Why Hedera might pull off a surprising comeback in 2023’s NFT market

- Hedera made some significant developments in 2022, paving the way to becoming an NFT powerhouse.

- A price pivot could be on the way, as HBAR was shy of oversold conditions despite the downside.

Now that 2022 is ending, it is time to recap the performance of some of the top layer 1s. Hedera [HBAR] rose to prominence over the last year, as it saw some significant developments that may lay the foundation for strong growth ahead.

Read Hedera’s [HBAR] Price Prediction for 2023-24

There were notable developments and partnerships in 2022 that underscored Hedera’s potential for more growth in the NFT market. These included the network’s collaboration with LG Art Lab, a partnership that aimed to facilitate NFT distribution.

In a tweet on 27 December, LG Art Lab reiterated its commitment towards building on the Hedera network despite the challenges the market faced in 2022.

As the markets continue to work out the inner details of FTX’s collapse, HBAR has had volatile movements as projects continue to build on top of Hedera.

In a recent interview with HBAR Foundation’s Chief Legal Officer, he had stated that Hedera has already issued grants to… pic.twitter.com/3qXaOs1Zt9

— LG Art Lab (@LGArtLab) December 27, 2022

The LG Art Lab update also confirmed that it was already building over 150 projects on the Hedera network, thus contributing to healthy network adoption despite unfavorable external market conditions.

Such partnerships and developments will allow Hedera to play a bigger role in the mass adoption of NFTs.

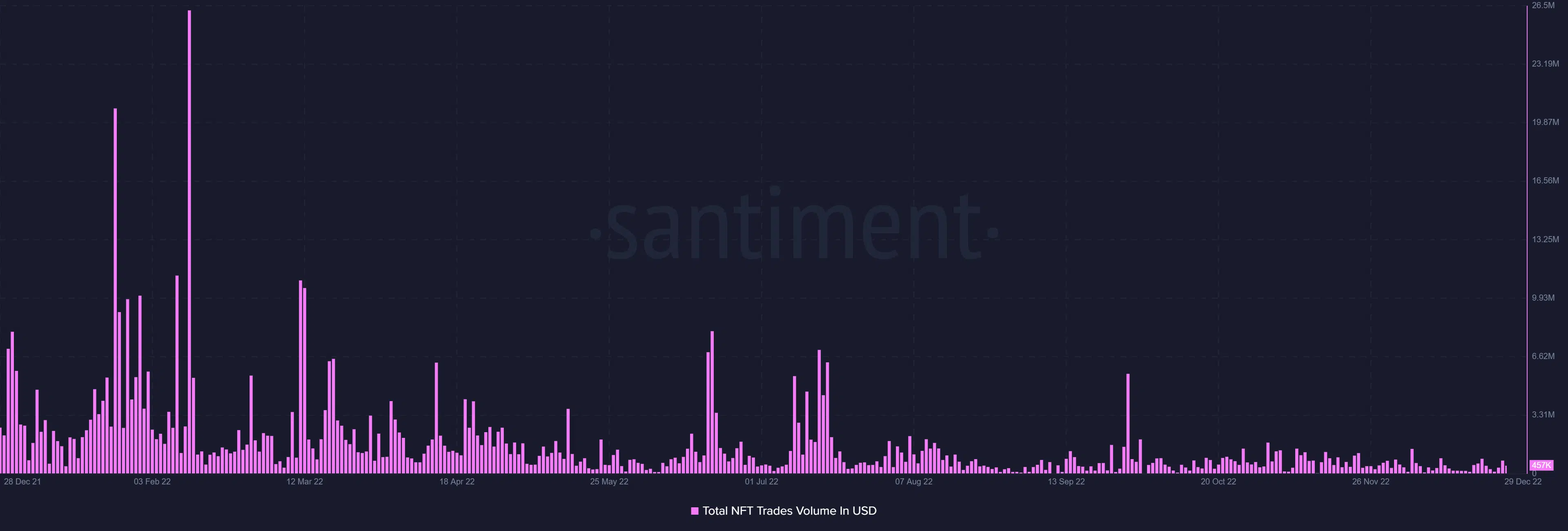

2022 was not exactly the best year for Hedera’s NFTs. Though it started off with healthy NFT trade volumes at the start of the year, the demand tapered as the market faced external economic pressures.

The partnership with LG Art Lab may facilitate faster adoption of digital art, which can be showcased via LG displays. This would foster support not only in the NFT market but also in the art industry. But what does this all mean for HBAR’s performance?

Can Hedera’s NFT activity revive HBAR demand?

Hedera’s market impact was reflected in HBAR’s price action, which was heavily discounted in 2022. Its $0.040 press time price tag is the same price at which it traded in January 2021.

