Ethereum

Why Ethereum’s 77K inflows can spell trouble for ETH

A further crash may be well on its way.

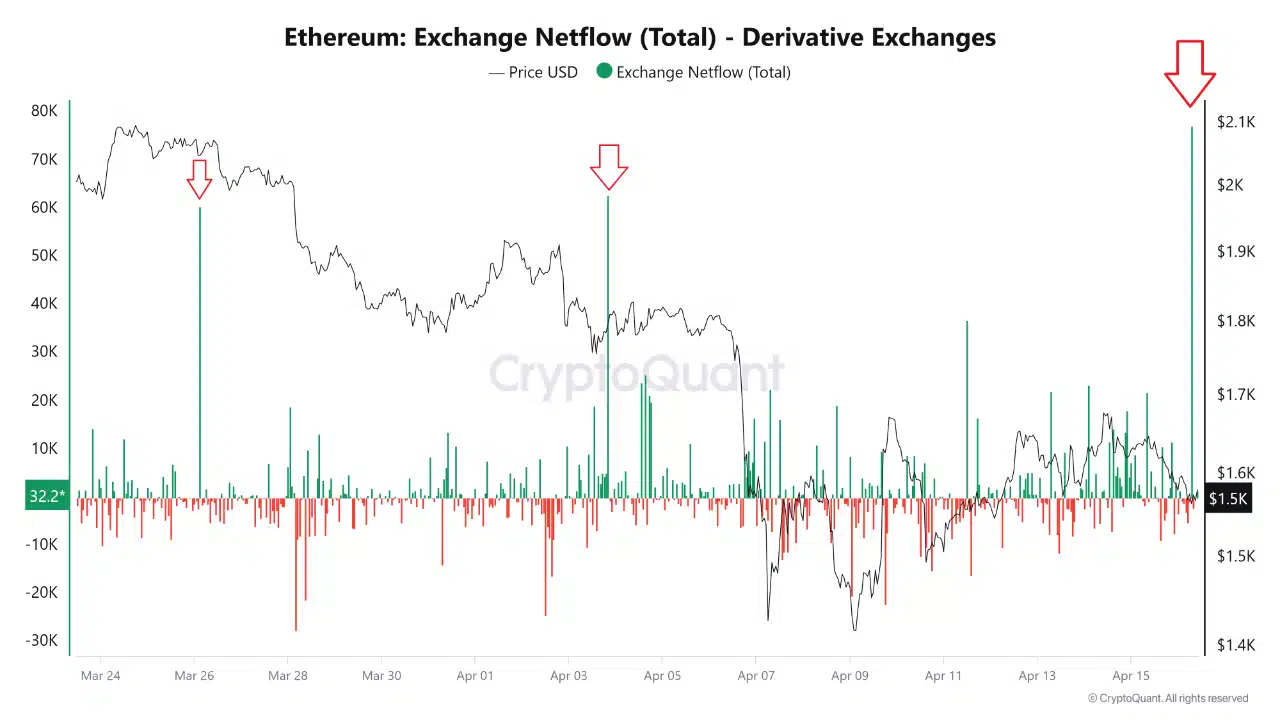

- Over 77K ETH hit derivative exchanges, signaling potential bearish pressure — or a market bottom.

- Ethereum bounces to $1,600, but weak momentum and macro headwinds keep traders cautious.

Something big just moved.

Over 77,000 Ethereum [ETH] flowed into derivative exchanges in a single day. This is Ethereum’s largest shift of the year, and everyone’s watching.

Signals like this have spelled trouble before… but this time, the story might be different.