Why Lido Finance’s support of Ethereum upgrade is important?

- Ongoing voting showed that the Lido community would most likely support the Ethereum Shanghai Upgrade.

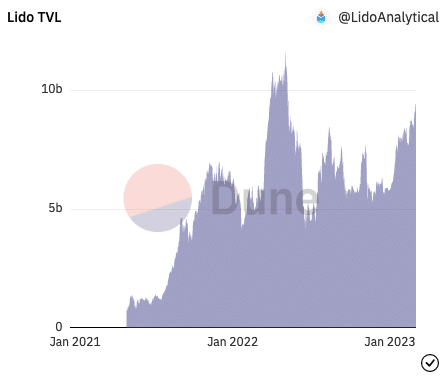

- The protocol’s TVL growth has evidently surpassed others.

The call by Lido Finance [LDO] on its community to approve withdrawals on its Staking Router might have yielded the much-needed fruits.

According to the snapshot of voting, 100% of the liquid-staking protocol community member who had taken part in the process were in support of the proposal.

How much are 1,10,100 LDOs worth today?

A few days back, Lido proposed the V2 upgrade which could affect its off-chain and on-chain system. On 28 February, the voting process opened as the protocol would play a part in the fast-approaching Shanghai Upgrade on the Ethereum [ETH] blockchain.

Uncertainty in the midst of rewards

Details from the snapshot showed that the voting process would last till 7 March. With the current momentum, there is a high chance that those opposed to the suggestion might have to settle with the agreement. Irrespective of the outcome Lido remains the largest staking protocol on Ethereum.

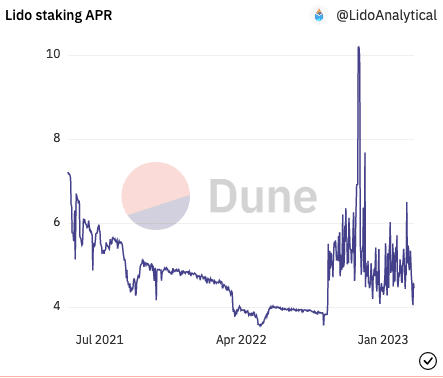

According to the Dune Analytics dashboard, investors who had taken the Lido staking APR offer had suppressed to low figures. Despite the fall, Lido still had a number as high as 129,224. The protocol had taken a 31.30% share of the total Ethereum staked.

With the incoming support, Lido, on 22 February, had explained how the Capella hard fork would affect its ecosystem. The Capella hard fork also known as the Shanghai Upgrade will allow validators who staked 32 ETH to withdraw their rewards.

As of this writing, the upgrade had passed the Sepolia Testnet stage. And, the Georli Testnet is the last stage before the final Mainnet part.

The Lido communique on the said date mentioned that it was not sure how fast the withdrawal request would be fulfilled. The protocol pointed out,

“In the best case, withdrawal requests can be processed within hours without requiring a validator exit. In a worst-case scenario, they may take significantly longer”

Realistic or not, here’s LDO’s market cap in ETH’s terms

He who prepares gets the best result

Further, it seemed that investors were already gearing up for the aftereffect of the Shanghai upgrade on LDO. At press time, the protocol maintained its lead of the DeFi Total Value Locked (TVL). The TVL takes into consideration the maximum supply, market cap, and deposit into an ecosystem.

This helps to contribute to the overall health of a project. Lido’s TVL at the time of writing had gained 9.37% in the last seven days. Its competition MakerDAO [MKR] did not record such growth. Hence, this means that Lido was gaining most of the attention in the DeFi sector.