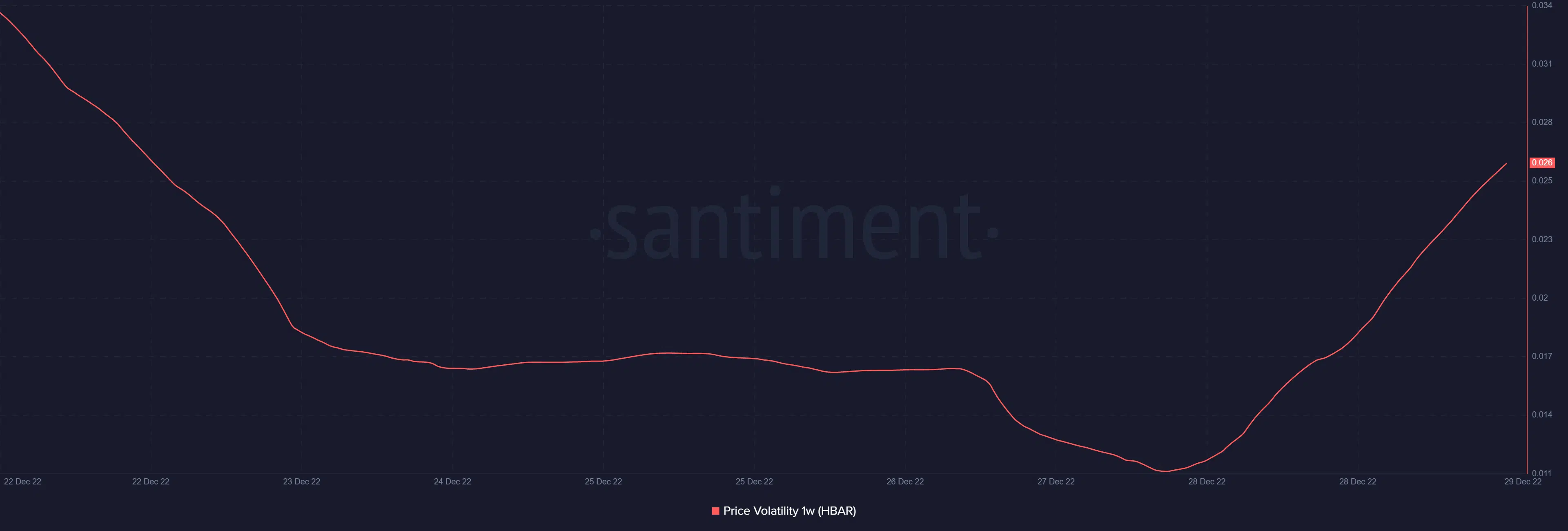

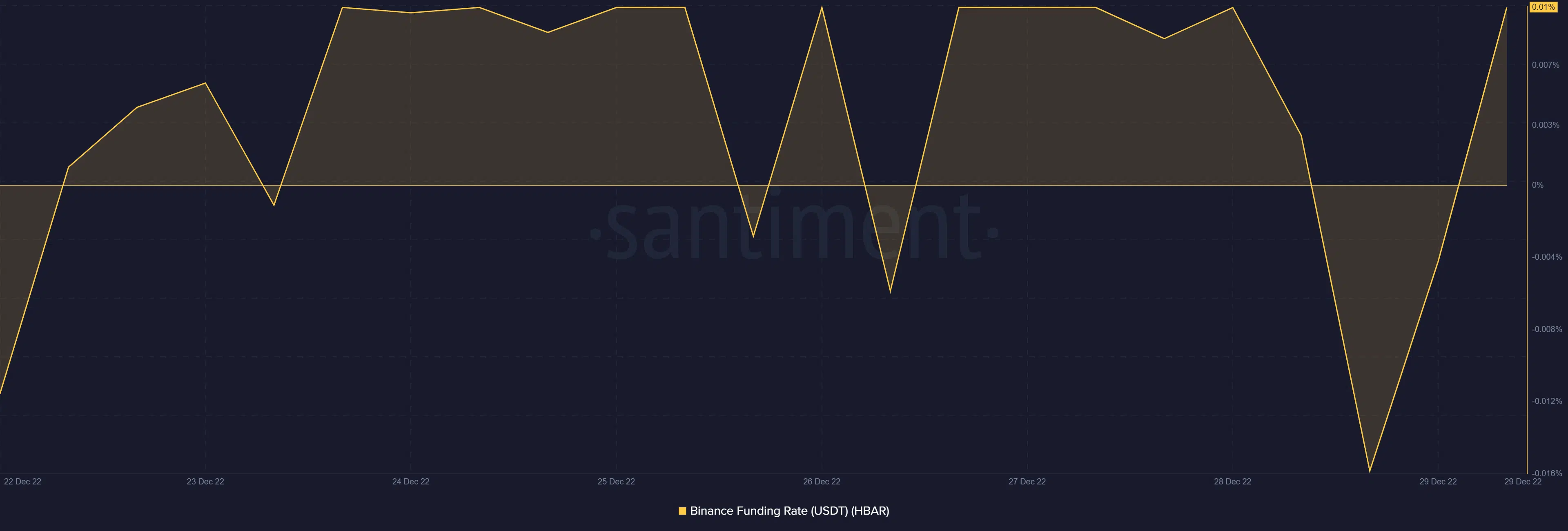

Is a pivot in the works? HBAR is still slightly shy of oversold conditions despite the downside. Its RSI indicated positivity after retesting its bottom range for the second time in the last four weeks. Also, its weekly volatility metric flipped in the last two days, indicating higher incoming volatility.

The surge in volatility has also been accompanied by an uptick in Hedera’s Binance Funding rate, suggesting that there was some demand stimulation for HBAR in the derivatives market, at press time. This was especially interesting because a resurgence in derivatives demands often precedes demand in the spot market.

Are your HBAR holdings flashing green? Check the profit calculator

The above analysis meant that HBAR bulls might flex their muscles in the next few days. The price drop may also be a great opportunity for long-term holders looking for a heavily discounted entry point.