Why Ethereum’s circulating supply keeps falling to new lows

- Increased demand for the Ethereum network has led to a surge in burn rate.

- This has brought about a decline in the coin’s circulating supply.

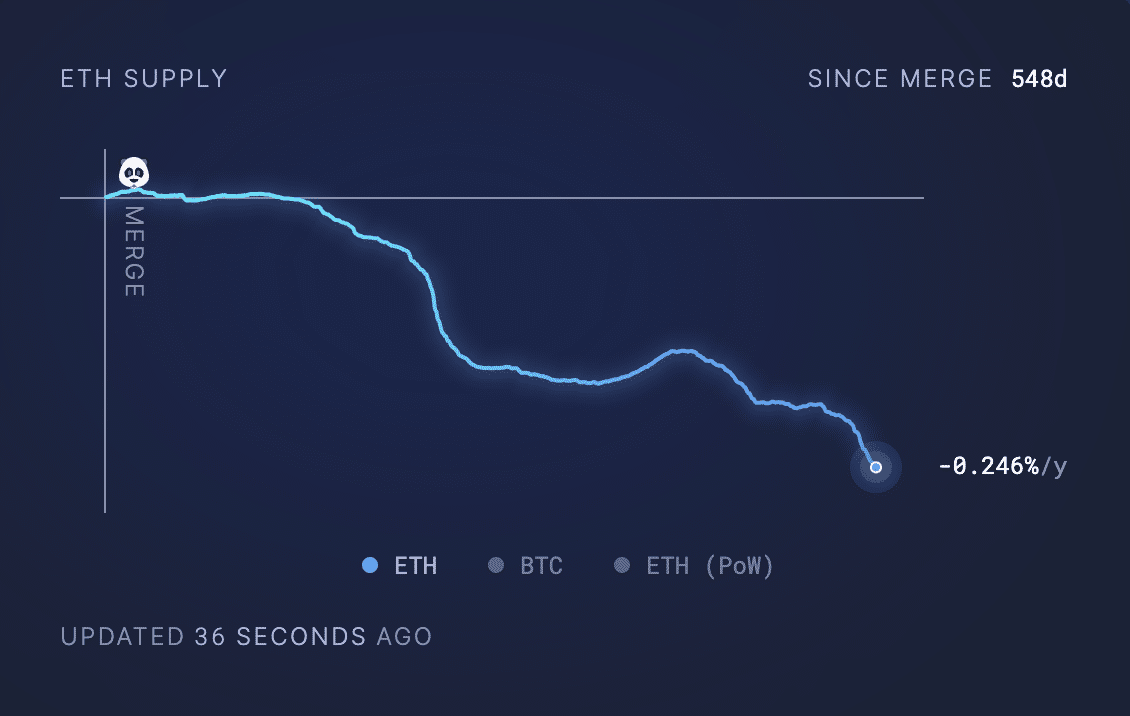

Ethereum’s [ETH] circulating supply has fallen to a new post-merge low, according to data from Ultrasound.money.

In the last month, 86,219 ETH worth around $300 million at the altcoin’s press time price has been removed from circulation in the last 30 days.

The decline in ETH’s circulating supply showed that the Proof-of-Stake (PoS) network has seen an uptick in demand and use, causing its burn rate to increase.

AMBCrypto previously reported that the daily count of new addresses created on the Ethereum network recently surpassed 116,000, a year-to-date (YTD) high.

This signaled a surge in user activity on the Layer 1 (L1) network.

At press time, ETH’s circulating supply totaled 120.07 million ETH, the lowest level in 548 days since the network transitioned from Proof-of-Work (PoW), in an event popularly referred to as “The Merge.”

Ecosystem performance in the last month

An assessment of Ethereum’s decentralized finance (DeFi) ecosystem revealed an uptick in total value locked (TVL) in the last month.

According to DefiLlama’s data, Ethereum’s TVL was $51 billion at press time, rising by 21% in the 30 days. During that period, Lido Finance, the leading protocol on the chain, saw its TVL increase by 27%.

