Why Ethereum’s price volatility is on the rise?

Since the first phase of the bullish rally in 2020, Bitcoin and Ethereum have been struggling with each other to re-instate a bullish dominance in the market. Ethereum has often rallied on its own when BTC stagnated a little but Bitcoin managed to breach its previous all-time high before Ethereum did.

Over the past week, both Bitcoin and Ethereum registered new ATHs with $58k and $2k breaches, but following the surge, a key difference was observed between both the asset’s trend.

Bitcoin vs Ethereum; Realized Volatility vs Implied Volatility?

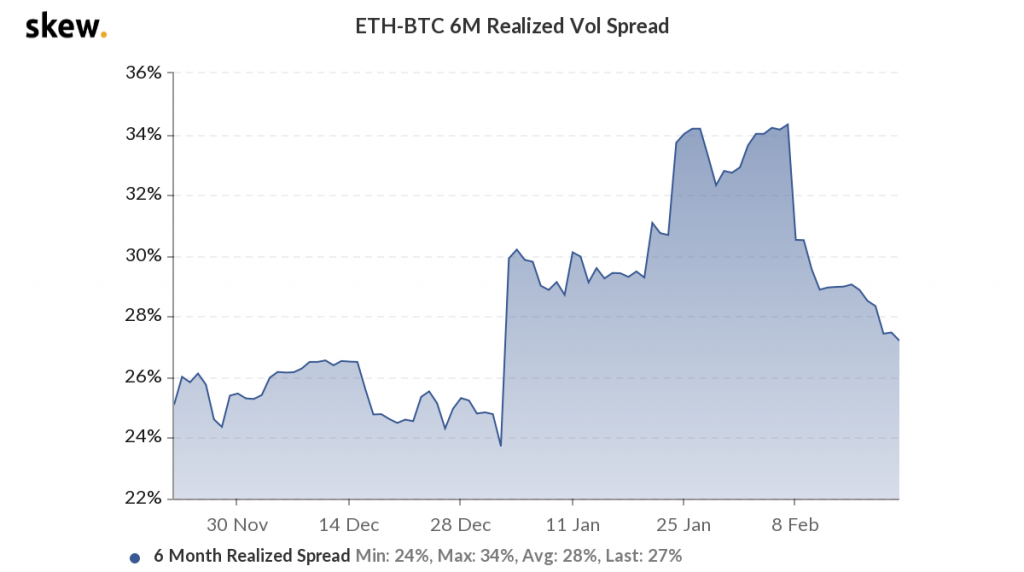

According to data derived from Skew, it was observed that ETH-BTC 6 month realized volatility spread has decreased. It indicates that Bitcoin has registered a greater volatility spread than Ethereum over the past few days, which is relatively true since Bitcoin bridged a higher valuation gap over the period of February.

As illustrated in the chart above, Bitcoin is up by 74% in the month of February in comparison to Ethereum’s 48.51% in the same time period. However, the market is indicative of a different scenario going forward.

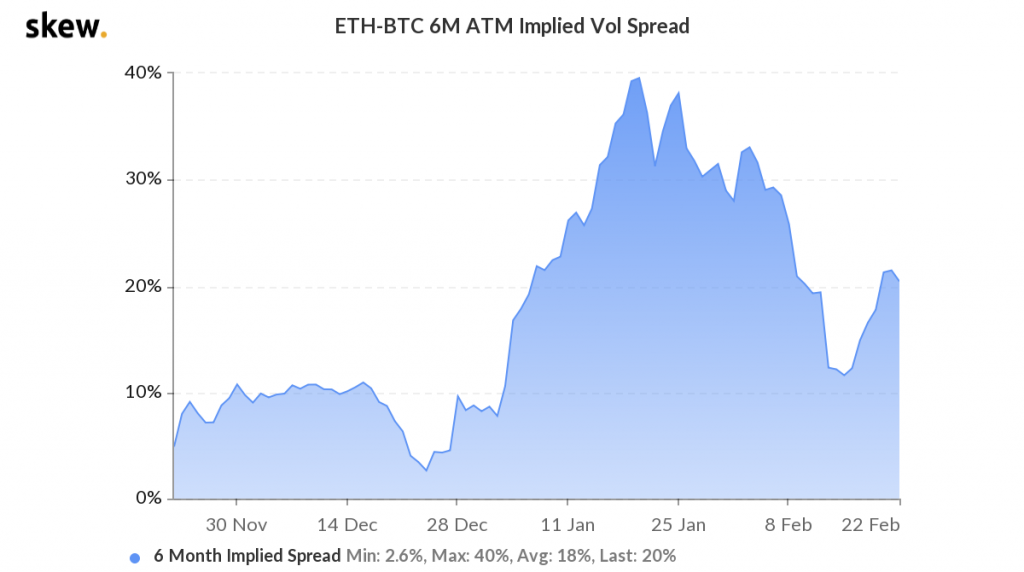

The ETH-BTC 6 month Implied Volatility spread has rapidly risen over the past couple of weeks. The increasing Implied vol spread suggested that the expected volatility for Ethereum is currently much higher than what is expected off Bitcoin over the next few days. It can be inferred that Ethereum may trade at a higher volatility with respect to Bitcoin and the largest altcoin might be able to bridge the valuation rise, currently held by Bitcoin in terms of short-term growth.

