Why this matters: Bitcoin active addresses decouple from price

2020 has been a very consequential year for Bitcoin and it went past its previous ATH established in the infamous bull run of 2017. Taking a cue from the past year, the past 7-days of 2021 have been no different. Bitcoin has been repeatedly in the news for outdoing itself by surging all the way up to over $41k and has since settled around the same price range. However, an interesting metric seems to be slowly moving downwards.

According to a recent report by LongHash, Bitcoin and its active addresses are now moving rather curiously. As the king coin keeps moving upwards on the price charts, its correlation with its active address count has been heading in the opposite direction. This in turn suggests that the number of people using Bitcoin may have decreased and also shows that such a factor seems to have a decreased impact on the confidence of new investors and the price of BTC. The report, elaborated,

“To be clear, Bitcoin’s active address count is on the rise — in fact it’s near an all-time high. But it’s not as correlated with Bitcoin’s price as it used to be, according to a Pearson correlation analysis performed by LongHash using data from Quandl.”

Bitcoin and its active addresses have always shared a high correlation if one were to look at the network’s historical data. In other words, every time the price went up the number of active addresses has also gone up. Despite the continued positive correlation between these two aspects of Bitcoin, LongHash’s report observed a subtle change, it read,

“If we reduce the scope to just data from 2020, though, that number drops to 0.55 — still a strong positive correlation, but not as strong as it has been historically. And if we reduce the scope still further, to data from August 1, 2020 through January 4, 2021, the number drops again: 0.28, a weak positive correlation.”

This highlights how over the course of 2020 Bitcoin’s price has decoupled from its active address count which is quite different from the 2017 bull run which noted a positive correlation of 0.82.

One of the key reasons for why such a change is taking place in Bitcoin’s strong bull run ever is once again due to the change in its audience. The 2020 bull run to a large extent was sparked by large-scale institutional investment that involves large volume trades that don’t require very many BTC addresses.

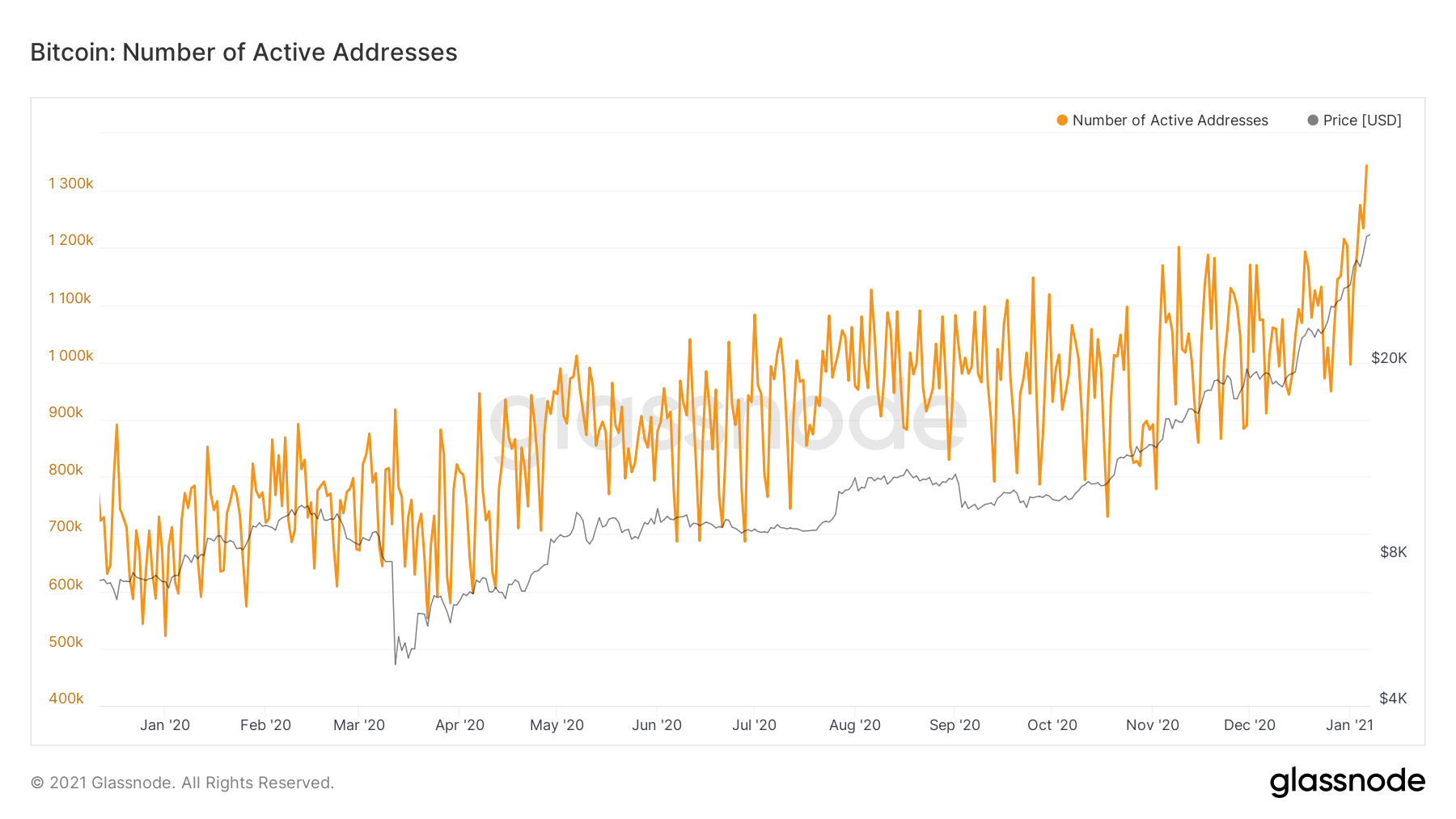

Source: Glassnode

While the addresses have increased over the course of 2020, as per Glassnode’s data from 700k to 1300k, the slight drop in the correlation between price and active addresses may be yet another factor that hints not just at the evolving Bitcoin landscape, but also suggests changes in Bitcoin’s userbase.

To a large extent, this shift can be seen if one were to take a look at BitPay’s findings regarding BTC’s role in payments. According to the data presented,

“while Bitcoin remains the most commonly-used crypto token for online payments, its share has dropped substantially: from accounting for 89% of crypto payments in June of 2020 to 79% in November of 2020”