Why USDT dominates 70% of the stablecoin market

- The stablecoin market capitalization was trending upward once again

- One metric hinted at negative sentiment and selling pressure in the market

Stablecoins are integral to the crypto ecosystem. Generally tied to a fiat currency, these tokens are minted on the blockchain and backed by a reserve of said fiat by an external entity. One of the most popular ones is Tether, whose token is USDT.

Tether is backed by a vast reserve of USD held as cash or cash equivalents and is a type of stablecoin known as fiat-backed.

There are many other stablecoins, with USD Coin [USDC] and Dai [DAI] being some of the most prominent ones. The latter is backed by USDC as well as by other cryptos such as Ethereum [ETH] and Bitcoin [BTC]. This marks DAI as a crypto-collateralized.

Stablecoins help protect against volatility, giving holders an option to sell their crypto and convert it to stables, thus offering crucial liquidity. The stable tokens’ value (most likely) will not waver despite intense waves of selling.

One stablecoin to rule them all

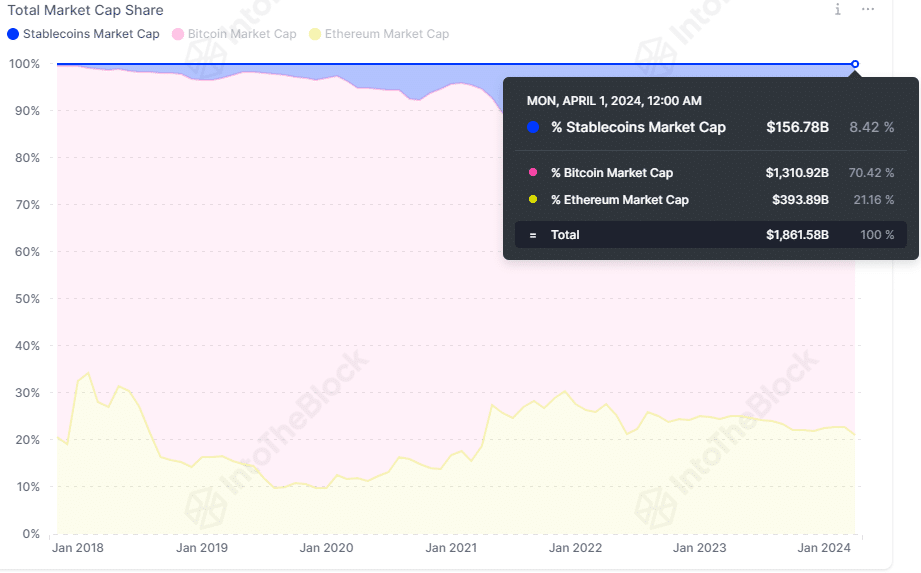

Source: IntoTheBlock

A look at the market share of stablecoins, compared to the rest of the crypto ecosystem, showed that they made up 8.42% of the total crypto market capitalization. This works out to $156 billion.

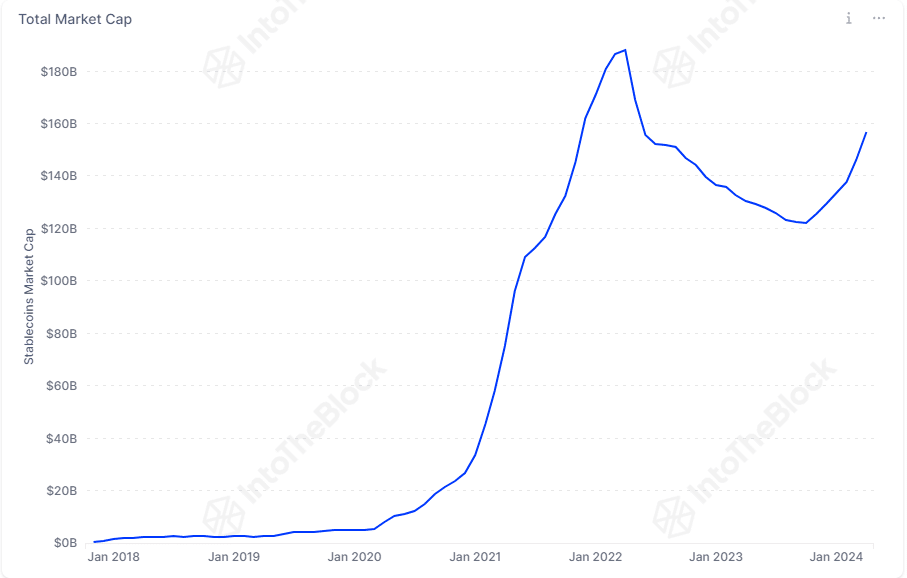

Source: IntoTheBlock

The all-time high in stablecoins market cap was reached in April 2022 at $188 billion. During the bear market in 2022, the market cap decreased. This was likely due to disillusioned crypto participants moving back towards traditional assets and exiting the market.

Crypto regulation also plays a major role. Paxos is the company that mints Binance USD (BUSD), a USD-pegged stablecoin launched by Binance and Paxos.

In November 2023, the New York Department of Financial Services (NYDFS) ordered Paxos to stop minting the token. Binance announced they will gradually stop supporting the stable token, leading to BUSD losing any market traction.

