Will Arbitrum reach $2.4? – Traders, watch out for THESE levels!

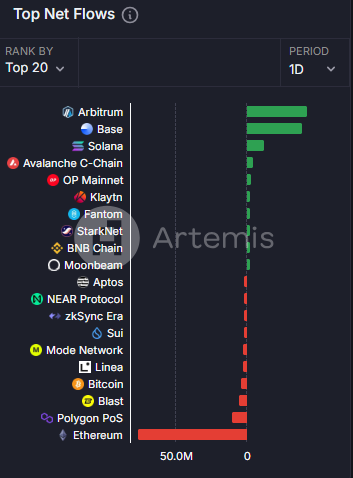

- ARB recorded the largest chain netflow in the last 24 hours, surpassing Ethereum and Solana.

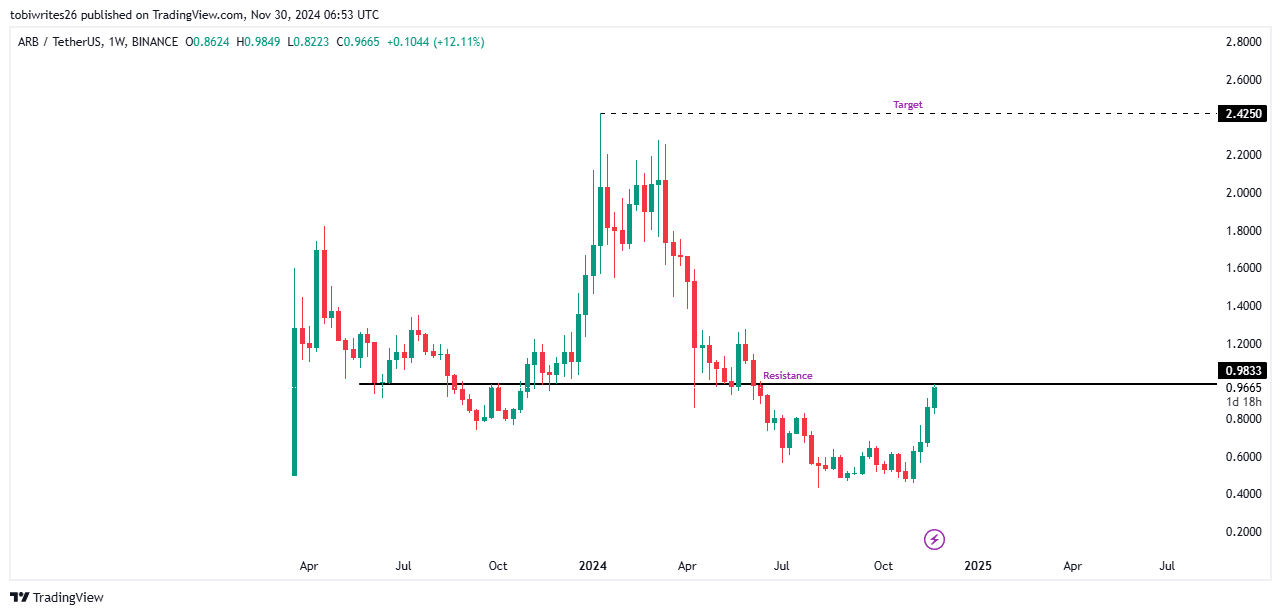

- However, it faced a major hindrance at a key resistance level, where significant selling pressure exists.

Over the past month, Arbitrum [ARB] has exhibited a consistent bullish trend, with a notable 78.80% gain. This momentum extends to shorter timeframes, with weekly and daily increases of 15.20% and 8.08%, respectively.

As AMBCrypto previously reported, this upward trend could persist as market participants’ actions continue to support the bullish momentum,

Rise in netflow fuels accumulation interest

At press time, data showed that the altcoin recorded the highest chain netflow in the last 24 hours, surpassing Base, Solana [SOL], and Ethereum [ETH] with $42.6 million in net inflows.

