Will ApeCoin’s looming token unlock make things worse for APE

- The unlock would release $16.74 million worth of APE.

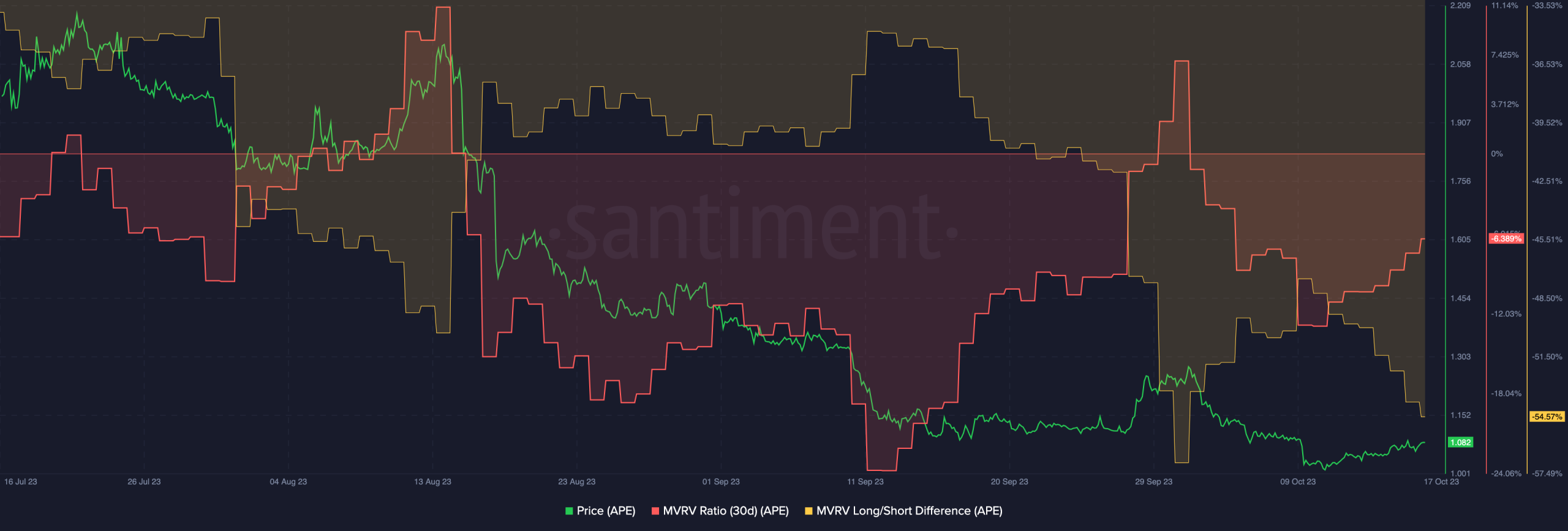

- APE’s bearish trend, low MVRV ratio, and falling network growth caused problems for the token.

ApeCoin [APE] has faced its fair share of hardships in the recent prolonged bear market. Unfortunately, more challenges loom on the horizon with an impending token unlock.

Is your portfolio green? Check out the APE Profit Calculator

New fears “unlocked’

This unlock, scheduled to release $16.74 million worth of APE, equates to roughly 4.2% of the total supply. As with many token unlocks, there are both potential advantages and disadvantages to address.

A token unlock can increase liquidity in the market. Additionally, token unlocks can lead to a broader distribution of tokens.

Weekly Cliff Unlocks : 16-23 Oct 2023

4 Tokens are set to have cliff unlocks with a total value of $87.81m

? Highlights: $AXS ?$AXS 11.50% – $64.74m$APE 4.2% – $16.74m$ID 6.46% – $3.44m$CTSI 2.91% – $2.79m

.

.

( % of cir. supply)More Details : https://t.co/8XoTR8t40l pic.twitter.com/t8gT6yhPZY

— Token Unlocks (@Token_Unlocks) October 16, 2023

On the other hand, a large release of tokens can lead to oversupply and a subsequent drop in value. Over the last three months, APE’s price experienced a considerable decline marked by a series of lower lows and lower highs, indicating the establishment of a bearish pattern.

Furthermore, the MVRV ratio for ApeCoin currently hovers at a notably low level, signifying that the majority of APE holders find themselves in an unprofitable position.

A continued descent in price could translate to more holders selling at a loss. This sentiment is reinforced by the fact that most holders are short-term, as evidenced by the diminishing long/short difference. Typically, short-term holders are more inclined to sell their holdings for profit.

