WIF falls 28% in 4 days, but do not short just yet

- WIF witnessed large price fluctuations, causing a surge in liquidations.

- Social volume and sentiment around the WIF token also fell.

Dogwifhat [WIF] has taken the crypto world by storm over the last few days, owing to its growing popularity in the meme coin sector.

Due to the increasing interest surrounding it, the meme coin managed to outperform multiple tokens in terms of market cap.

Liquidations on the rise

Despite the surge in interest, WIF declined significantly over the last few days. Since the beginning of April, its price fell by 28%. This resulted in massive liquidations for traders.

AMBCrypto’s analysis of Coinglass’ data showcased that $1.15 million worth of long positions had been liquidated over the last 24 hours.

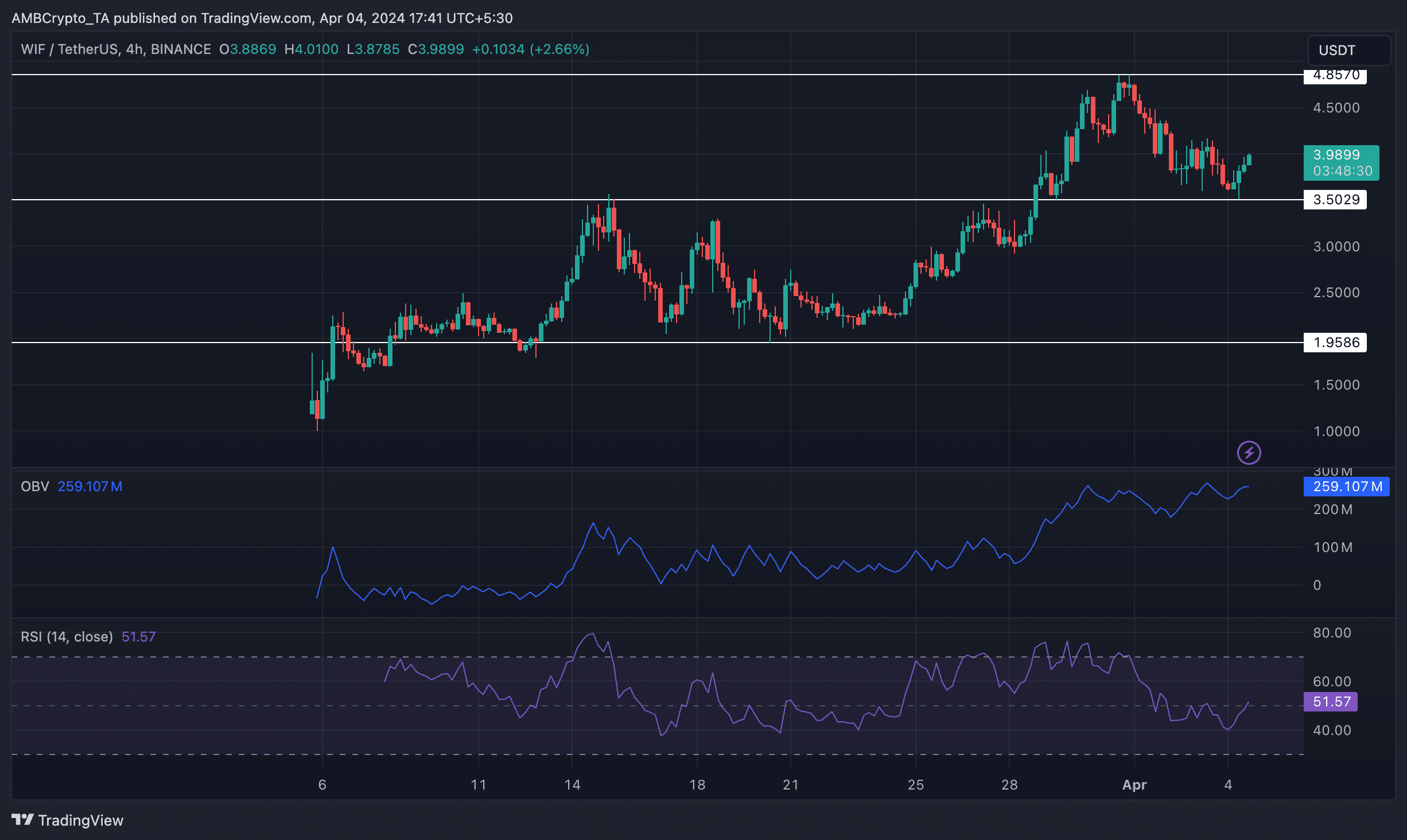

Even though the correction in price was significant, it wasn’t enough to break WIF’s trend. Over the last month, WIF showcased a large number of higher highs and higher lows.

