Why the U.S. SEC’s approval of Bitcoin ETF could prove to be a gamechanger

After a flash crash, some consolidation, and another crypto ban by China, Bitcoin fell by over 20% from its multi-month high of over $52K. September hasn’t been too kind for the king coin and after a rather sad September BTC needed a massive push. So, as anticipation of Bitcoin’s September blues giving way to October highs heightened the market wished for a miracle to pump BTC price.

At this point, Bitcoin ETFs looked like the light at the end of the horizon, that may be able to pull the king coin up. Over the last couple of days, there have been speculations that Bitcoin ETFs could arrive by the end of October after Mike McGlone, a senior commodity strategist at Bloomberg Intelligence said the same.

He further pointed out that external events like the huge volume of trade that Canadian BTC ETFs saw were among the major factors that pressured the SEC towards a positive ETF decision even though nothing could be said about the decision as of now.

If Bitcoin ETFs are approved in the U.S. it won’t just be a major crypto milestone but would also aid the adoption of the top coin. But before delving into how the future of Bitcoin ETFs would look, it would be helpful to see how ETFs have performed in the past.

ETFs’ past looks pleasant

When Gold ETF was introduced it turned out to be a real game-changer, in fact, in just seventeen years GLD ETF is about $57 billion in assets under management which makes it the 20th largest ETF in the world. It received immediate success and GLD came to control over 1,000 tonnes of gold to back its value. People have speculated that a part of the jump that saw gold saw, that is, from $300 per ounce to $1,600 between 2004 and 2010 was in fact driven by the physical gold ETFs ramping.

Further, when Grayscale launched GBTC (an ETF-like investment option) in 2013, from January to April 2013 BTC’s price rose by almost 1200%. In the second half of the year, its price rose by over 700% hitting the $1000 mark by December 2013.

This is how BTC ETFs will pump prices

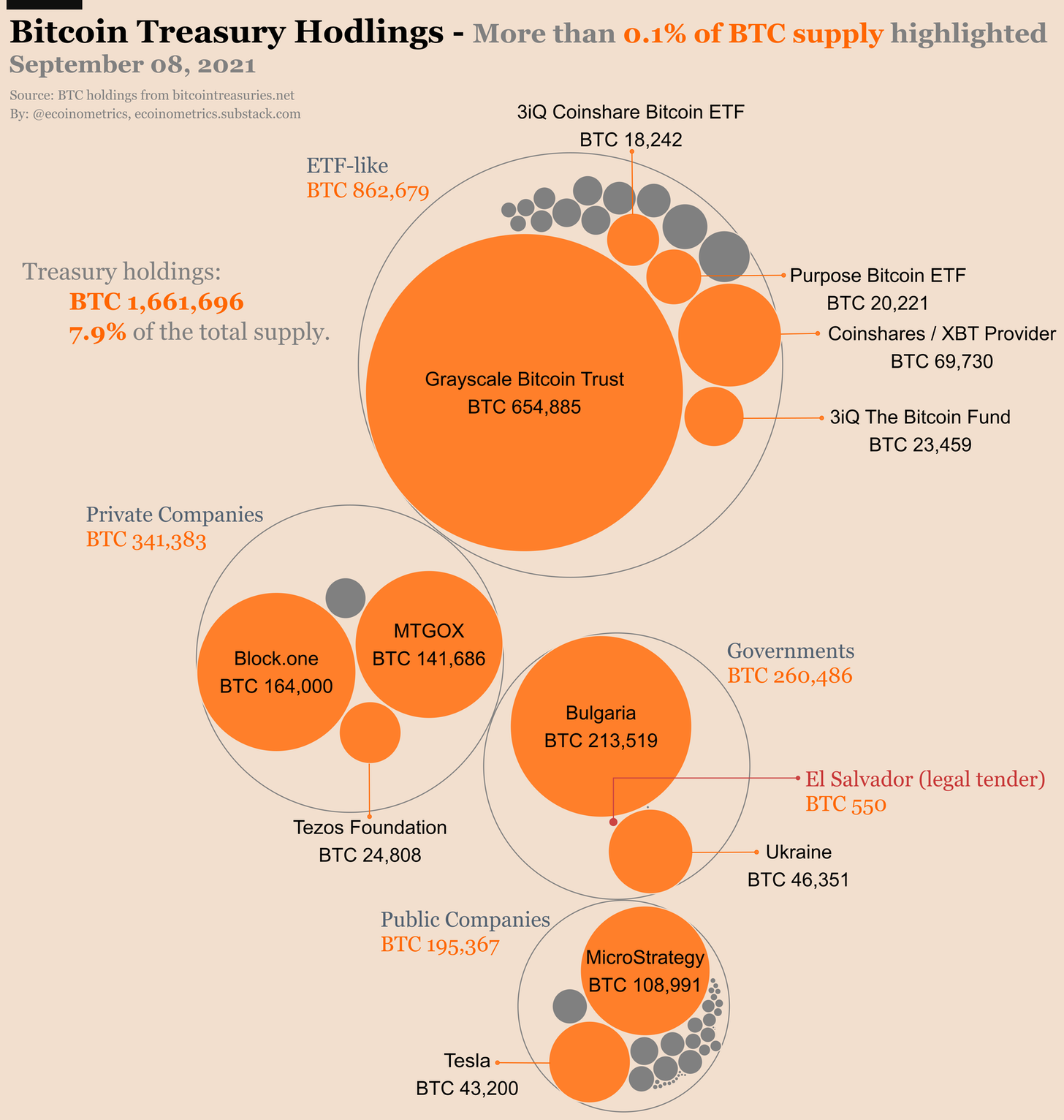

Bitcoin ETF’s could create an additional demand pressure that will have price implications. An Ecoinometrics newsletter pointed out that already without a proper physically-backed Bitcoin ETF in the US, the ETF-like investment vehicles (including GBTC) capture 4% of the maximum supply. Another Bitcoin ETF could push that fraction to around 6% or even 8%.

