Why you should track Bitcoin, USDT on this CEX

- Bitcoin’s Open Interest in Bitfinex dropped 21%.

- A correlation between Bitcoin’s Open Interest and USDT has come to light.

Over the last few days, Bitcoin [BTC] endured significant downward pressure, tumbling as much as 14% from the yearly peak of $48,000 recorded on the day spot ETFs were cleared for trading in the U.S.

As of this writing, the king coin was exchanging hands at $41,197, with concerns of further downsides playing on the minds of market participants.

The Bitfinex link

Amidst these developments, CryptoQuant analyst Joao Wedson drew attention to intriguing events unfolding on popular crypto exchange Bitfinex.

Wedson noted a 21% decrease in Bitcoin’s Open Interest (OI) on the exchange. Coinciding with this was an exponential jump in Tether’s [USDT] reserves on the trading platform, from $5.3 million to $190 million.

Observing these trends, the analyst deduced,

“These figures suggest a clear trend: major traders are closing or reducing their positions in response to recent price fluctuations in the cryptocurrency market.”

Furthermore, the analyst highlighted the relationship between Bitfinex’s Open Interest (OI) and the price movement of Bitcoin.

This was noteworthy because market observers do not place the same value on Bitfinex’s OI as they do on other large exchanges.

Note that out of $17.67 billion invested into Bitcoin derivatives as of this writing, a little more than $219 million was through positions opened on Bitfinex.

As evident in the graph above, a drop in Bitcoin’s price resulted in a proportional drop in money locked in unsettled Bitcoin futures contracts on Bitfinex.

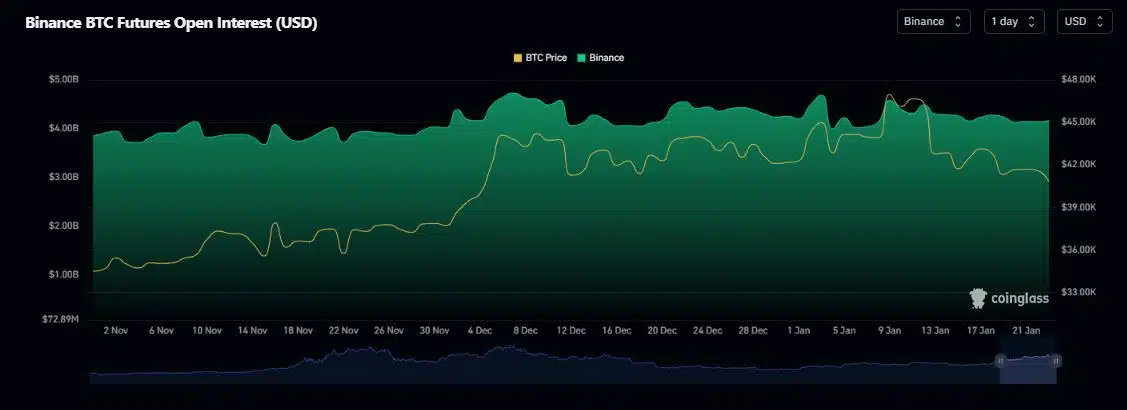

Binance witnesses a much lower drop in OI

To cross-check these assertions, AMBCrypto analyzed Bitcoin’s OI trend on premier exchange Binance.

Notably, Binance’s Open Interest (OI) fell only 3.4% since the 11th of January. Bitcoin, as mentioned earlier, has dropped 14% since then.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, Bitfinex’s OI fell by 12.5% in the aforementioned period, much closer to Bitcoin’s drop.

As a result, Bitfinex’s OI trends could provide critical insights into the future direction of Bitcoin’s price.