Why is 25th June critical for Ethereum?

Ethereum reached an all-time high valuation of $4375 on 9 May 2021 but the elation investors felt was short-lived. It registered a decline of 56% within a week, dropping down to $1880, following which another low at $1728 was observed. Now, over the past few weeks, the asset has made recovery above $2000, but collectively, the industry is still predominantly bearish.

Now, moving forward, 25 June carries significant importance, as it may assist Ethereum in reaching its ATH range.

June 25th; 2nd Quarterly Ethereum Options expiry

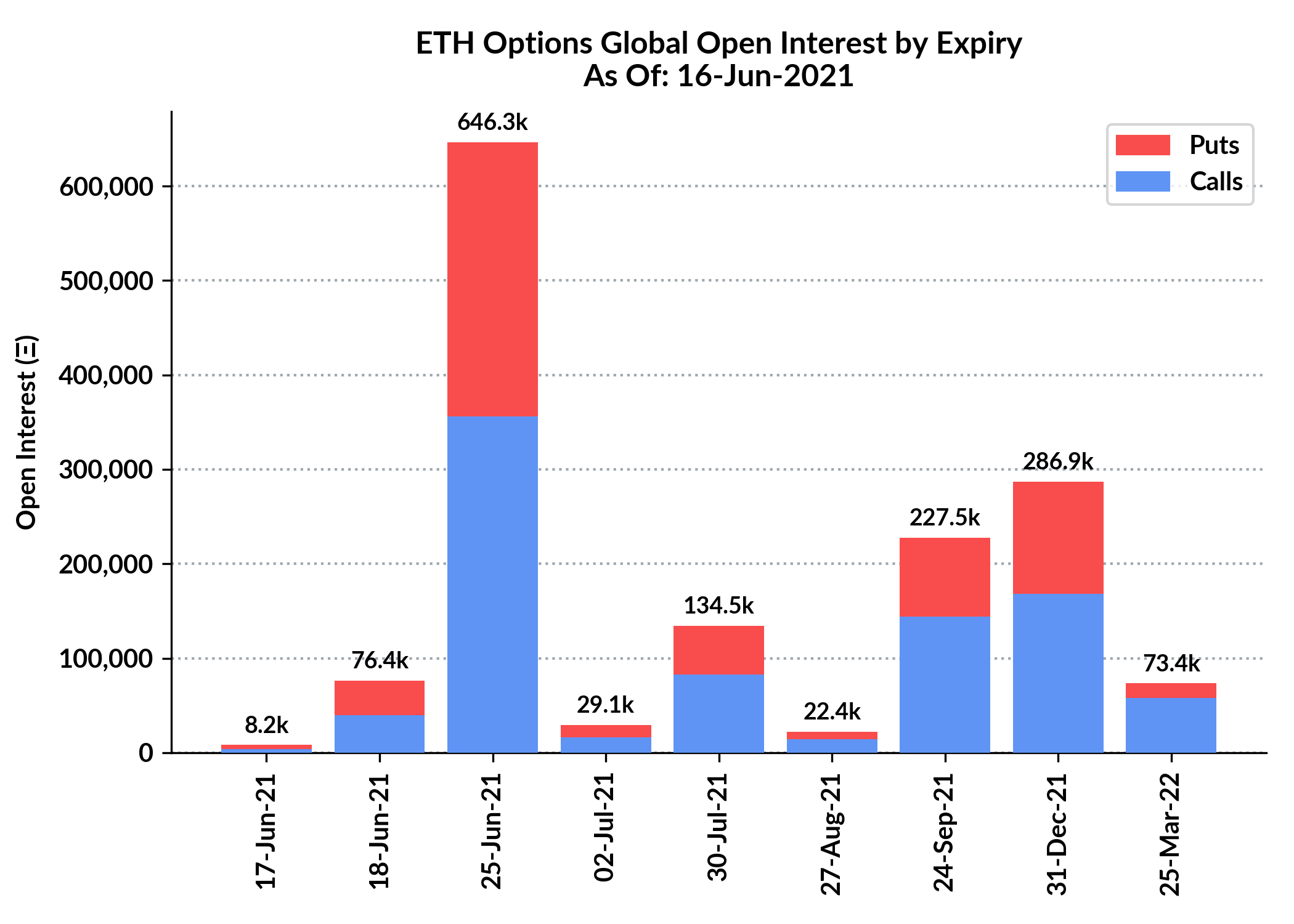

According to Skew, 646,300 ETH Options will undergo expiry on the 25 June, which is worth over $1.5 billion in Open-Interest. The total ETH expiry in June is currently valued at $3.6 billion.

It is also important to note that the aforementioned expiry is ~33% larger than the one that took place on 26 March. Here’s how the market unfolded after the 1st Quarterly Expiry.

ETH/USDT on Trading View

5-days prior to the expiry, Ether’s value had dropped by 15.35% in the charts. However, between 26 March and 15 April, ETH’s price surged by 60.70% before a minor correction took place. The asset then went on to register another rally till the 2nd week of May. Now, keeping the effects of the derivatives market in mind, speculators are suggesting that the expiry might have a similar impact on ETH’s price again.

Between Bulls and Bears, where is the line drawn?

Now, according to data from Bybt.com, there is a huge amount of call options at $2,200 with higher strikes. It means that Ether’s price needs to be above $2,200 when the expiry takes place for these ~97k call options to come into play. Otherwise, these options will be completely worthless.

Similarly, ~75k put options are more protective with a strike price at $2,100, where the line is drawn between bullish and bearish traders. At press time, Ethereum is consolidating near $2,400 so the upper hand is on the bullish side, but a lot can change in a week.

Investors need to keep a keen eye on this particular quarterly expiry, since the continuation of a bullish cycle for Ethereum, might depend on its expiry. The market structure for Ether remained in question from a bullish/bearish perspective. Hence, the expiry could play a relatively important role in dictating the direction going forward.