Why Uniswap’s legal victory may seem hollow for hopeful UNI holders

- Class action suit against Uniswap tossed out after failing to secure merit.

- Assessing the impact of the lawsuit on Uniswap’s operations.

The crypto world, and more specifically DeFi has secured another legal win barely 24 hours after Grayscale’s victory against the SEC. This time Uniswap [UNI] was making headlines after a judge dismissed a class action suit against the decentralized exchange.

Is your portfolio green? Check out the Uniswap Profit Calculator

Six people who purchased tokens through Uniswap filed a class action suit Against Uniswap in April 2023. They sought compensation for losses suffered because they allegedly purchased scam tokens. However, the New York district judge presiding over the case dismissed the lawsuit on the grounds that Uniswap is not responsible for illegal transactions.

The same judge that’s set to take the Coinbase case just slapped a frivolous Uniswap case out of her court room. The administrative state will keep taking L’s. pic.twitter.com/u9RCXAd2uB

— Ryan Selkis ? (@twobitidiot) August 30, 2023

Basically, Uniswap’s win was based on the argument that there are bad actors in traditional finance. However, their actions do not necessarily reflect on the service provider. Despite the ruling, it is clear that scam tokens are a menace to decentralized exchanges. Fortunately, different crypto protocols have been exploring safer approaches to token listing to overcome such challenges.

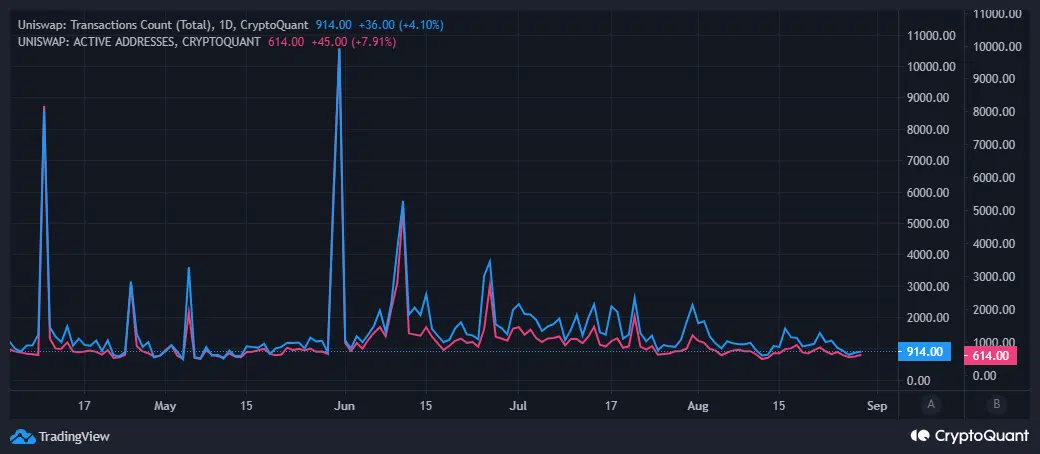

Despite being a chip over Uniswap’s shoulder, the lawsuit barely had an impact on the DEX’s operations. Nevertheless, Uniswap’s on-chain activity did slow down considerably in the last few months, especially from May highs to recent lows.

This was particularly evident from Uniswap’s transaction count and active addresses that hovered near their lowest levels so far this year.

Source: CryptoQuant

It has been business as usual for Uniswap despite the class action suit. This was largely because the lawsuit was not big enough to threaten its operations, as well as the influencing major changes to Uniswap’s UNI token.

The crypto market has been quite sensitive to legal decisions lately and that was evident in XRP’s situation as well as the Grayscale. However, UNI’s situation turned out to be quite different. The announcement did not yield a significant change to its demand dynamics. In other words, the recent judicial ruling did not cause a significant level of excitement in the market.

How many are 1,10,100 UNIs worth today

UNI exchanged hands at $4.64 at press time after giving up some recent gains. The cryptocurrency kicked off the week with a bullish attempt to exit its recent bottom range.

However, the pullback in the last 24 hours suggested that the market wasn’t exactly ready to bounce back. This was largely because there were several concerns that economic conditions may trigger more downside in the next few weeks. Hence the low bullish demand.