Why TRON’s $200M fee surge could be the key to its next major rally

- TRON’s bullish momentum is reflected in its rising fees and strong price action, with key resistance at $0.1635.

- On-chain signals remain neutral, but a potential short squeeze and rising social sentiment could fuel further gains.

TRON [TRX] has witnessed an explosive rise in monthly fees, hitting an all-time high of approximately $200 million. This surge indicates strong bullish momentum and heightened demand for the network’s blockspace.

With TRON’s price currently at $0.1604, up 0.63% at press time, many are wondering whether this spike in fees could be the precursor to TRON’s next big rally.

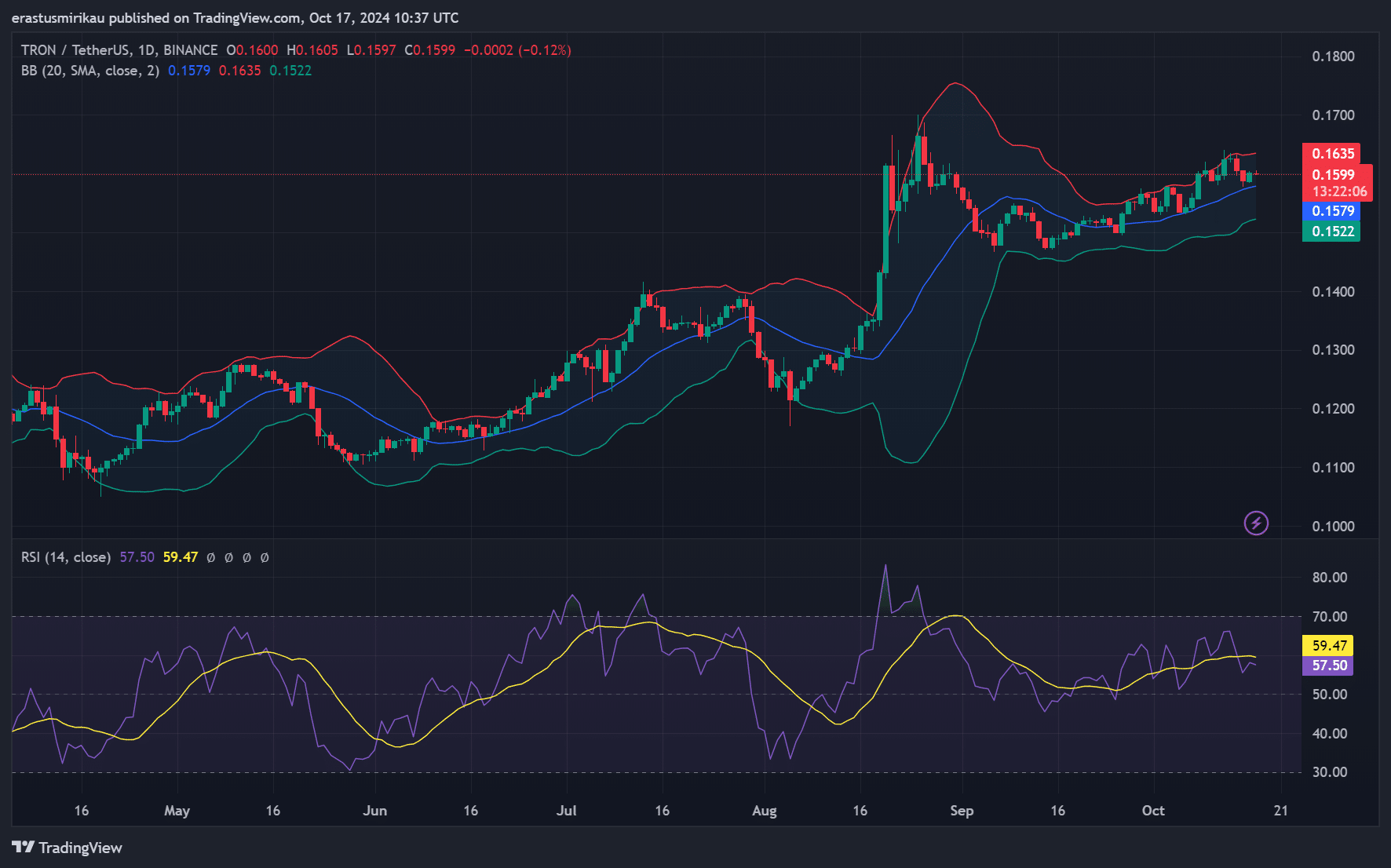

Tron’s chart analysis: Are bullish signals holding firm?