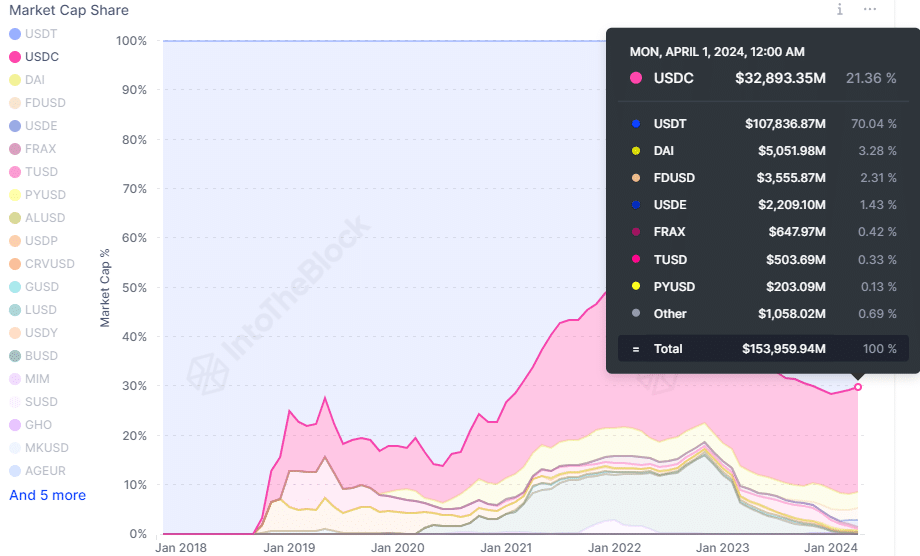

Source: IntoTheBlock

The Tether market cap share is at 70.04%. The closest second is USDC at 21.36% of the stable token market capitalization, with DAI making 3.28% of the share. This shows the market’s evident preference for USDT.

They have been in the market for longer, and have survived numerous waves of FUD. Their asset reserves are transparent and help build trust.

Gauging sentiment from stablecoin exchange netflow

The market capitalization of stablecoins has trended higher since October 2023, as Bitcoin and crypto market prices soared higher. This reflected increased buying power in the market and was a positive sign.

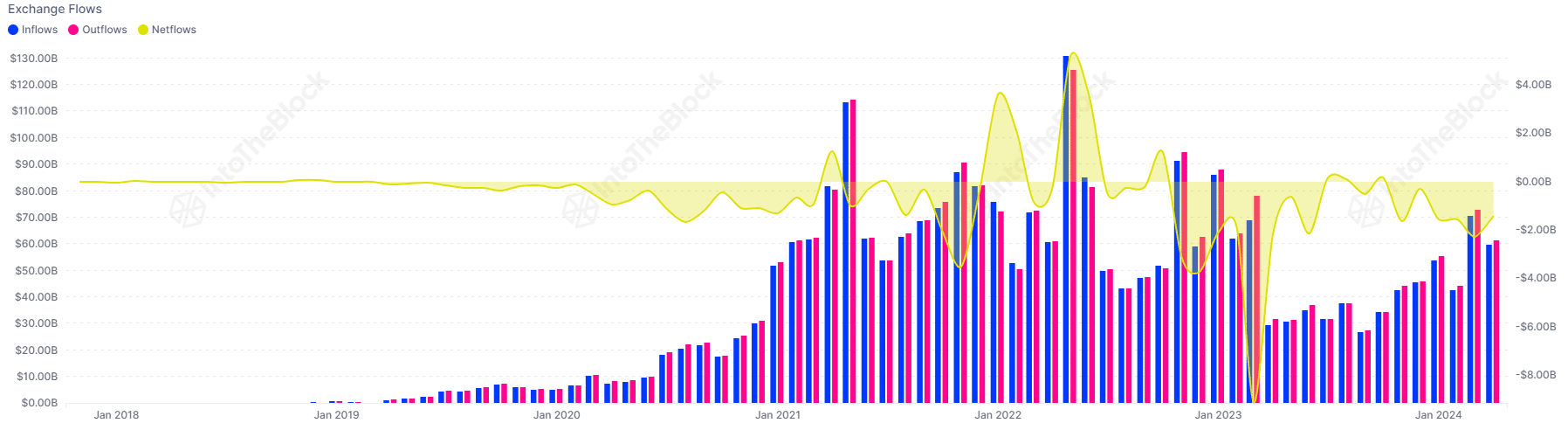

Source: IntoTheBlock

On the other hand, since October 2023, the exchange netflow of stablecoins has been negative. This trend has been in play since November 2022. This pointed toward a possible increase in selling pressure in the past 18 months.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The market sentiment was also likely negative, based on this chart. However, the only large positive inflows of stables were in January and May 2022.

So this inference of selling pressure lowered trade activity and negative sentiment from the netflow is just one strand in a complex web, and doesn’t reflect the full picture.

![Dogecoin [DOGE] drops 16% – But is a $0.25 rally now loading?](https://ambcrypto.com/wp-content/uploads/2025/06/08519350-41B0-4D47-8530-DADB272A4AD3-400x240.webp)