Why this is the ‘biggest and best thing that could have happened to Bitcoin’

Many financial advisors are of the belief that DeFi is a much more pitchable investment to Wall-Streeters, as opposed to Bitcoin. DeFi capital assets can be equated to equities, liabilities, high liquidity, and short-term yields: something that venture capitalists can wrap their heads around when compared to the intricacies of blockchain technology, mining, and staking among others.

In a recent podcast with Bankless, Jim Bianco, President of Bianco Research, reiterated the same. He stated that the ‘biggest and best thing that could have happened to Bitcoin’ is DeFi, adding that they were two sides of the same coin. He says:

“They understand the token because it is so similar to what they’ve seen in this space. I could see a day in the future where companies’ capital structure is not just stocks and bonds but it’s a whole variation of tokens as well.”

He’s not entirely wrong in that sense, as many top-ranking companies currently hold Bitcoin and several other cryptos on their balance sheet. Data from crypto asset management firms is also proof that an increasing number of advisors and investors are looking at crypto in general and DeFi in particular to diversify their portfolios.

Bianco went on to talk about the inefficiencies of the financial system and how venture capitalists would try to capitalize on the same, just as it happens during the recurring mergers and acquisitions on wall street in the US. But the rise of DeFi can change all that according to him, giving the power back to the people. He said:

“Mergers and VC firms will come in and buy these companies because they think they can unlock value because of the inefficiencies of the current market system. People that buy these companies go private and laymen cant invest in the private equity firms as they are not accredited, investors or advisors. But breaking that down into the token world & all of a sudden anybody can start looking at that value too. The token world can open up a lot of possibilities for a lot of other companies.”

What he meant was if big companies with cheap consumer goods tokenize their shares, along with providing an incentive to buy that token, they will help themselves just as much as their consumers. The consumers would not need large pools of capital to buy those tokens, and every time the value of the company goes up, so would the value of the tokens held by them. In this way, small investors can escape the current equity system that tends to favor those that already have a lot to allocate to their portfolios.

However, the DeFi community itself would have to step up in order for such a change in investor sentiment to take place. To scratch beyond the surface, according to Bianco, a strict definition of the token is required. He said:

“If we could get a definition of what a token is and open up all of the use cases for tokens beyond what we’ve got now, we could see a lot of forward-thinking Wall-Streeters.”

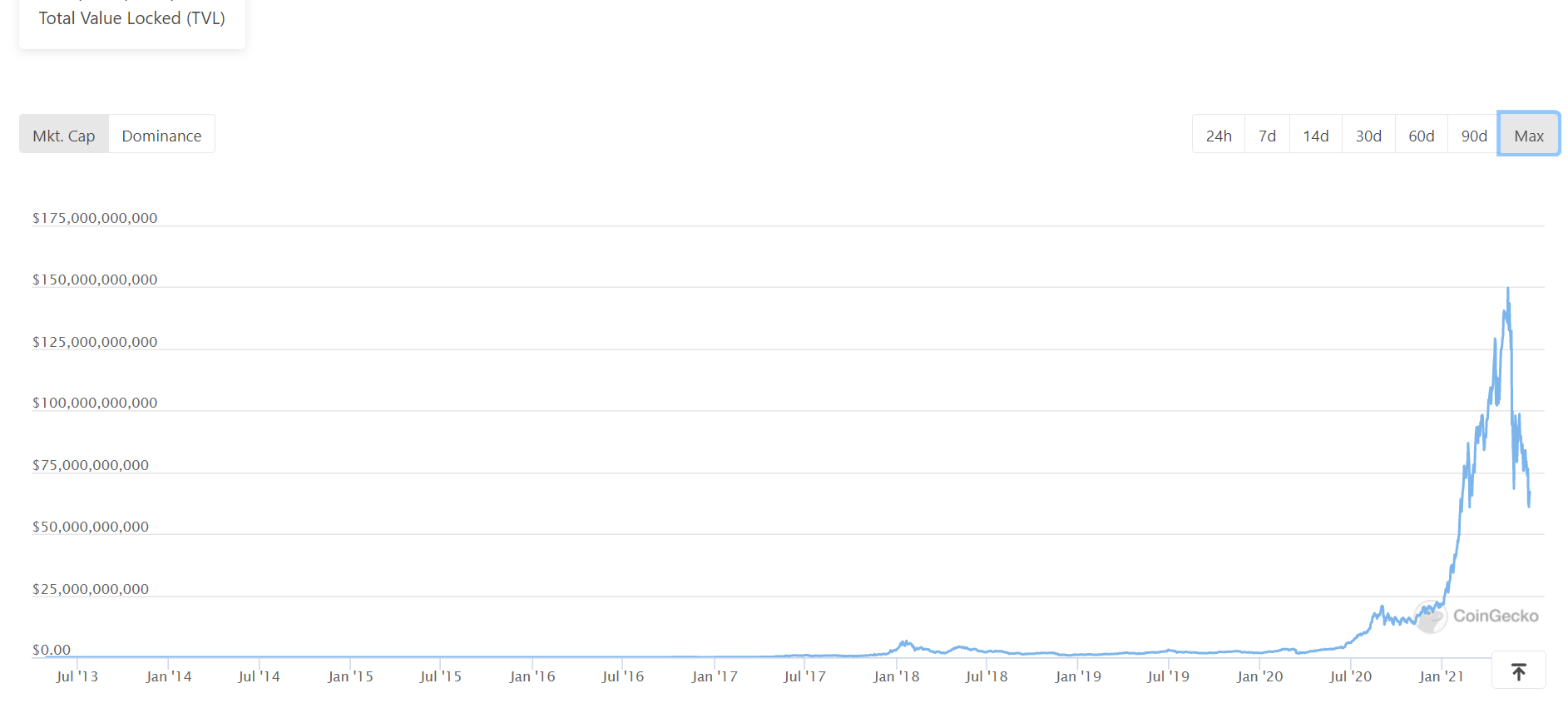

The total value locked into DeFi sits at $98.68 billion, according to DeFi Llama, which is a substantial amount when taken in the context of the $1.5 trillion global crypto market cap. At its all-time high, DeFi was valued over $142 billion, but larger market corrections have slowed it down. The DeFi boom came late last year, and according to investors, is here to stay.

Source: CoinGecko