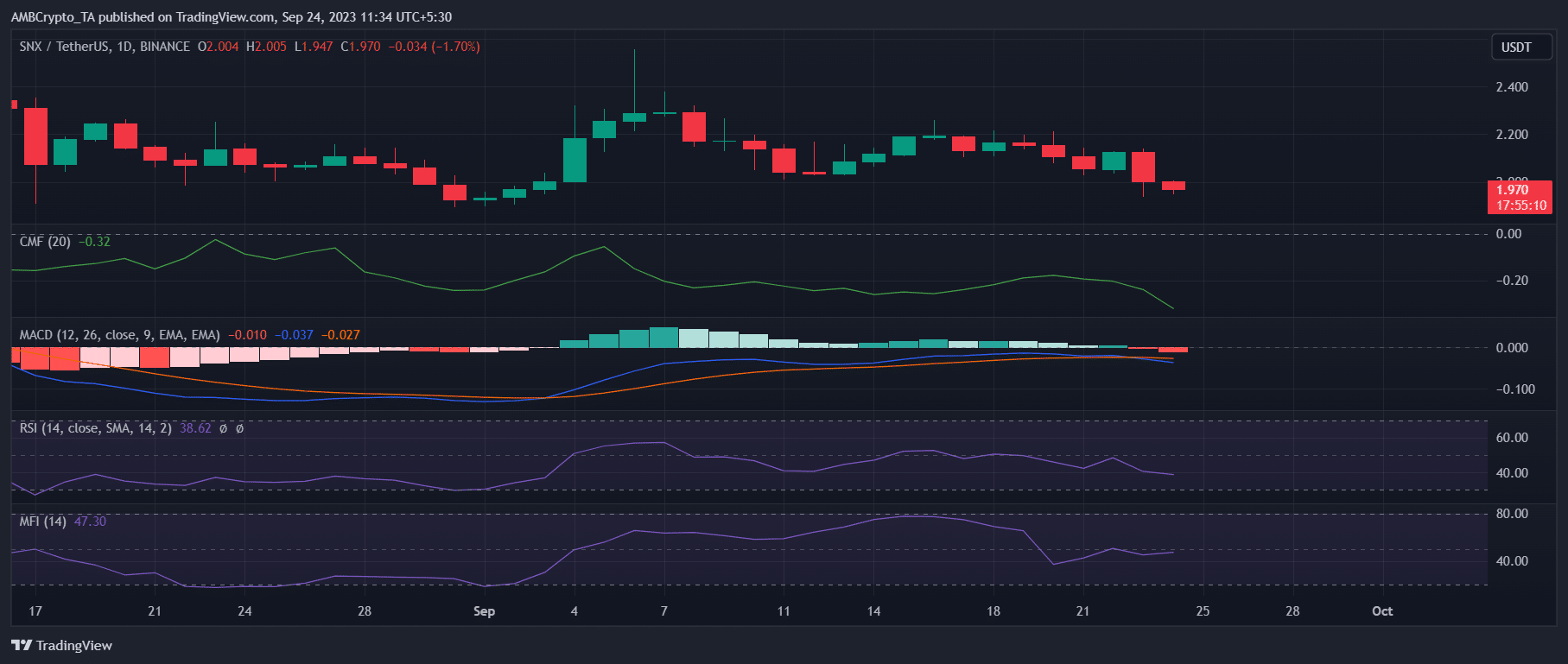

According to CoinMarketCap, at the time of writing, SNX was trading at $1.98 with a market capitalization of more than $534 million. A look at the token’s daily chart helped provide a better understanding of what was going on.

Most of the market indicators supported the sellers as the MACD displayed a bearish crossover, which could cause trouble in the coming days. Not only that, but SNX’s Chaikin Money Flow (CMF) declined sharply.

Its Relative Strength Index (RSI) also rested below the neutral mark of 50, further increasing the chances of a continued price drop. Nonetheless, Synthetix’ Money Flow Index (MFI) provided much-needed hope as it registered a slight uptick on 24 August 2023.

Chainlink is stealing the limelight

Interestingly, while the aforementioned whale sold SNX, it then bought LINK, expecting the token’s price to pump further. As per Lookonchain’s tweet, after selling Synthetix, the whale bought 569,907 LINK, worth $4 million.

This whale sold $SNX and then bought 569,907 $LINK ($4M) back.

This whale spent $1.41M to buy 174,138 $LINK before and sold for $1.18M, with a loss of ~227K.https://t.co/U6ZQRBHB4J pic.twitter.com/NB4BzIPB3h

— Lookonchain (@lookonchain) September 23, 2023

Interestingly, other big players were also increasing their LINK holdings. This was evident from Whalestats’ data, which revealed that LINK ranked tenth on the list of cryptos that the top 100 ETH whales bought in the last 24 hours.

