MATIC’s price is flashing a buy signal; here’s what you should do

- A major technical indicator revealed that MATIC could rebound.

- Funding decreased while spot traders continued to buy the dip.

Polygon’s [MATIC] 21.57% correction in the last seven days might soon end if the prediction by analyst Ali Martinez is anything to go by. According to Martinez’s post on X, the Tom DeMark (TD) Sequential flashed a buy signal for MATIC.

For the uninitiated, the TD Sequential is a technical tool that can identify trend exhaustion. It does this by finding an overextended price move. When this happens, the direction of the cryptocurrency changes and countertrends the overextended part.

From the analyst’s post, the indicator has been spot-on for some time. Therefore, the signal that the Polygon native token might bounce off the $0.92 support should be taken seriously.

The bounce may have begun

At press time, MATIC’s price was $0.95, indicating a 3.20% jump within the last hour. A move like this suggests that the aforementioned opinion might be valid. However, AMBCrypto considered it important to analyze the prediction using other indicators.

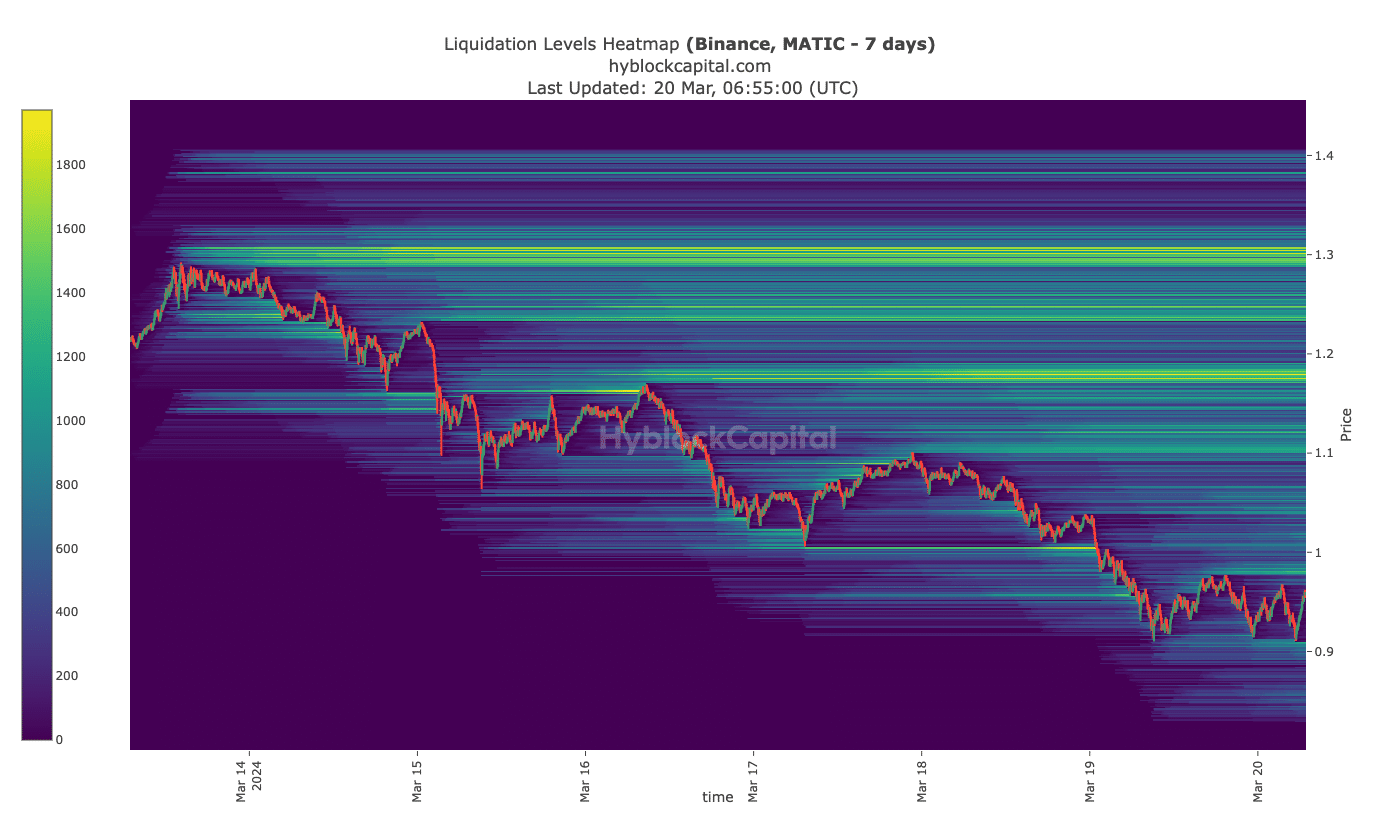

The first indicator we checked out was the liquidation heatmap. The liquidation heatmap can be helpful in different ways. First, traders can identify areas of high liquidity. Also, a concentration of potential liquidation levels indicates that the price might move toward the region.

