Why Monero [XMR] is a growing favorite among ransomware groups

Monero is reportedly the most favored currency used by ransomware actors. A recently released study by CipherTrace reports on the trends in ransomware in 2021. The study titled, “Current Trends in Ransomware” talks about the growing trend of ransomware in the crypto ecosystem.

Monero: The new face of ransomware

CipherTrace analysts have found a growing pattern in recent ransomware attacks. Most groups have been found to use privacy coins such as Monero (XMR). Groups tend to use these coins for their increased anonymity as compared to Bitcoin.

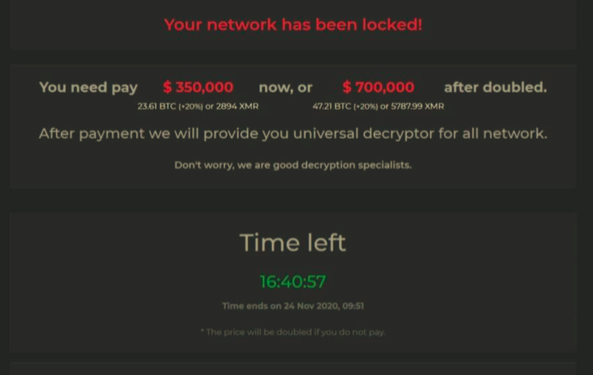

The report sheds light on the same with this example.

“DarkSide—the group behind the US Colonial Pipeline attack— accept both BTC and XMR but charge a 10-20% higher price for payments in BTC. This can be seen in the image below, under the “$350,000” and “700,000”, a note reads “(+20%)” for BTC. In other cases, CipherTrace analysts have observed premiums of only +10%.”

Recently, a group called Everest Ransomware allegedly hacked into the U.S government. After a failed negotiation, the group decided to sell the data for $500,000 in XMR only.

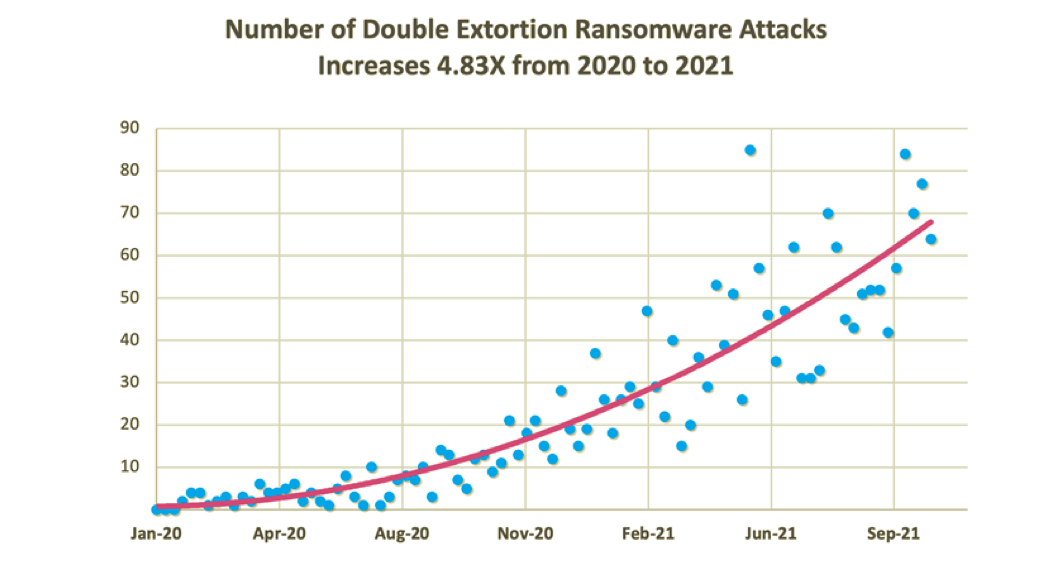

Another trend emerged with the increasing measures of curbing security breaches. The act of double extortion has grown at large where attackers threaten to release encrypted data. The data points to a 5X increase in the number of double extortion attacks from 2020 to 2021.

Where does XMR stand now?

Monero has been on a surge since late February. Despite the failure of flagship currencies such as Bitcoin and Ether failing to hold their 2022 highs, XMR has continued to rise.

As per Bloomberg, many XMR owners began withdrawing from major exchanges. The move was later dubbed as “Monerun”. According to a post on the token’s dedicated subreddit, the move away from exchanges is designed to create an intentional short squeeze.

“The Monero community has come to a loose consensus that many exchanges don’t actually hold all of XMR which customers have purchased,” according to the post by Reddit user “bawdyanarchist”.

The withdrawal is intended to force those exchanges to purchase actual tokens, which would in turn push Monero’s price much higher, according to the Reddit user.

The Monero surge is evident in the price chart with XMR dashing its highest numbers since November 2021. XMR was able to cross $275 twice in the bull run and looks set to extend the resistance line over $300 in the coming weeks.

The RSI value has also suggested a bullish activity with the index value consistently staying in the overbought zone. The value has stabilised around 70, at reporting time which represents a major demand for the currency. It looks set for a bullish surge further as we wrap up April.