Why Litecoin’s holder count rose despite falling prices

- Since Litecoin’s halving event on 2 August, LTC’s value has dropped by over 20%.

- However, despite the decline, its holder count continued to surge.

The number of addresses holding Litecoin [LTC] for over 12 months has almost doubled in the past year despite the steady decline in the cryptocurrency’s price, data from IntoTheBlock revealed.

Long-term Litecoin holders are surging! Nearly 5M addresses have held $LTC for over a year, almost doubling the count from last year's 2.55M. A clear sign of confidence from holders despite market conditions.

More data: ?https://t.co/rG2UOkZLc5 pic.twitter.com/sQy57dmYxE

— IntoTheBlock (@intotheblock) August 29, 2023

Is your portfolio green? Check out the LTC Profit Calculator

According to the on-chain data provider, nearly 5 million addresses have held LTC for over 12 months. This represented a 96% uptick from the 2.55 million addresses that held the altcoin for a year by August 2022.

LTC since the blockchain’s third halving event

On 2 August, Litecoin conducted its third halving event within its 12-year period of existence. The halving event reduced the miners’ block reward from the previous 12.5 LTC to 6.25 LTC.

Although some believed that market participants had anticipated the halving event and that a significant price decrease would not be imminent, the opposite has occurred. According to data from CoinMarketCap, the altcoin’s price has since declined by 27%.

It is, however, noteworthy to point out that while LTC trended downwards following the halving event, most of the price decrease occurred after the liquidity flush out from Bitcoin’s [BTC] futures markets on 17 August. Between then and press time, LTC’s value plummeted by double digits.

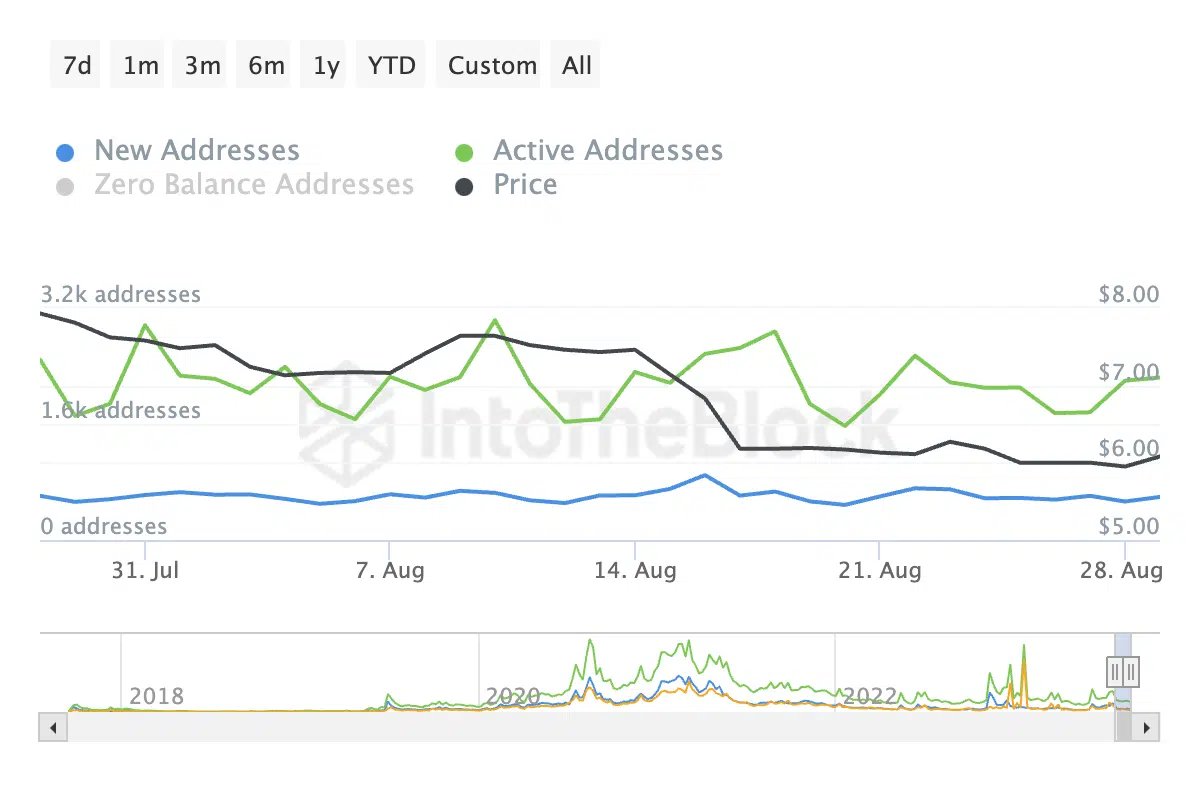

As a result of the negative sentiments that have permeated the general market, demand for LTC has dwindled since the beginning of the month. An assessment of the coin’s network activity revealed that since 10 August, the daily count of new addresses created to trade LTC has dropped by 7%.

