Why this trend of Bitcoin and Ethereum is ‘completely fine’

Since Bitcoin has been stealing the limelight with its crazy price movements, Ethereum was somewhat forgotten in the midst of this volatility. And thus, ETH started imitating BTC. Higher highs, lower lows, price spikes, and crashes, all looked a little too similar for both the coins. Why is ETH behaving in such a manner and what is it about to do next?

Surprisingly the answer to Ethereum’s questions can be found in Bitcoin’s movement. And for that very reason, these two cryptocurrencies have established some pretty crucial levels for the next few days.

Bitcoin has a fan!

Given Ethereum’s movement over the last few days, it does appear to be the case that the 2nd-gen coin is closely following the king coin’s price action. In the last 2 weeks alone, both cryptos have noted an unnaturally similar movement. Looking at the movement during the 13 June rally, the gradual decline until 19 June, the consolidation period until 21 June, and the 72 hours of volatility that ensued after, appear all but the same.

Bitcoin 12-day price movement (4-hour chart) | Source: BTC/USD – TradingView

Ethereum 12-day price movement (4-hour chart) | Source: ETH/USD – TradingView

The only difference that separates the two is the on-chain exchange flows which, in the case of Ethereum, have been much lower than expected.

? Daily On-Chain Exchange Flow#Bitcoin $BTC

➡️ $1.4B in

⬅️ $1.4B out

? Net flow: +$18.2M#Ethereum $ETH

➡️ $479.4M in

⬅️ $531.9M out

? Net flow: -$52.5M#Tether (ERC20) $USDT

➡️ $557.3M in

⬅️ $684.3M out

? Net flow: -$127.0Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) June 24, 2021

Critical levels to watch put for

Despite these similarities, both coins have different important levels going forward. While BTC might be retesting the $32,000-level (black line) as support, it creates a possibility of a hike from this point. In fact, according to popular analyst DonAlt, if Bitcoin manages to close in the $35,000-range, a rally up to $45,000 can be definitely expected.

Important Bitcoin test levels | Source: Rekt Capital

On the contrary, Ethereum has a few critical ranges where it can shine going forward. Trader and analyst Michael van de Poppe remarked that over the next few trading sessions, ETH must hold within the $1700 – $1900 levels. Should this zone act as support, going forward the coin can potentially test $2300 or even $2600, based on how far it rallies.

Critical Ethereum test levels | Source: Michael van de Poppe

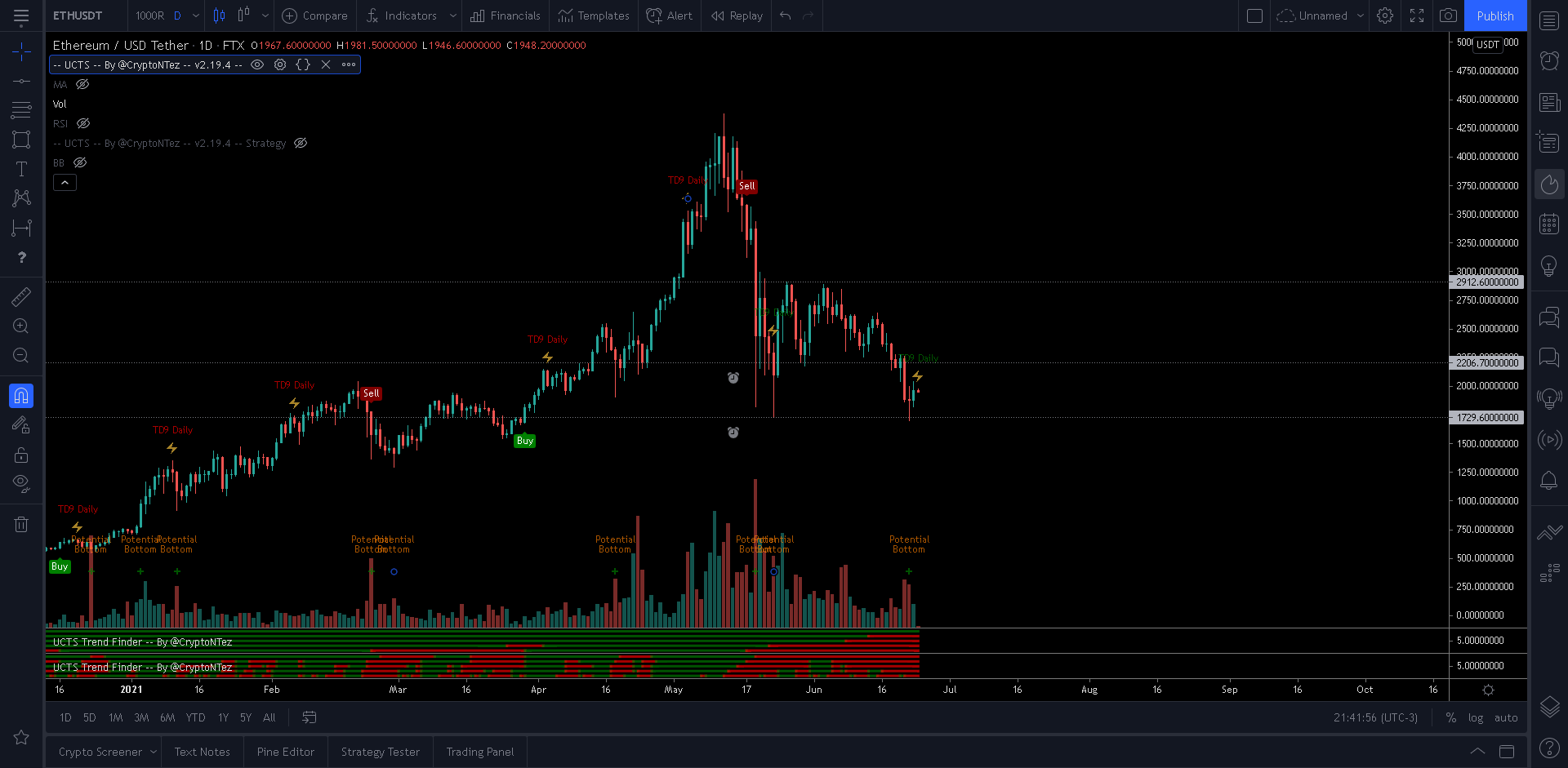

Similarly, well-known trader Nico found that ETH’s movement might not be looking quite strong at the moment. However, moving ahead, if ETH manages to maintain consolidation or engage in price appreciation, then $2200 can be observed as a strength test.

Ethereum strength test level | Source: Nico

Since these test and support targets are yet to sustain themselves, it is important to understand the present price action is not very weak either. As long as all coins manage to keep themselves from falling any further, the market would turn out to be positive. Don’t believe me? Then just listen to what Poppe says,

“Consolidation on the markets, that’s completely fine.”