Chain netflow measures the difference between an asset’s inflow and outflow. It is used to track fund movement, user activity, trading behavior, and liquidity trends. Positive netflow, as seen with ARB, indicates accumulation and suggests potential upward price movement.

Further analysis by AMBCrypto highlights a strong likelihood that ARB’s bullish momentum will persist.

Selling pressure eases as gains momentum

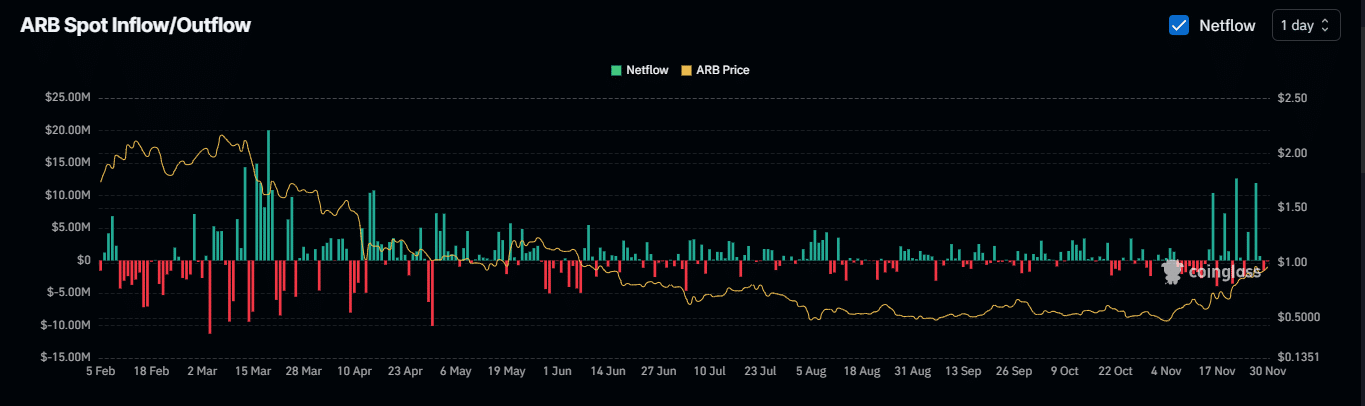

After four consecutive days of significant positive exchange netflow totaling $17.04 million, indicating selling pressure—a turnaround has occurred.

Over the past 48 hours, negative netflow has been recorded, signaling that market participants are now holding onto their ARB. At the time of writing, $1.66 million worth of ARB negative netflow transactions contributed to its recent 8% price gain.