Option Traders expecting a BTC dip & an ETH spike

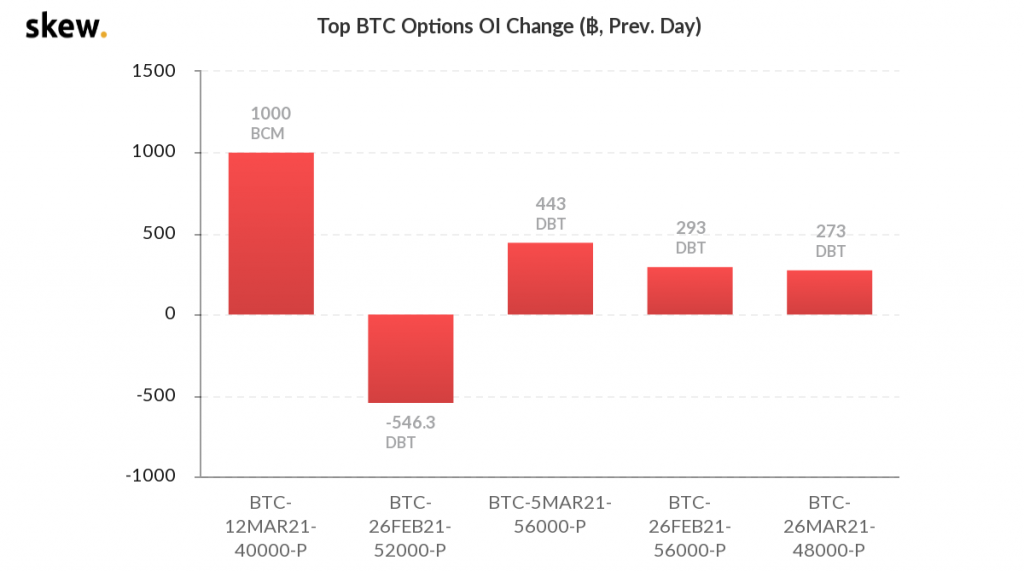

As Ethereum is expected to move forward in the charts over the coming days, BTC Options trader sentiment is heading towards a decline. According to data, most traders have a higher number of put sell contracts, with strike prices of $56,000 and $48,000.

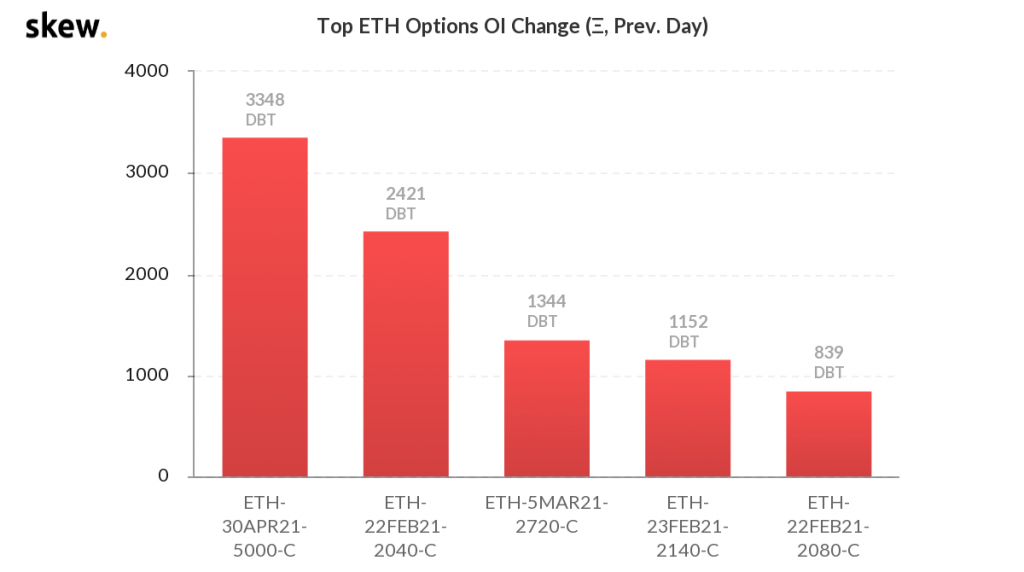

On the other hand, the collective sentiment of Ethereum Option traders is extremely positive. At present, there are 3348 DBT contracts expecting ETH prices to reach $5,000 before the end of April. 1344 ETH contracts were also held a strike price of $2720 on 5th March 2021.