Why Ethereum is still in the ‘buy-zone’

At the current price level, Ethereum is trading at the $1800 level and it is being absorbed by HODLers who don’t sell within 2-4 years or in the short term. The asset’s total value in the ETH 2.0 deposit contract just reached an all-time high of 3,551,682 ETH. The increase in reserves signals the increasing liquidity and volatility in Ethereum’s price.

Source: Twitter

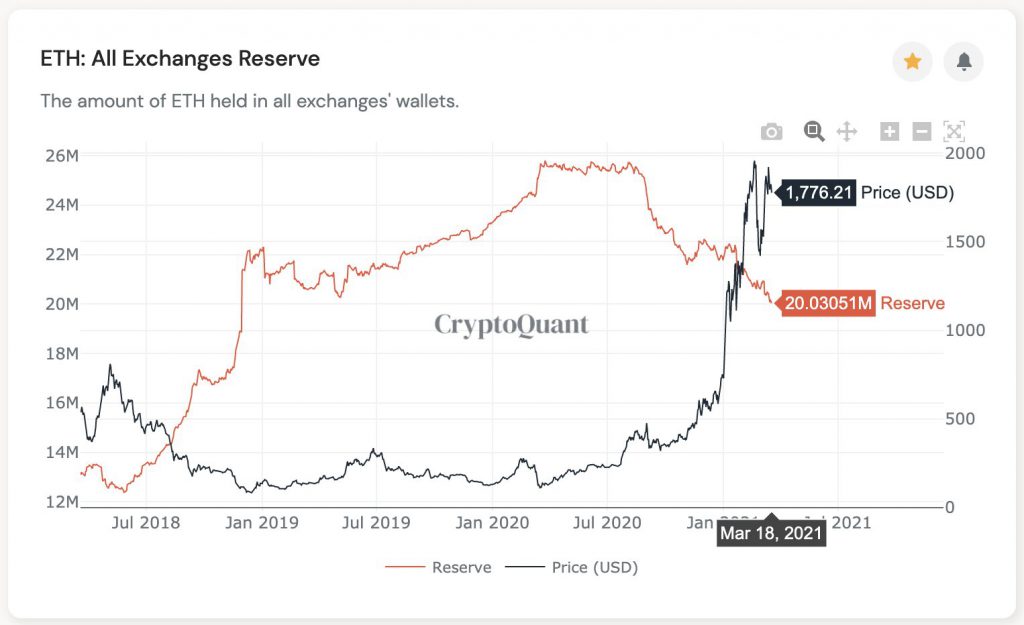

If Bitcoin traded sideways, it would offer Ethereum and large market cap altcoins to trend and rally. Ethereum has traditionally led the altcoin rally, so the increased volatility is a positive sign. As shown in the chart above, Ethereum reserves on exchanges increased from week 1 in march, and have dropped now. The ETH 2.0 deposit contract is gaining traction and there is an increase in the number of active traders on the ETH network.

Something similar happened to Bitcoin in November 2020. Around this time, Bitcoin’s price went from 10k to 60k, that is 6x, if Ethereum’s price responded in a similar manner traders can expect at least over 3x price hike. At the current price level, Ethereum may continue to remain undervalued. The altcoin is headed towards a massive supply shock and it may hit within the next 12 months, meaning that the impact on price will be long-term. Few important data points that directly influence the supply are 10-20% Ethereum’s supply is locked in staking, of the circulating supply $10-$20 Billion is burned in EIP 1559 every year.

Additionally, the drop in issuance of ETH would lead to a drop of 4.5% in the supply. This coupled with other drops, may shock Ethereum’s supply creating an increased demand for the asset on spot exchanges. This shortage of supply narrative is in-line with Bitcoin’s bullish narrative this market cycle.

Besides, the two assets are correlated strongly, 86% precisely. This is the highest correlation that Ethereum has with any other asset and this is playing an instrumental role in shaping up the drop in supply and driving the price rally higher. Undervalued or not, currently ETH is in the buy zone, even at the $1800 level when it is valued in light of the upcoming supply shock and expected to increase in value in the following weeks.

In the short term, there may be further corrections in the price before hitting a new ATH. Price discovery beyond ATH is likely, however, ETH reserves and ETH value in deposits are not expected to have an immediate impact on the price.