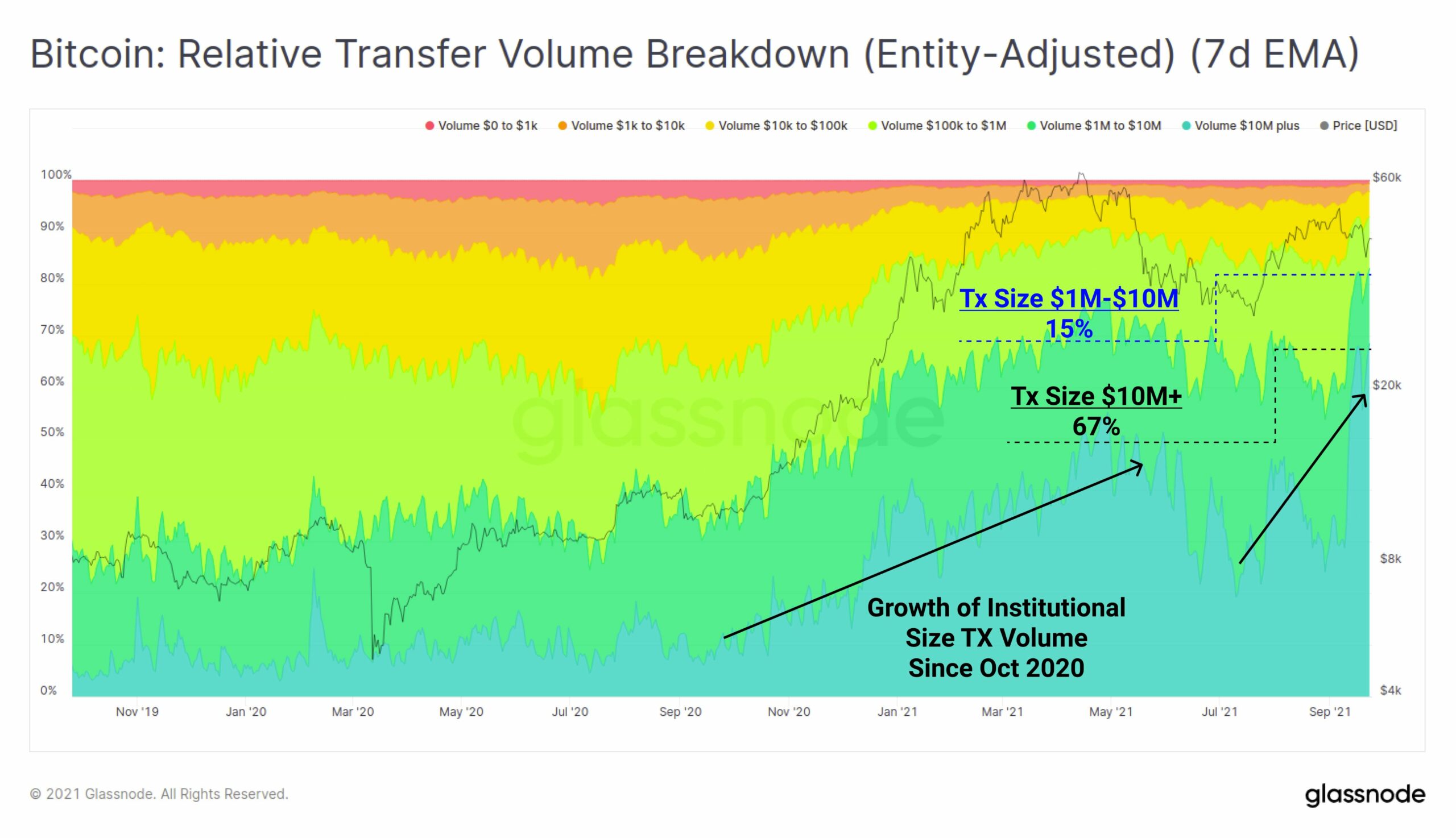

Further, as BTC’s adoption is already high and there was growth in institutional sized capital since October 2020, the chances of a BTC ETF changing the game for good are high. Bitcoin transaction volumes continued to reflect big money moving in the space. Further, institutional-sized capital of over $1 million transaction size represented around 82% of settled volume over the past week. This noteworthy growth in institutional sized capital kicked off in October 2020 and has been on an uptrend ever since.

However, as of now, nothing could be said for certain as SEC’s decision is pending. Other than that, SEC would need to allow for a Bitcoin ETF that is backed by an actual spot BTC. Nonetheless, a decision in the favour of Bitcoin ETF in the U.S. would be a game-changer for the asset.