Why you should look closely at Bitcoin, Ethereum, other alts’ trading volumes

Trading volume has been an important metric to gauge the amount of market activity in 2021. While assets like Bitcoin and Ethereum have dominated the proceedings before, volumes have been much more distributed over the course of the last few months.

While Ethereum’s trading volume has caught up with Bitcoin on Binance, Bitcoin led the charge for a significant period of time before the month of May.

In this article, we will be looking at the different levels of trading volumes across different exchanges and what they may indicate in terms of identifying the general investor (Trading volumes of only USDT pair assets have been considered).

Ethereum, altcoin trading volumes dominated Bitcoin in May

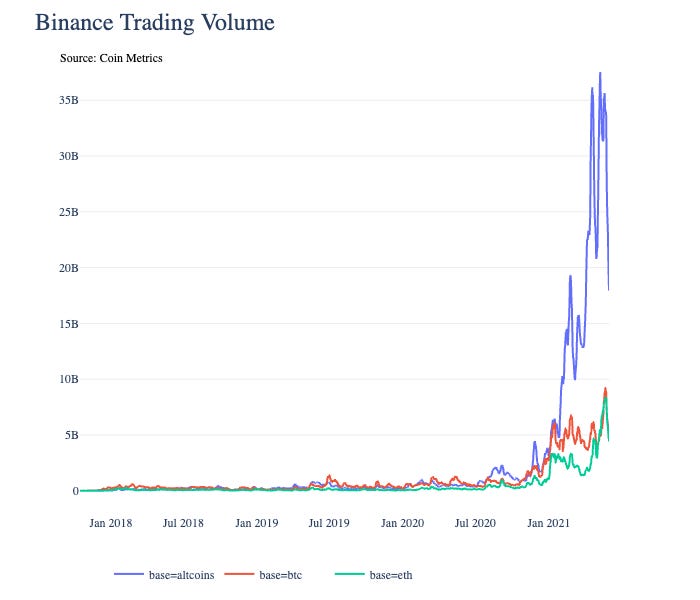

May was a turbulent month for the ecosystem as both buying and selling volumes were taking over the industry. Now, according to Coinmetrics, Binance’s trading volume has been largely dominated by altcoin trading in 2021.

Source: CoinMetrics

One of the reasons being its heavy altcoin list with USDT pairs, but it took a noticeable leap over Bitcoin and Ethereum in 2021. And yet, in the month of May, Ethereum registered the highest trading volume, and it was followed up by Bitcoin. Dogecoin, Binance Coin, XRP, and Cardano.

Now, this was a similar trend across other exchanges as well.

Source: CoinMetrics

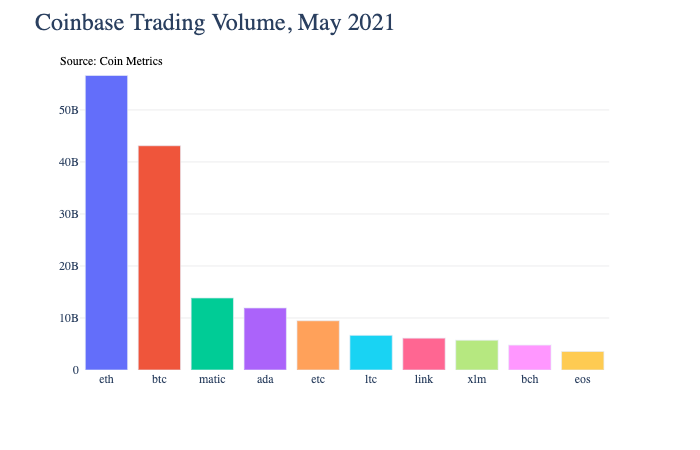

On Coinbase, the spread coverage by Ethereum was more dominant than on Binance, where BTC, ETH volumes were almost neck and neck. Altcoin volumes lagged strongly on this platform.

Source: CoinMetrics

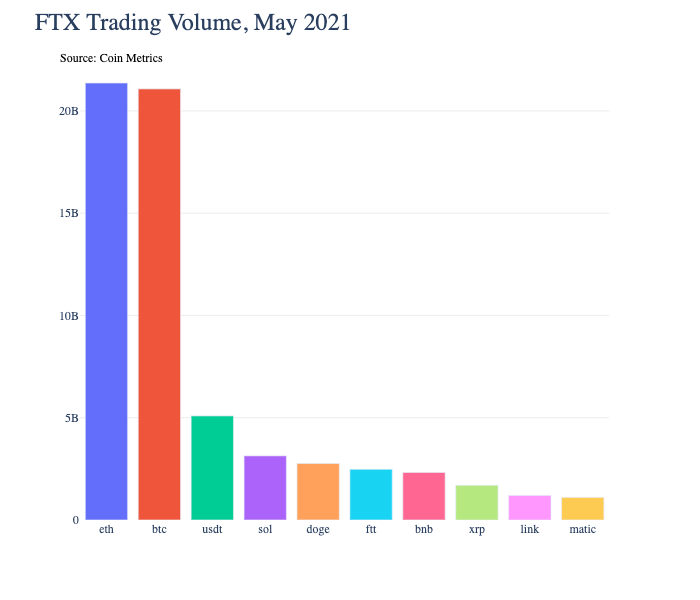

On FTX, the trading volume was more comparable again for Bitcoin, Ethereum, with other assets hardly accruing relatively high trading activity.

Finally, the CME was the only platform where Bitcoin outperformed Ethereum in terms of Future volumes, a finding that meant that institutional investors were still favoring Bitcoin over Ethereum. Here, it is important to note that ETH Futures were only recently introduced on the exchange.

Retail v. Institutional; East v. West; Altcoins v. ETH, BTC?

Now, there are a few things that can be inferred from the aforementioned trading volume differences on multiple exchanges, with respect to multiple coins. When it came to altcoin trading, it has been limited to only Binance’s platform since it caters to the largest retail investors’ group. So, a majority of trading for these assets usually comes from one particular end.

On the question of Bitcoin and Ethereum, however, unsurprisingly, the interest was widespread and cohesive. It can be stated that both East UTC and WEST UTC time traders were involved with Ethereum, Bitcoin trading,

Hence, it can be speculated that there is a higher chance that altcoin trading concentrated only on one platform might have been prey to some form of wash trading over time. Bitcoin, Ethereum have maintained relatively active trading activity (not quantifiable) across multiple platforms. While an argument can be made that the listing of different altcoins makes a difference, major altcoins are still pretty popular across all exchanges.