As of this writing, the liquidation heatmap showed a cluster of liquidity around $1.18. This is denoted by the areas colored in yellow. Going by the aforementioned definition, the price of MATIC could head toward that region.

However, Polygon could face resistance around the same price. If bulls break through the resistance, the next target would be around $1.30. On the other hand, rejection at $1.18 might drag the price back below $1.

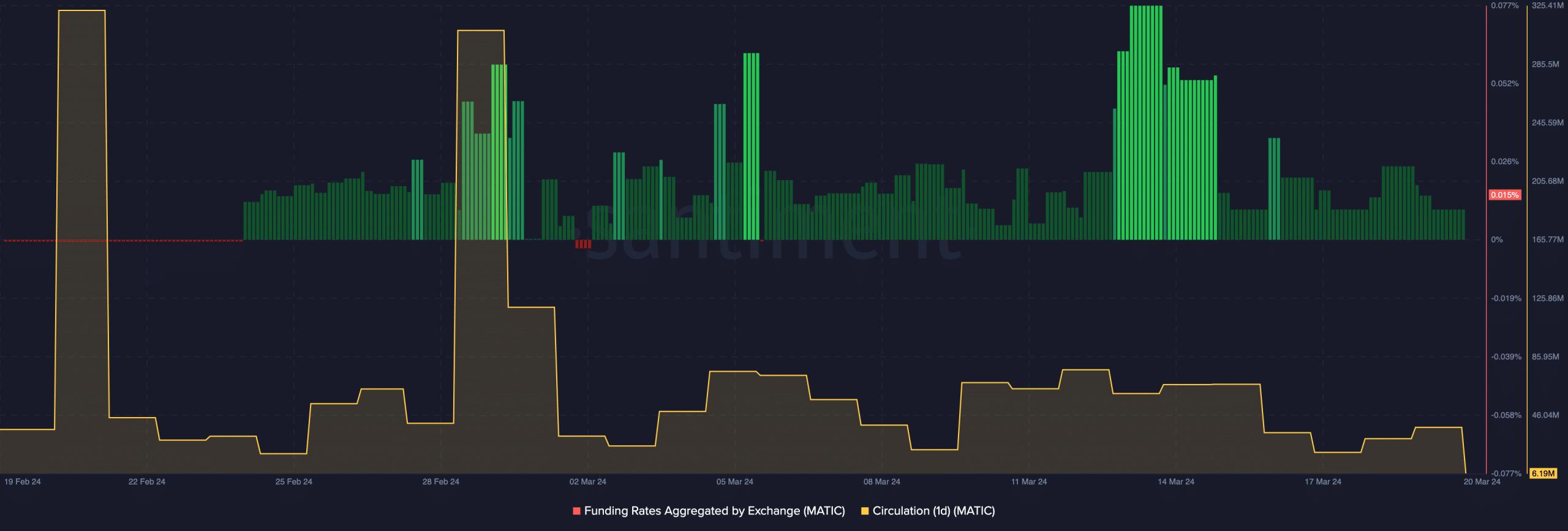

But considering the display above, that looked unlikely. From an on-chain point of view, AMBCrypto observed that MATIC’s Funding Rate was 0.015%.

No room for bears?

Funding Rate is the cost of holding an open perp position. If the metric is negative, it means shorts are paying longs to keep their positions open. Otherwise, a positive Funding Rate implies that shorts receive the fee.

One thing we noticed was that funding decreased as Polygon’s price attempted to move higher. This implies that perp sellers were in disbelief. It also suggested that spot traders were aggressively buying the dip.

As per the price, this movement is bullish. Therefore, the value of the token might rise toward $1.18 over the next few days. Circulation was another metric supporting the bullish thesis.

Read Polygon’s [MATIC] Price Prediction 2024-2025

At press time, MATIC’s one-day circulation had dropped to 61.9 million. This decrease suggests a decrease in the usage of the token.

For the price, the decline was a positive signal, indicating less selling pressure. Should the circulation continue to drop, then MATIC’s rebound might be significant.