Why Ethereum may touch sub-$3000 levels amid delay in the ‘Merge’ upgrade

Ethereum price is in a tough spot after the recent bounce from a support level. Although the uptick is bullish, there might be a revisit or perhaps a sweep of the said barrier before a full-blown uptrend begins.

Ethereum needs to survive the test of faith

Ethereum price action between 24 January and 27 March created a symmetrical triangle pattern, obtained connecting the three lower highs and four higher lows formed. This technical formation forecasts a 34% move to $3,818, determined by adding the distance between the first swing high and swing low to the breakout point.

On 27 March, Ethereum price breached this setup at $2,837 and rallied 22%. While the initial upthrust was impressive, it faced exhaustion leading to a 17% pullback to tag the support level at $2,952.

A bounce from this barrier has led to a 7% upswing so far with a minor retracement on the cards. Due to the current state of BTC, this move could send ETH to revisit the 11 April swing low at $2,947.

If sidelined investors step in, causing a sudden spike in buying pressure, another leg-up is likely to will propel ETH to retest the 200-day Simple Moving Average (SMA) at $3,493.

Due to the significance of this hurdle, a successful move above it will indicate a resurgence of buying pressure and catalyze a bull run to $3,833 a.k.a the symmetrical triangle’s forecasted target.

Although unlikely, a highly bullish case could see ETH tag the $4,000 psychological barrier, bringing the total gain to 25%.

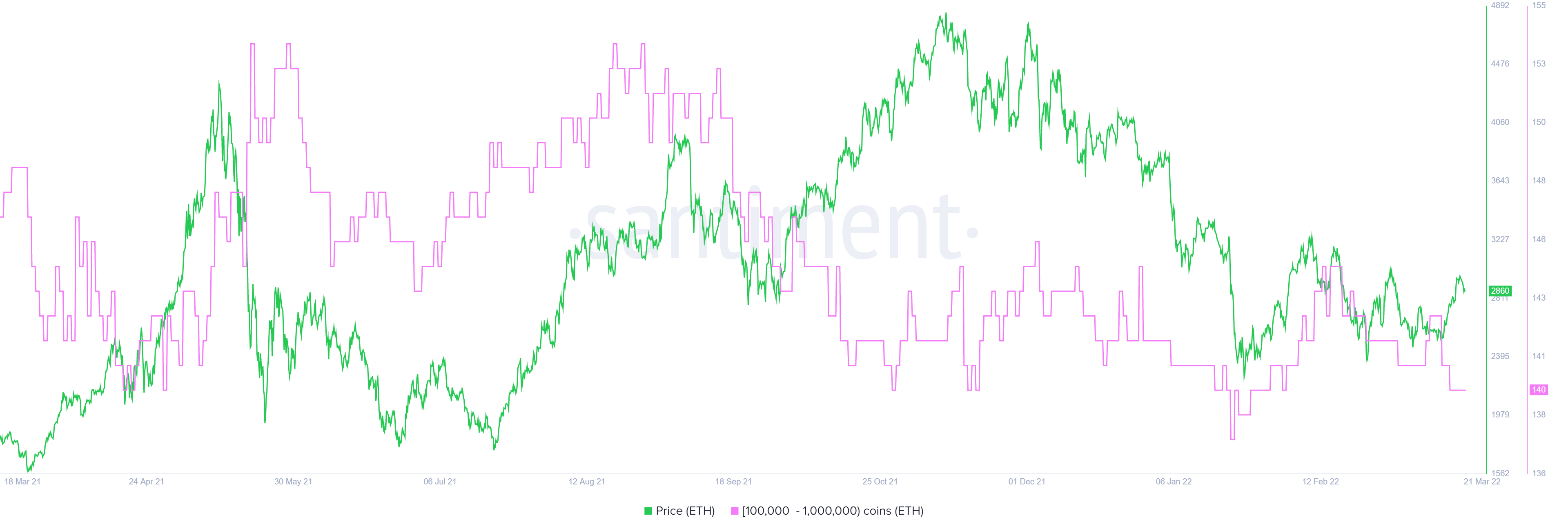

Supporting the short-term correction of the Ethereum price is the supply distribution chart based on the number of addresses. The whales holding between 100,000 to 1 million ETH have been on a downtrend since August 2021.

These holders’ numbers have dropped from 154 to 140 over the last eight months. This decline indicates that the investors are unsure about the performance of ETH in the near future. Furthermore, market participants need to exercise caution as a breakdown of the $2,952 support level could trigger a crash to $2,500.

A daily candlestick close below $2,500 will trigger a crash to $1,730, where buyers can accumulate ETH at massive discount, triggering another run-up.