Why MKR could be the next top gainer: MakerDAO leads on THIS front

- MakerDAO showed signs of budding activity and resilience despite growing competition.

- However, MKR struggled to gain bullish traction as rival coins cruised to new tops.

MakerDAO [MKR] was one of the top DeFi projects during the 2021 bull run. Fast-forward to the present, and the DeFi segment is more saturated with newer projects and thus competition has intensified.

But how has MakerDAO been fairing with these changing conditions?

According to a recent dApps ranking, MakerDAO managed to squeeze into the top 10 dApps by weekly fees generated.

This was an important observation because it revealed that the platform was still experiencing decent levels of utility.

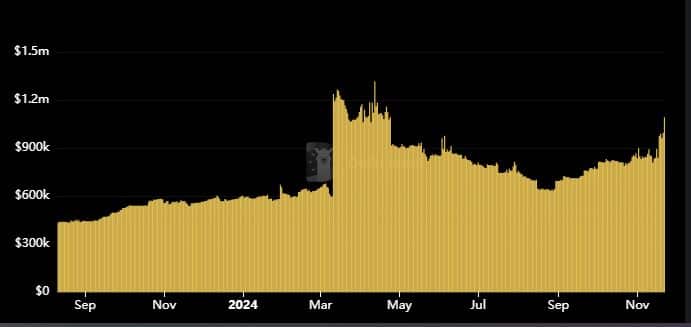

The DeFi protocol’s fees have achieved impressive growth in the last two years. For context, MakerDAO daily fees averaged less than $30,000 in October 2022.

However, daily fees embarked on an upward trajectory, with the highest recorded figure occurring at $1.19 million on the 8th of April 2024.

The 22nd of 22 November marked a significant milestone for MakerDAO fees. This was because it was the first day that dApp fees surged above $1 million in the second half of 2024.

Other metrics also confirmed growing dApp activity. For example, token volume surged from less than $40 million to $356 million in the last four weeks. It averaged over $200 million in the last three days.

MakerDAO’s TVL has also been in recovery mode for the last few weeks. It has so far gained by $1.5 billion from its lowest point in October this year.

Will MKR benefit?

The surge in volume, TVL and fees were clear indications that MakerDAO utility is growing with the recent market excitement. However, this growth has hardly reflected on its MKR token.

MKR has been mostly bearish so far in 2024. It fell to a 12-month low of $1,006 on 25 October. It has since bounced back by 61% to its $1,630 press time price tag.

Most of its top rivals have more than doubled from their lowest 2024 prices. This suggests that MakerDAO has been underperforming.

In other words, it could be on the lineup for relatively undervalued tokens with a lot of upside potential.

MKR’s surge so far this year suggests that accumulation has been taking place at its recent bottom range. However, demand has been relatively weak, but this could change as liquidity rotation continues.

Read Maker’s [MKR] Price Prediction 2024–2025

However, this does not necessarily mean that such an outcome could occur.

MKR’s high price tag might be a deterrent to potential investors. This may explain why it has seemingly been sidelined.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)