This indicated that WIF had established a bullish trend for quite some time.

Even after the decline in price, WIF tested the 3.5 level and jumped back immediately.

If WIF re-tests the $4.85 level, it may end up surpassing it and reach new all-time highs going forward. The Relative Strength Index (RSI) for WIF stood at 48.46.

This indicates a moderate level on the RSI scale, suggesting neither overbought nor oversold conditions. At 48.46, WIF may be experiencing a balanced level of buying and selling pressure in the market.

Based on the RSI, WIF could continue to see some sideways movement before making any massive price adjustments.

Nevertheless, the On-Balance Volume (OBV) for WIF experienced notable growth. This indicated an increase in trading volume on days when the price of WIF closes higher, compared to days when it closes lower.

A rising OBV suggests that buying pressure is accumulating, potentially signaling bullish sentiment among traders.

Realistic or not, here’s WIF’s market cap in BTC’s terms

Looking at the social angle

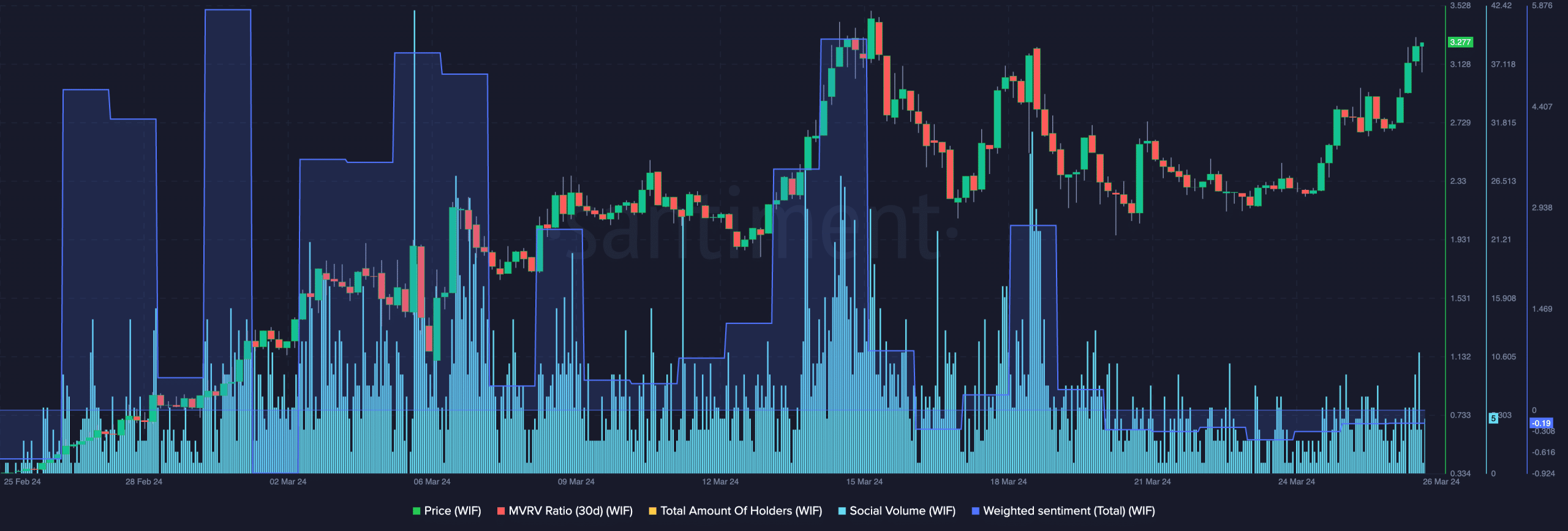

A large part of WIF’s price trajectory will also be dictated by Social Volume around the token. It had fallen over the last few days, indicating that the popularity of WIF had waned.

Moreover, the Weighted Sentiment around WIF had also declined, meaning that the number of negative comments around the meme coin had grown significantly.