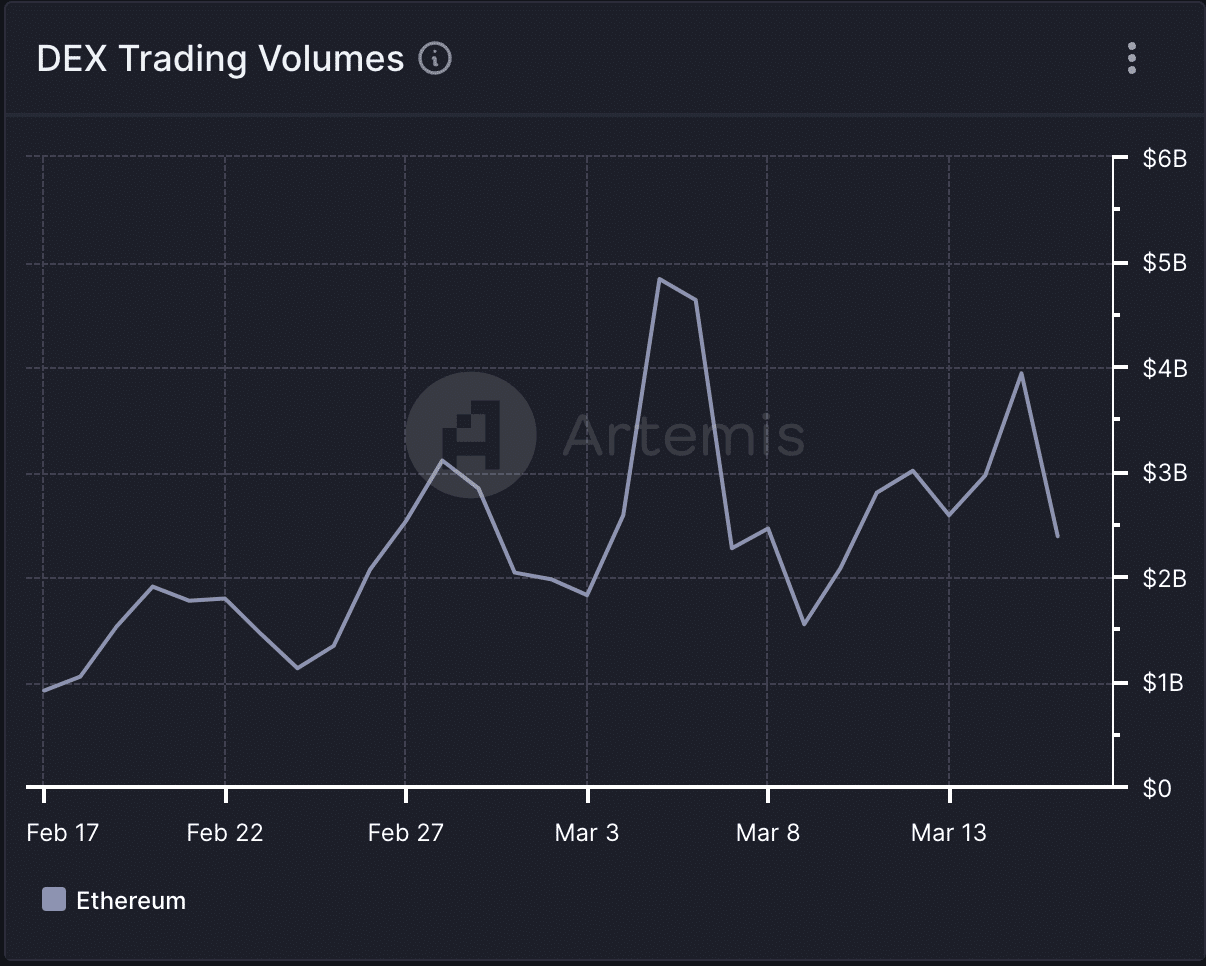

Amid the recent rally in the altcoin market, Ethereum witnessed a spike in its decentralized exchange (DEX) trade volumes in the last month.

According to data from Artemis’, the daily trading volume across the DEXes housed within Ethereum has risen by 161% in the past 30 days.

Regarding the network’s non-fungible token (NFT) sector, it also witnessed growth in the last month.

According to data from CryptoSlam, NFT sales volume totaled $617 million in the past 30 days, registering a 17% rally.

This spike in trading volume occurred despite the 57% decrease in the number of NFT sales transactions completed during that period.

