Why despite SHIB’s active burning protocol, its price action has remained stagnant

Nobody can underestimate the growth that Shiba Inu showcased in the past year. In 2021, the cryptocurrency recorded a stunning 26,000,000% spike after stealing investors’ hearts. Although Shiba Inu’s price dropped after reaching an all-time high, SHIB is still making a buzz.

Well, that is mainly due to its token burning exercise and thereby gradually reducing supply to increase demand.

Burning like a boss

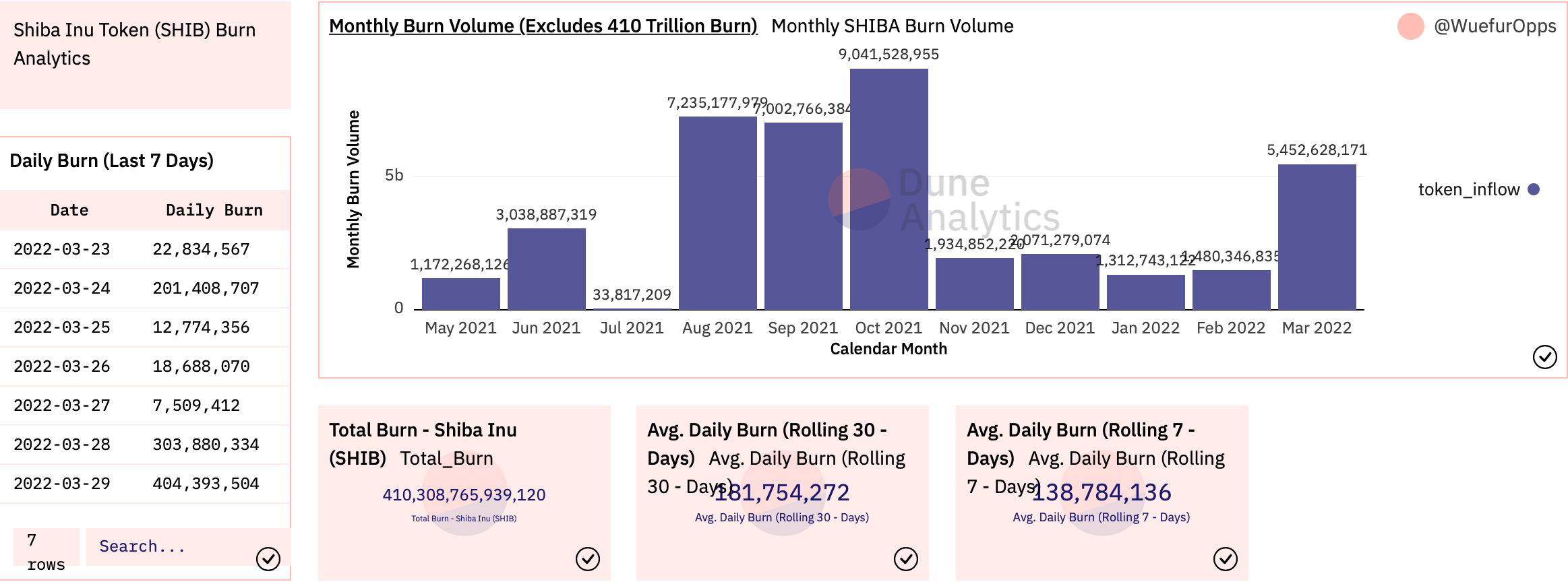

SHIB’s highest burn observed back in August, September, and October peaking at 9 billion SHIB. But ever since November, the exact figure slipped to 1.1 billion owing to the lack of activity from investors after SHIB fell by 74%.

Now, the current month saw a significant increase in the said activity. According to the Twitter page of Shibburn crypto tracker, the SHIB Army burned close to 700 million Shiba Inu tokens burned in the past two days.

In the past 24 hours, there have been a total of 404,393,504 $SHIB tokens burned and 5 transactions. Visit https://t.co/t0eRMnyZel to view the overall total of #SHIB tokens burned, circulating supply, and more. #shibarmy

— Shibburn (@shibburn) March 30, 2022

In fact, just a day ago, a total of 401,471,262 burned as a part of this drill. Earlier, @Shibburn also tweeted that 303.6 million Shiba Inu were sent to “incinerator wallets” or a “dead wallet”.

Overall, the sum of SHIB burned in the past two days amounted roughly 707 million SHIB tokens.

Who’s buying?

Well, the dominant whales mostly. The first whale that purchased 420 billion SHIB made two large transactions. The first transaction was worth $4 million three hours before the second one of $7.3 million.