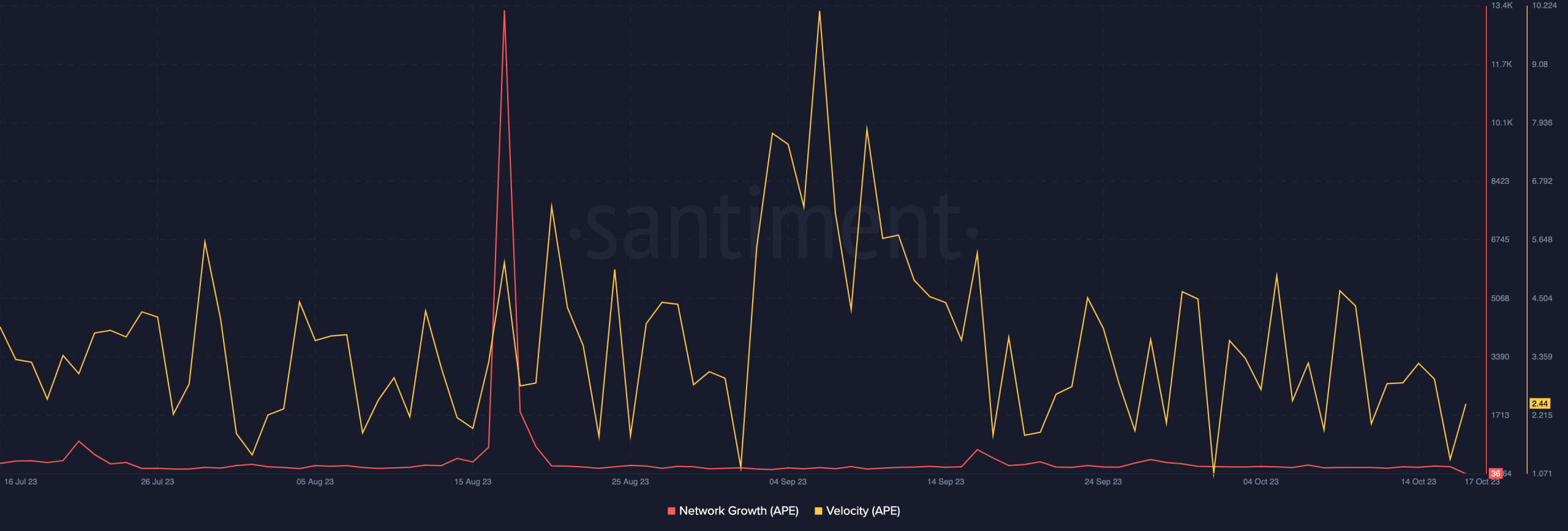

Delving further into the state of APE, its network growth has taken a substantial hit over the past few months. This plunge is indicative of waning interest from new addresses, perhaps mirroring the broader decline in enthusiasm for the NFT sector over the course of this year.

Some positives

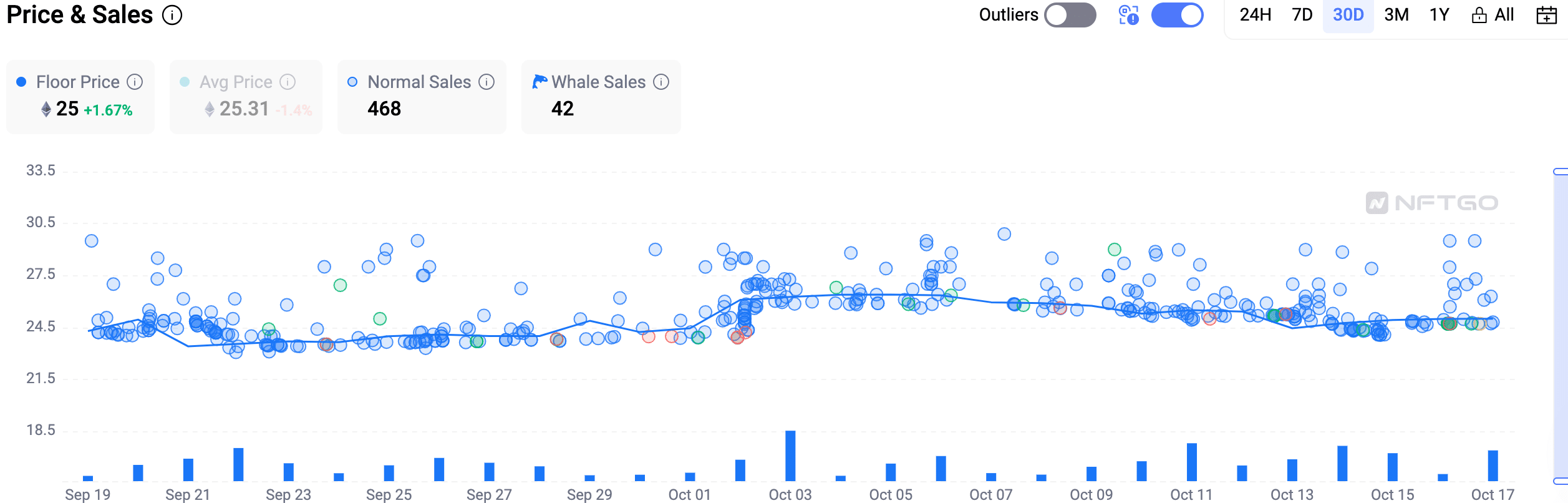

Yet, amidst the apparent market lull, select Yuga Labs collections, particularly the Bored Ape Yacht Club, showed a noteworthy increase in their floor prices.

Realistic or not, here’s APE’s market cap in BTC terms

The rising popularity of Yuga Labs’ NFTs offered a glimmer of hope for APE. If this trend continues, the APE token could potentially benefit from the renewed interest in NFTs.

The impending token unlock, combined with APE’s bearish trend, raises legitimate concerns regarding its near-term future. Observing the token’s performance and the dynamics of the broader NFT market will be essential to gauge the direction ApeCoin takes in the coming days.