Exchange reserve climbs to a one-month high

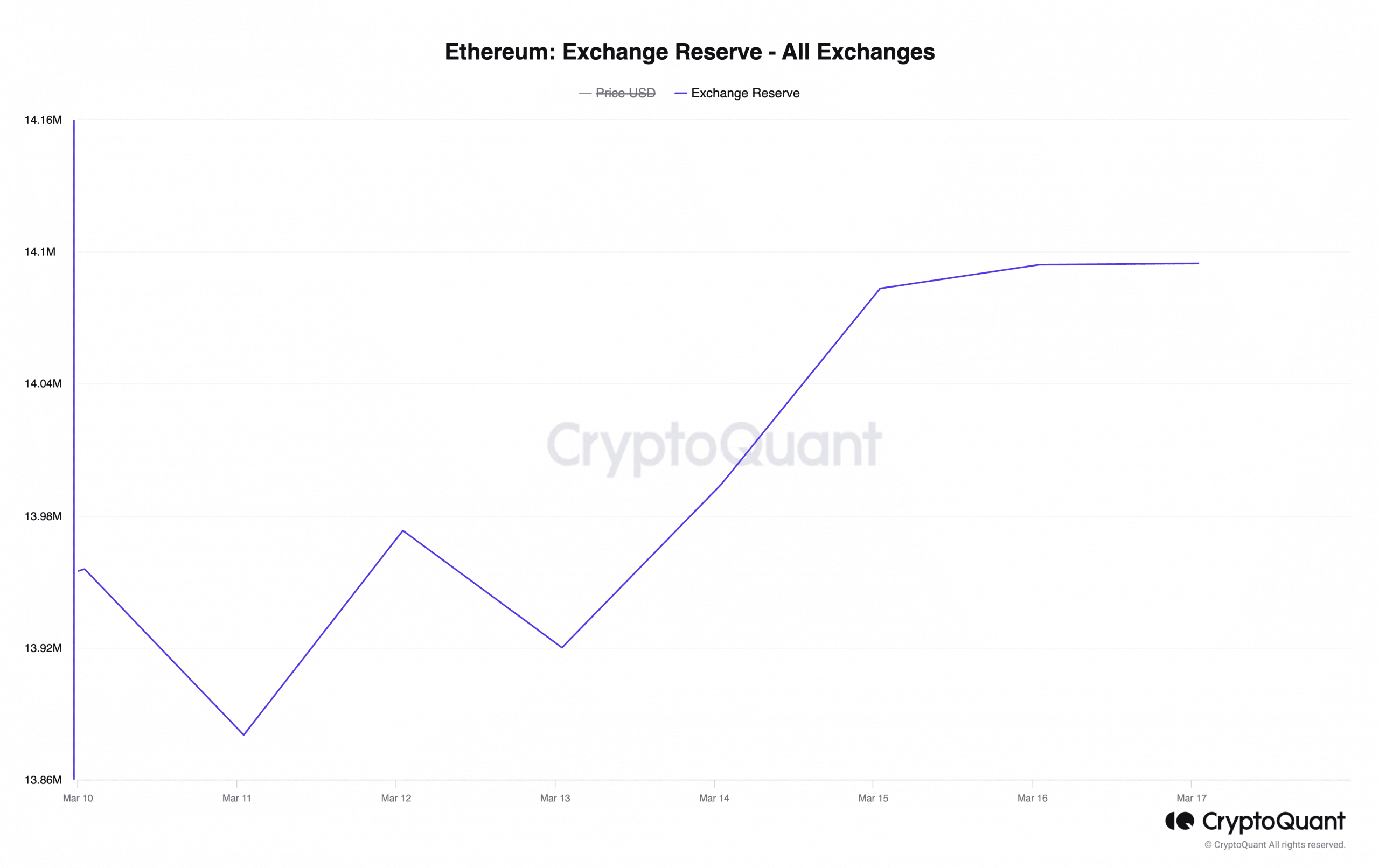

As the crypto market becomes significantly overheated, with the crypto fear & greed index indicating a marked increase in greedy sentiment, sell-offs of ETH have surged.

How much are 1,10,100 ETHs worth today?

This has resulted in a spike in ETH’s supply on exchanges. Per CryptoQuant’s data, ETH’s exchange reserve was 14.1 million at press time, its highest level in the last month.

When an asset’s exchange reserve climbs this way, it suggests an increase in selling pressure.