Why Dogecoin will continue its downtrend after late-June rally

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Dogecoin showed short-term bullish momentum earlier this month but the bears were back on top.

- The higher timeframe resistance at the $0.073 level did not yield, meaning DOGE could see the losses climb.

Dogecoin [DOGE] was trending higher on the lower timeframe charts from late June. This short-term momentum saw the meme coin climb past the $0.07 mark, but the report highlighted that a correction could begin.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Bitcoin [BTC] saw some losses over the past week as well, which was reflected in the sentiment behind Dogecoin. The evidence at hand did not support a DOGE recovery but instead signaled that a slump toward $0.053 and $0.048 could be underway.

The Dogecoin rally to $0.0728 was valiant but likely fruitless

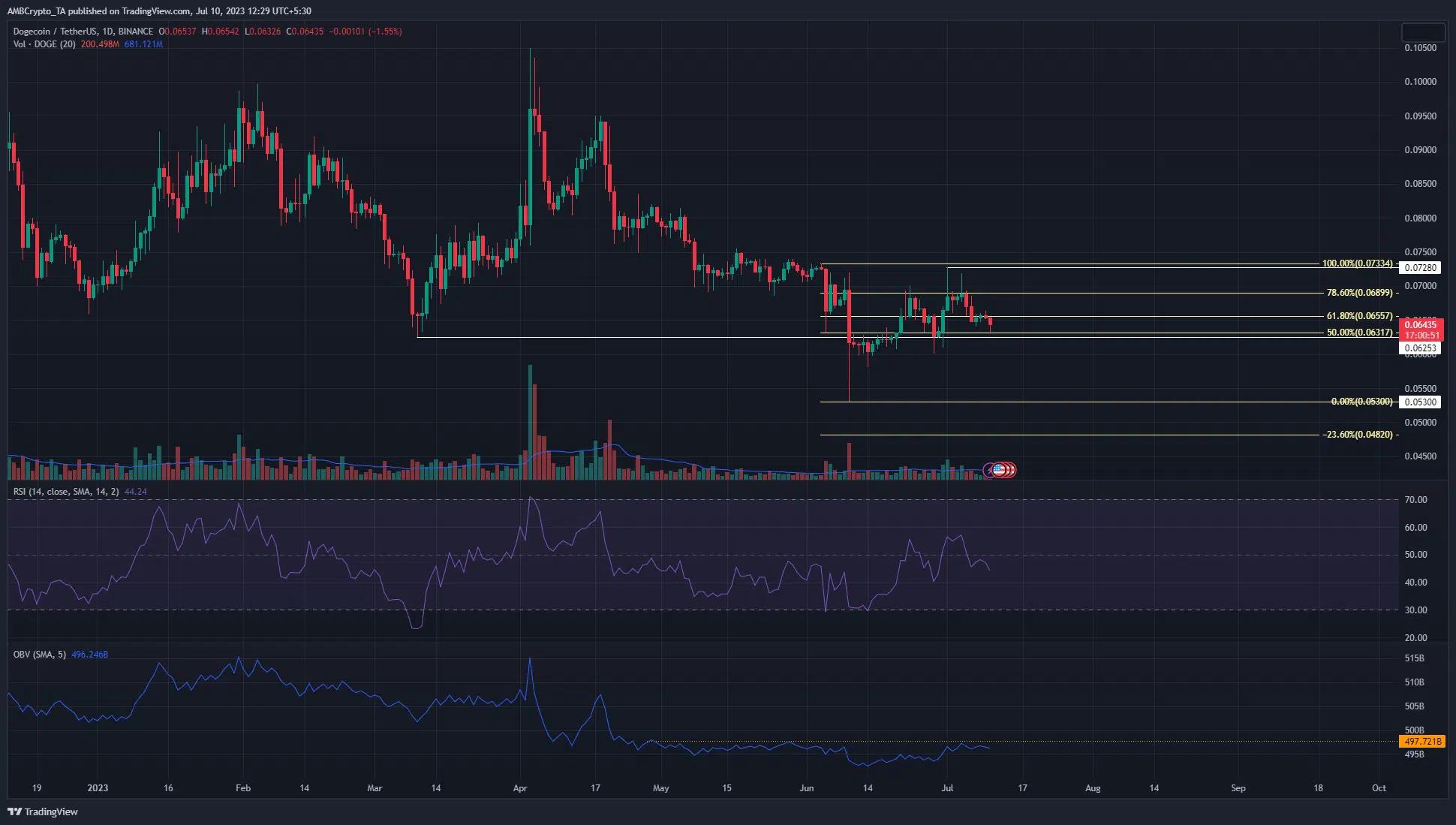

On the 1-day chart, we can see that the trend of DOGE was pointed downward. On 10 June the price fell to $0.53 but rallied to $0.728 by 1 July. This represented gains of 37.36% in three weeks. On lower timeframes such as 4-hour and 1-hour, the trend had been bullish in early July.