Examining TRX’s price chart, the Bollinger Bands suggest that TRON is trading near the upper band, signaling bullish pressure. The price, currently at $0.1599, is flirting with key resistance at $0.1635. Should it break above this level, further gains could follow.

Moreover, the RSI reading of 59.47 remains in a healthy range, indicating that TRX has room to rise without being overbought.

Additionally, the recent rally shows no signs of losing steam, though traders should monitor for any corrections. A pullback could occur if TRON fails to break through resistance, but for now, bulls remain in control.

Tron’s on-chain signals: What does the data reveal?

According to IntoTheBlock, TRON’s on-chain signals paint a more mixed picture. Net Network Growth is at 0.59%, which shows steady but unspectacular expansion.

In the Money readings stand at -0.20% bearish, indicating that a slight majority of TRX holders are currently at a loss.

However, large transactions reflect neutral levels, with 0.87% activity from major holders. This suggests whales are neither buying nor selling aggressively, which could mean stability in the short term.

Therefore, the combination of bullish price action and neutral on-chain signals may lead to a gradual rally rather than a sharp breakout.

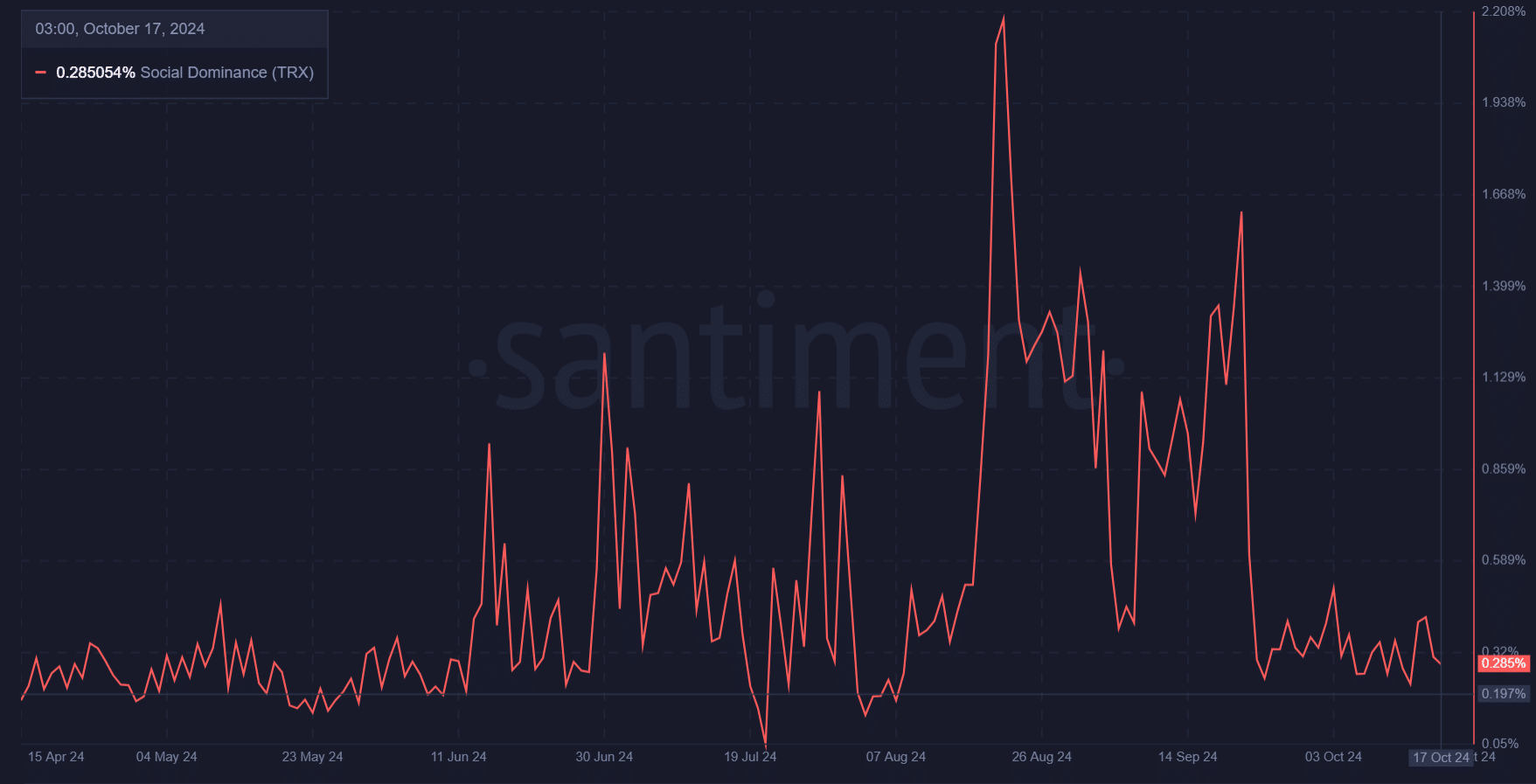

TRON’s social dominance remains low at 0.285%, signaling minimal social media buzz. Consequently, while there is less hype surrounding TRX, this also presents a hidden opportunity.

If social sentiment shifts in TRON’s favor, the increased attention could propel the token to new highs.

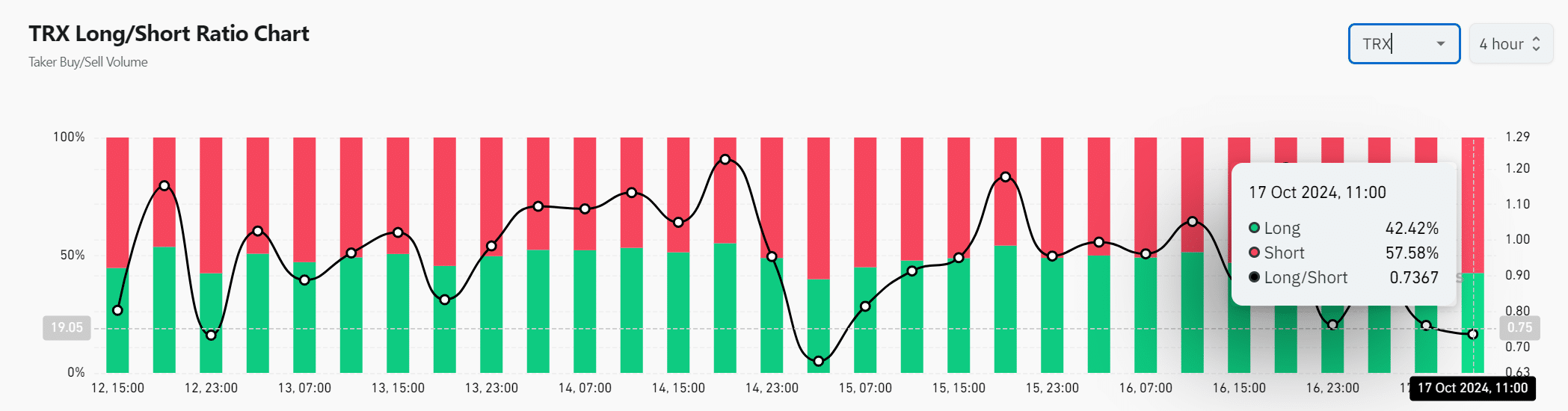

Long/short ratio: Could a short squeeze fuel the rally?

The long/short ratio shows 57.58% of traders holding short positions. Therefore, despite recent price increases, skepticism remains in the market.

However, this could create conditions for a short squeeze if the price continues to rise, forcing shorts to cover and adding buying pressure.

Realistic or not, here’s TRX market cap in BTC’s terms

TRON’s $200 million surge in fees reflects growing demand for its ecosystem, adding to the bullish narrative. While on-chain signals remain neutral, the bullish price action and the potential for a short squeeze could fuel further gains.

Therefore, this fee spike may indeed trigger TRON’s next rally, but traders should watch closely for confirmation through stronger social and on-chain metrics.