According to a recent tweet shared by WhaleStats platform, a whale named “Gimli” had the most number of acquisitions.

Last 24hrs, a whale names "Gimli" just bought 421,370,420,624 $SHIB worths $11,313,795 in two transactions:

? https://t.co/xBg4n1sRRC

? https://t.co/sH4HtZ49tA#ShibArmy, let's make some noise! Woof! Woof! ?? pic.twitter.com/GA3YgL9NbY— WhaleStats – BabyWhale ($BBW) (@WhaleStats) March 30, 2022

Shiba Inu ownership was highly concentrated. The top 10 addresses hold a whopping 64.7% of the token’s supply, while the top 100 hold 81.2%. As a result, despite a 21% surge over the week, SHIB suffered a fresh 3% price correction in 24 hours. At press time, the token fell to $0.00002.

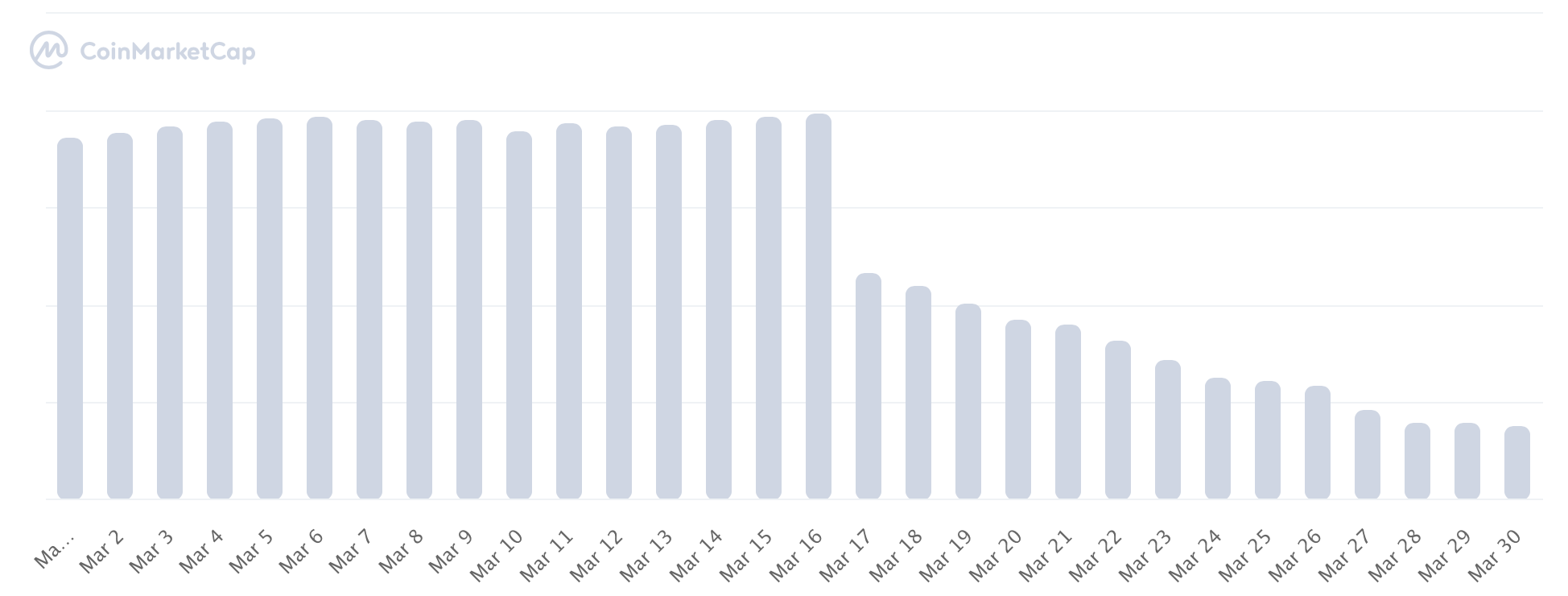

In fact, according to data from CoinMarketCap, the number of on-chain addresses holding SHIB has declined by over 60,000 within the last two weeks.

Source: CoinMarketCap

Does this indicate that even though SHIB holders have been loyal, maybe they’re getting tired? (The project lost of 43% of 118,695 users in a single week.)

The most likely cause are holders looking to exit for higher, safer gains. One of the reasons could be the recent interest rate hike by the Federal Reserve, to help offset record levels of inflation. Generally, when interest rates increase investors tend to migrate from high-risk, speculative investments, such as SHIB, to safer options that promise higher returns.