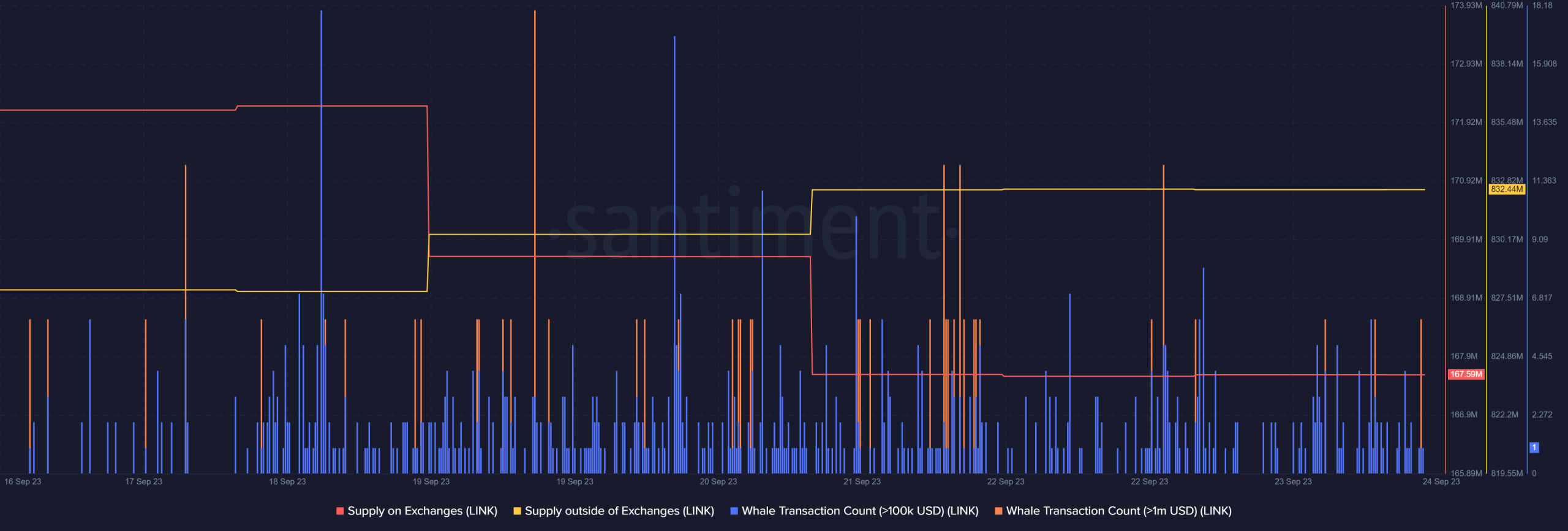

In fact, whale activity around LINK was high as its number of whale transactions increased over the last seven days. LINK’s supply on exchanges dropped last week while its supply outside of exchanges increased.

This clearly meant that buying pressure on LINK was high, which could result in a further hike in its price. According to CoinMarketCap, LINK’s price had already risen by more than 15% in the last seven days, along with a substantial rise in its trading volume.

At the time of writing, LINK was trading at $7.13 with a market capitalization of over $3.9 billion.

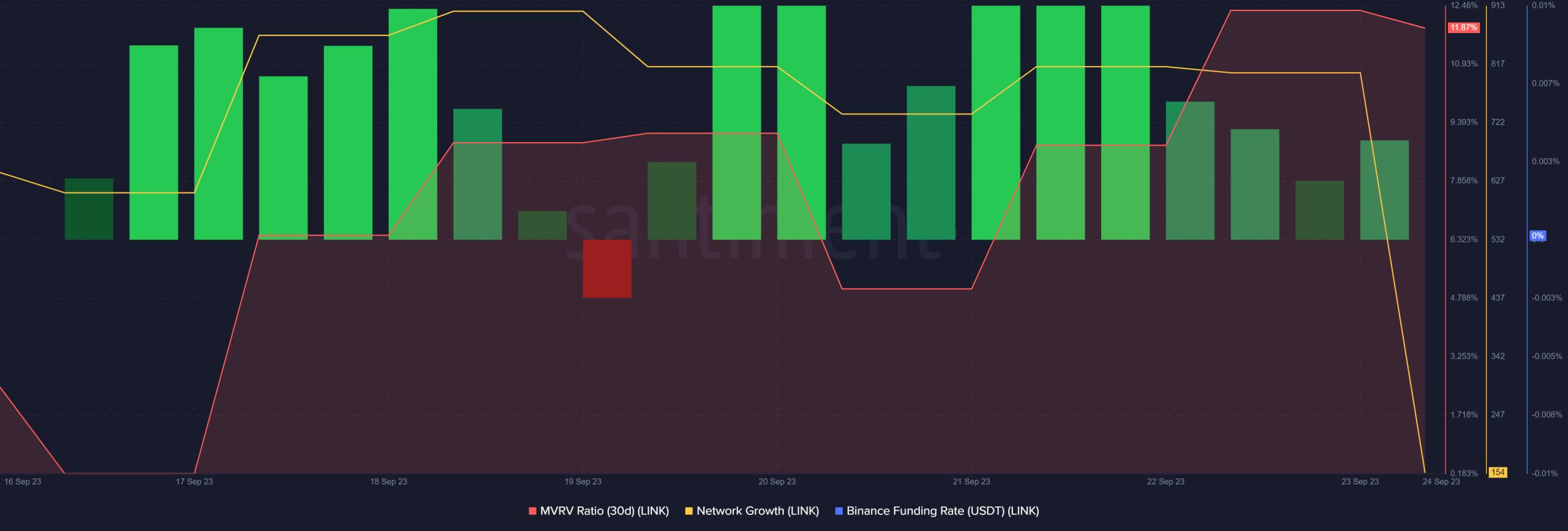

Chainlink’s gaining spree might continue longer as several of its on-chain metrics looked bullish on the token. For instance, LINK’s MVRV ratio climbed sharply last week.

Realistic or not, here’s LINK market cap in BTC‘s terms

Its network growth was also high, meaning that more new addresses were created to transfer the token. Moreover, LINK also remained in demand in the derivatives market, as evident from its green Binance funding rate.

Also, CryptoQuant showed some concerning data as it revealed that both LINK’s Relative Strength Index (RSI) and stochastic were in overbought positions. This can increase selling pressure in the coming days, putting an end to LINK’s bull rally.