This began to change around 5 July. After facing rejection at $0.072 on 4 July, Dogecoin bulls were unable to defend the $0.0655 support. This drop flipped the market structure bearishly. In the 1-day chart we can see that the structure did not flip bullish at all. The brief move above $0.072 was quickly quelled by the sellers, and the 78.6% retracement level has held firm.

With DOGE below the 61.8% retracement level, it appeared that the bears were preparing to drive the prices lower once more. The RSI slipped below neutral 50 to signify a shift in momentum. The OBV was unable to breach a resistance level from May, which highlighted the lack of conviction from the buyers.

The Open Interest chart reinforced the idea of buyer weakness

Source: Coinglass

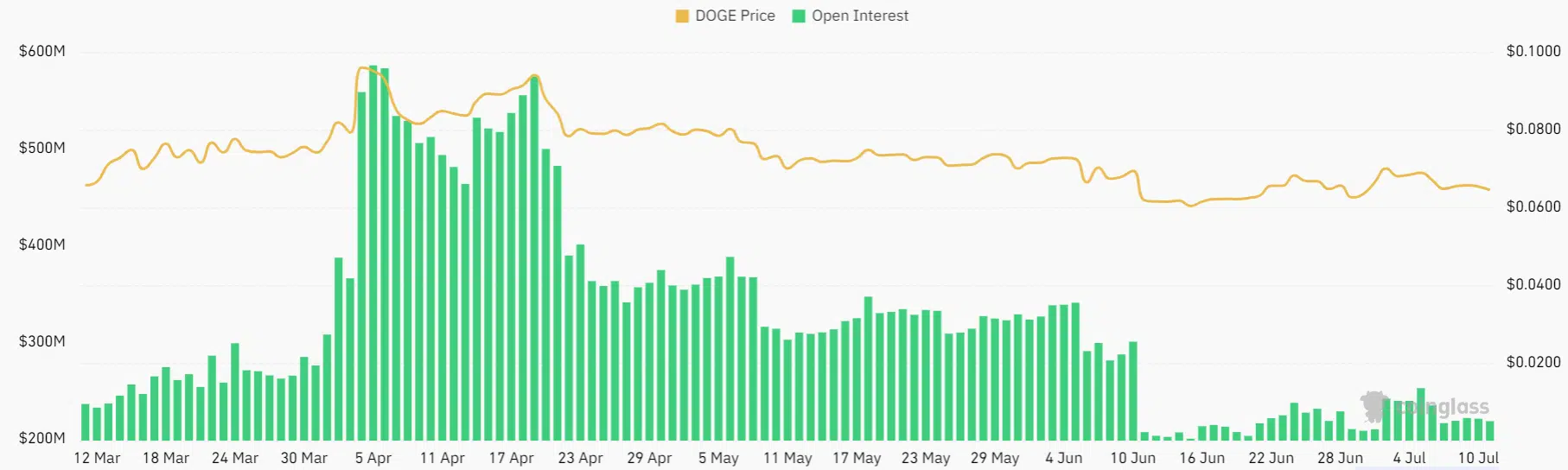

The Open Interest chart above showed that the metric rose from mid-June onward. This was when DOGE climbed above the $0.061 mark and continued higher.

Is your portfolio green? Check the Dogecoin Profit Calculator

Some buyers spotted the short-term rally and bought as prices slowly trudged higher. Yet it paled in comparison to the rally the meme coin saw in early April when Dogecoin pushed to the $0.1 level.

The lack of a strong uptrend on the OI suggested buyer confidence was low. This trend was repeated on the lower timeframes as well, according to Coinalyze data.