Why is this the best time to get back into Bitcoin?

Looking at how Bitcoin’s price went through a phase of corrections and dropped to $47,898 on the charts, it is worth noting that it is a tight spot for retail traders who sold their Bitcoins and are looking to buy in again. Whether this is a good time to jump back in or not, however, depends on where the price goes a month from now and further, where it will be towards the end of 2021.

Popular crypto-trader and analyst Jacob Canfield recently shared these sentiments when he tweeted,

“I have so many friends and family that held #Bitcoin for years underwater only to sell it at break-even around $13,000-$15,000.

Now they’re asking what’s the best price to get back in.

They missed a 4X on their money and they still want to FOMO in.

Retail is definitely here.”

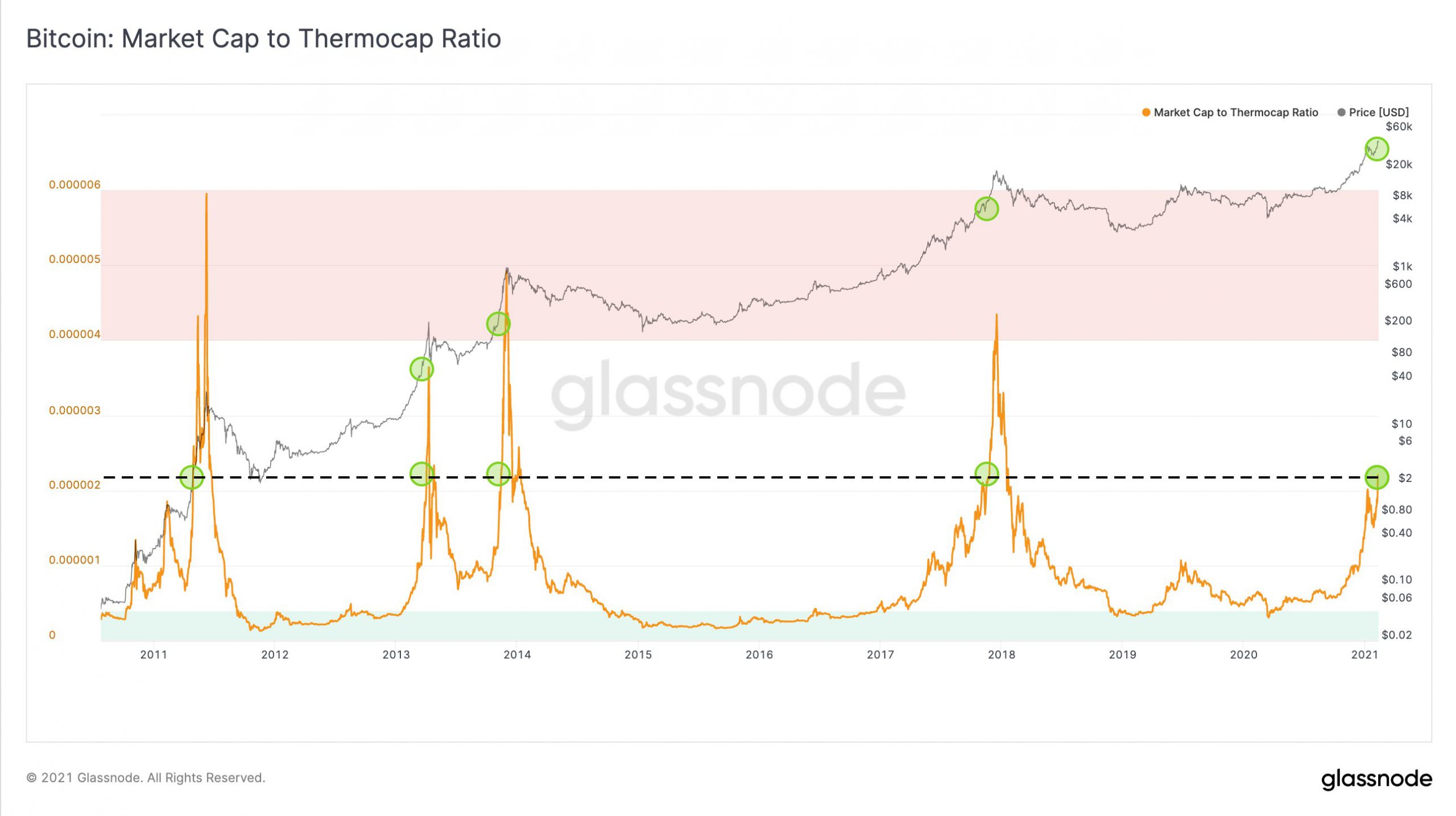

To get an estimate of whether the current price level is feasible for buying Bitcoin again, it may be useful to consider that during Bitcoin’s last bull run, the price was in the $8,500 to $9,000 range at the market cap to thermocap ratio seen currently. With respect to the current price rally, that would suggest a surge in price, one worth over 135 percent in less than 30 days.

Source: Twitter

Though there are several arguments to be made in favor of the assertion that this time the price rally is different, it is worth noting that a 135 percent hike from the press time trading price would push BTC above $110,000. Now, 30 days may be too short a time period, but while the timeframe may be an uncertainty, all indicators suggest the target isn’t.

Another metric that points to a price rally is the trade volume on derivatives exchanges. On 11 February 2021, crypto-derivatives exchanges traded at a new all-time daily maximum volume of $187.5 billion. During the previous bull run, the trade volume on derivatives exchange set a record of $93.36 billion on 26 November 2017.

Recent trading volumes have been much greater than the figures for 2017 and this signals a positive upcoming change. Trading volume on derivatives exchanges has often signaled a shift in sentiment and upcoming trend reversals critical to Bitcoin’s price rally. The current trade volume suggests that the price rally may extend itself and volatility may continue and there is a high probability that this may be a good time to buy back and HODL or wait before booking unrealized profits.