Why Polygon’s [MATIC] struggles continue despite growing transaction fees

- Polygon outperformed Arbitrum and Optimism in terms of transaction fees collected over the last 30 days.

- MATIC became the most traded token among top Ethereum whales.

According to a 28 February tweet, Polygon [MATIC] collected more than $7 million in transaction fees in the year-to-date (YTD) period, which highlighted the Ethereum [ETH] sidechain’s growing network usage.

With over $7.25M earned in $MATIC fees so far this year, the @0xPolygon blockchain is off to a good start?

Save this @DuneAnalytics dashboard to track key Polygon metrics in 2023??

Includes: fees, new & old address activity, DEX volume and more?

?https://t.co/18fgcXYKpu pic.twitter.com/AosVsSrPqe

— James (@JamesT0lan) February 27, 2023

Read Polygon’s [MATIC] Price Prediction 2023-2024

Additional data from Token Terminal revealed that Polygon outperformed layer-2 scaling solutions like Arbitrum [ARB] and Optimism [OP] in terms of transaction fees collected over the last 30 days.

Recent activity throws up challenges for Polygon

Though Polygon registered a decent run compared to the lows of 2022’s bear market, network revenue dipped considerably over the last week.

According to Dune Analytics, the daily gas fees have plunged 30% since 21 February. Since the protocol’s revenue depends largely on the gas fees collected, it underwent a decline as well.

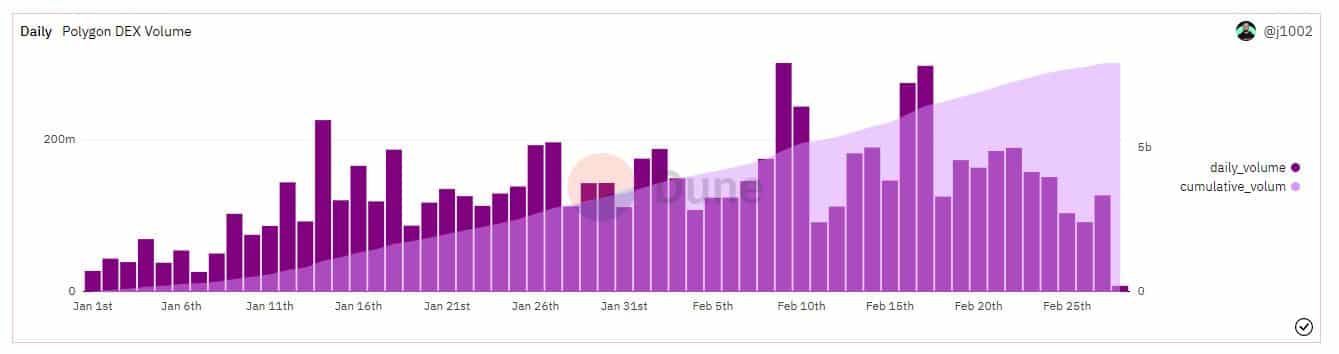

One reason behind the dip in transaction fees could be the dwindling action on Polygon’s decentralized finance (DeFi) front. Its daily decentralized exchange (DEX) trading volume plummeted 57% over the last 10 days.

On the other hand, big addresses displayed their liking for MATIC after it became the most traded token among top Ethereum whales, as per tweet from WhaleStats.

The surge in accumulation could be attributed to the much-anticipated Polygon’s zkEVM scaling solution, which was slated to be launched on 27 March.

? JUST IN: $MATIC @0xPolygon flipped $UNI for MOST TRADED token among top 100 #ETH whales

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#MATIC #UNI #whalestats #babywhale #BBW pic.twitter.com/F4fXzTKAJx

— WhaleStats (tracking crypto whales) (@WhaleStats) February 27, 2023

MATIC in the grips of bears?

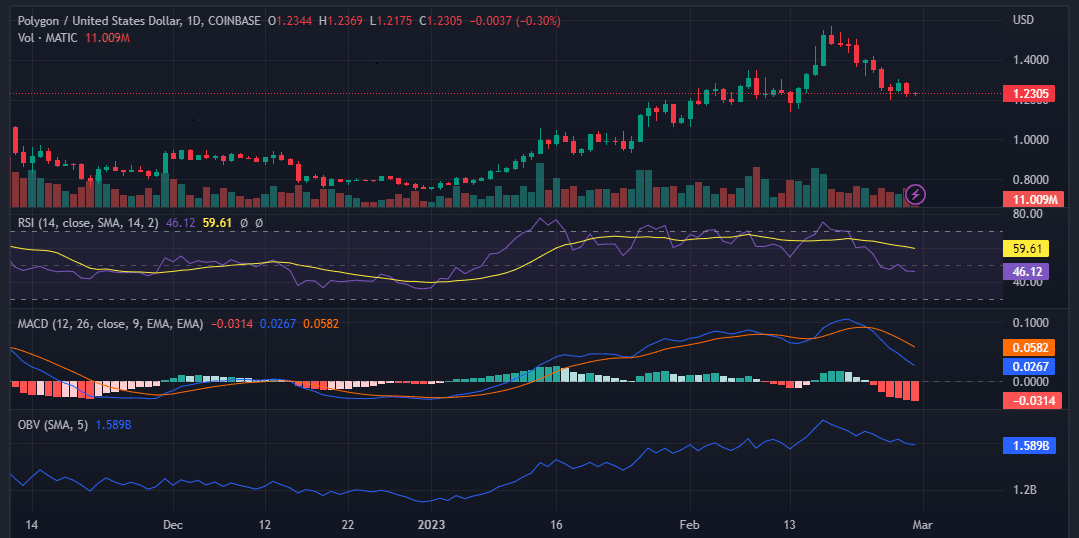

At press time, MATIC exchanged hands at $1.23, down 2.35% in the 24-hour period.

The Relative Strength Index (RSI) dropped below the neutral 50 level, implying that bulls were running out of steam.

Is your portfolio green? Check out the MATIC Profit Calculator

The Moving Average Convergence Divergence (MACD) sounded a strong bearish alarm for MATIC’s price. The On Balance Volume (OBV) made lower highs and lower lows in the last 10 days, which indicated that capital inflow into the market was decreasing.

Lastly, the technical indicators painted a bearish idea for MATIC and there was a high possibility of price dipping below $1.23.