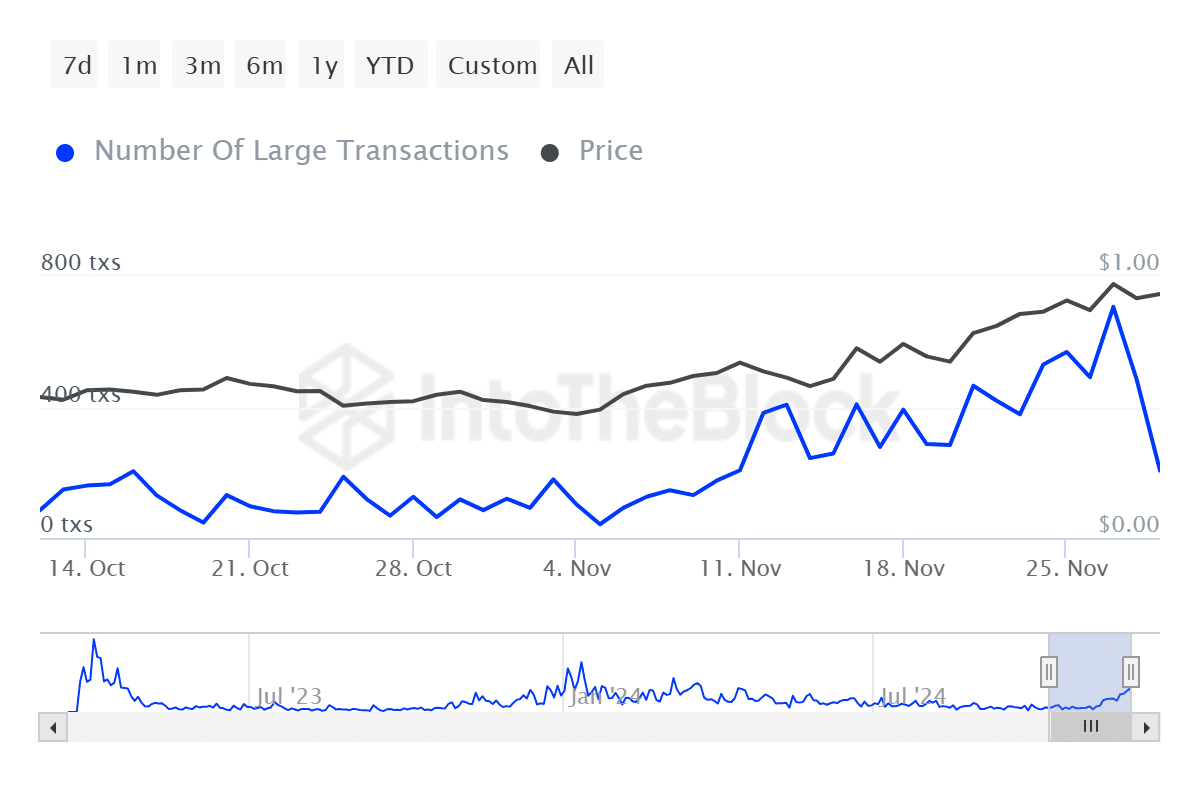

Additionally, there has been a notable decline in large-holder transaction volume, pointing out that whales are scaling back on selling ARB.

Data from IntoTheBlock shows a reduction of 500 large-holder transactions over the same 48-hour period, dropping from 706 to 206.

If this trend continues, ARB could sustain its upward momentum.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

Key resistance ahead for ARB with a $2.4 target in sight

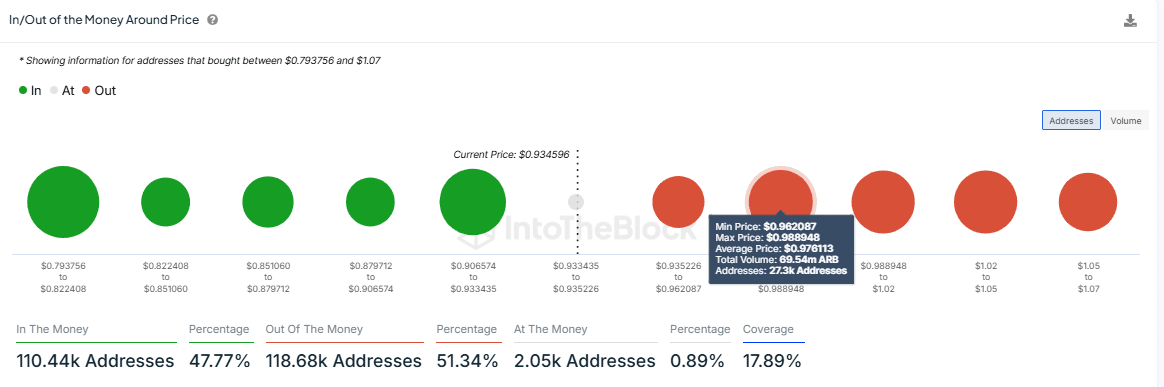

The coin is expected to encounter significant pressure as it approaches a major supply zone identified by the In/Out of the Money Around Price (IOMAP) metric.

The supply zone, ranging between $0.96 and $0.98, carries a calculated selling pressure of 69.5 million ARB distributed across over 27,000 addresses. This coincides with a resistance level at $0.983 on the chart, a point ARB has struggled to surpass.

If ARB gains sufficient momentum to breach this resistance, it could head toward the upper target of $2.4, where substantial liquidity is concentrated.