Why is Bitcoin more trustworthy at $30k than $3k?

How the times have changed. And apparently, so has The Financial Times. Consider this – A recent edition of the mainstream paper had Bitcoin take precedence and dominate the front page. The headline read, “High flyer: Bitcoin value tops $30,000.” Now, while the article does sound catchy and pretty, one must remember that FT wasn’t always so complimentary about the cryptocurrency.

In fact, in the past, FT would usually lead with the notional expectancy of an inevitable collapse, with the paper even going as far as claiming that “Bitcoin is dead.” However, something has changed over the past couple of years, and now, users are far less afraid of Bitcoin. The narrative is becoming more appreciative and here’s why.

Insert “Recognition,” backspace “Risk?”

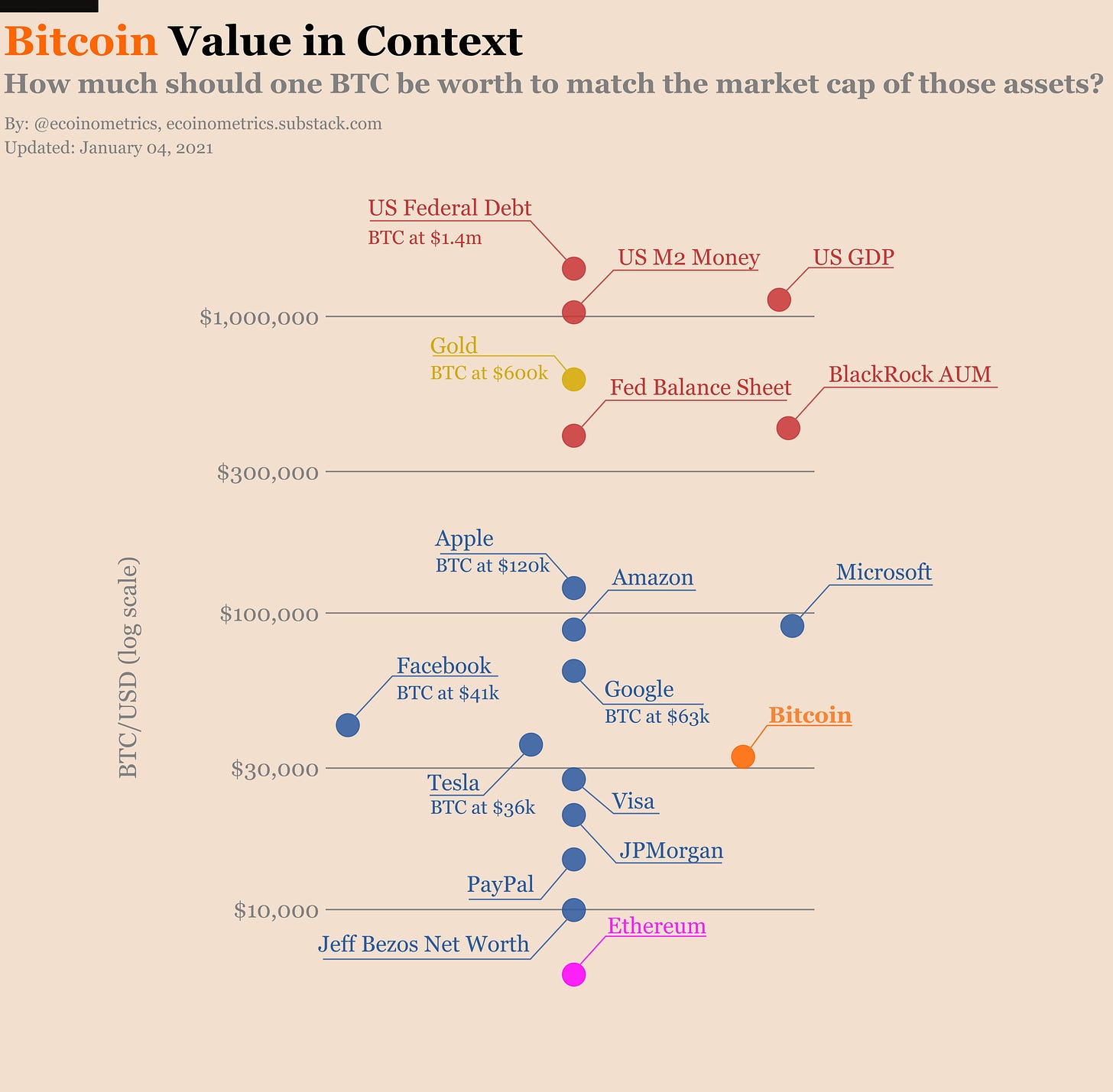

As highlighted by a recent report from Ecoinometrics, people are warming up more to Bitcoin at its current value near $30k, whereas they called it a blatant scam when BTC was priced at $3k or even, $10k. In fact, even popular crypto-skeptic Nouriel Roubini had to concede that Bitcoin might be a “partial store-of-value.”

What changed? Well, certain accredited investors had a different opinion, and as the floodgates of institutional capital opened in 2020, the narrative started to change.

While it is odd for a crypto-asset to become more popular after price saturation, Bitcoin’s case has been different because of a simple Return on Investment concept.

Investing $1000 in Bitcoin when it was $880 meant losing close to 50% if the price swing was anywhere near the $300-400 range. Hodling was not really popular then, and Bitcoin was meant to trigger fast profits.

Also, traders were then unwilling to lose more than they can afford to, and with Bitcoin, that was the case pre and post-2017. However, investing $1000 at $30,000, a trader would face a deficiency of less than $100 if the cryptocurrency was to register a 10% loss.

People are willing to see such a bear trend out as historically, Bitcoin has defeated the bearish odds multiple times.

Bitcoin is putting traders at ease now?

Since 2020, the world’s largest cryptocurrency has done an admirable job. With the crypto-asset continuing to perform through massive economic uncertainty in the past year, it is fresh in the minds of investors who have made money off the asset.

Hence, while a pullback will inevitably arrive, there’s more confidence about Bitcoin’s recovery now, than there was in 2017 or, even 2019. Bitcoin is creating its own niche in the financial market, one where institutional and retail interests are being rewarded for their trust.

Source: Coinstats