Likewise, the count of daily active addresses that have completed LTC transactions since then has fallen by 27%.

Due to the price decline, LTC whales have mostly stayed their hands from accumulating the coin. Data tracked by IntoTheBlock revealed that the daily count of LTC transactions worth between $100,000 and $1 million completed in the last month has dropped by 42%.

Similarly, the daily count of whale transactions that range from $1 million to $10 million has been reduced by 69% within the same period. The decrease in whale transactions in the last month mirrors the waning positive sentiment in the LTC market.

Futures markets are not any different

The poor sentiment was also spotted in LTC’s futures markets. LTC’s Open Interest across exchanges has declined steadily since 21 July. At $120.28 million at press time, LTC’s Open Interest has since fallen by 61%.

A decrease in an asset’s open interest often suggests a reduction in the number of traders interested in the asset. A steady decline in open interest means that many traders have decided to close their positions to either take a profit or cut losses.

How much are 1,10,100 LTCs worth today?

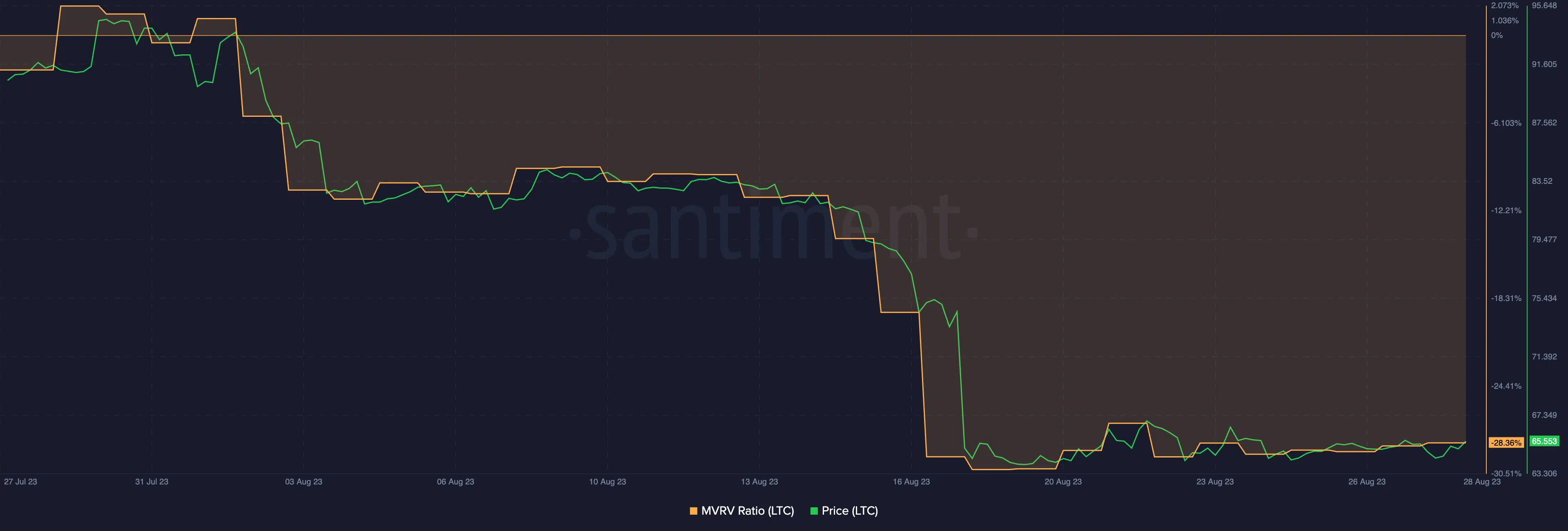

A look at LTC’s Market Value to Realized Value (MVRV) ratio suggested that most positions exited must have been closed to reduce losses. Since 1 August, LTC’s MVRV has been negative.

This showed that the coin has since been undervalued, with many traders holding on to coins below their cost basis.