Will Bitcoin Cash extend its stay below $200?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bitcoin Cash fluctuated between $190 – $200 in early September.

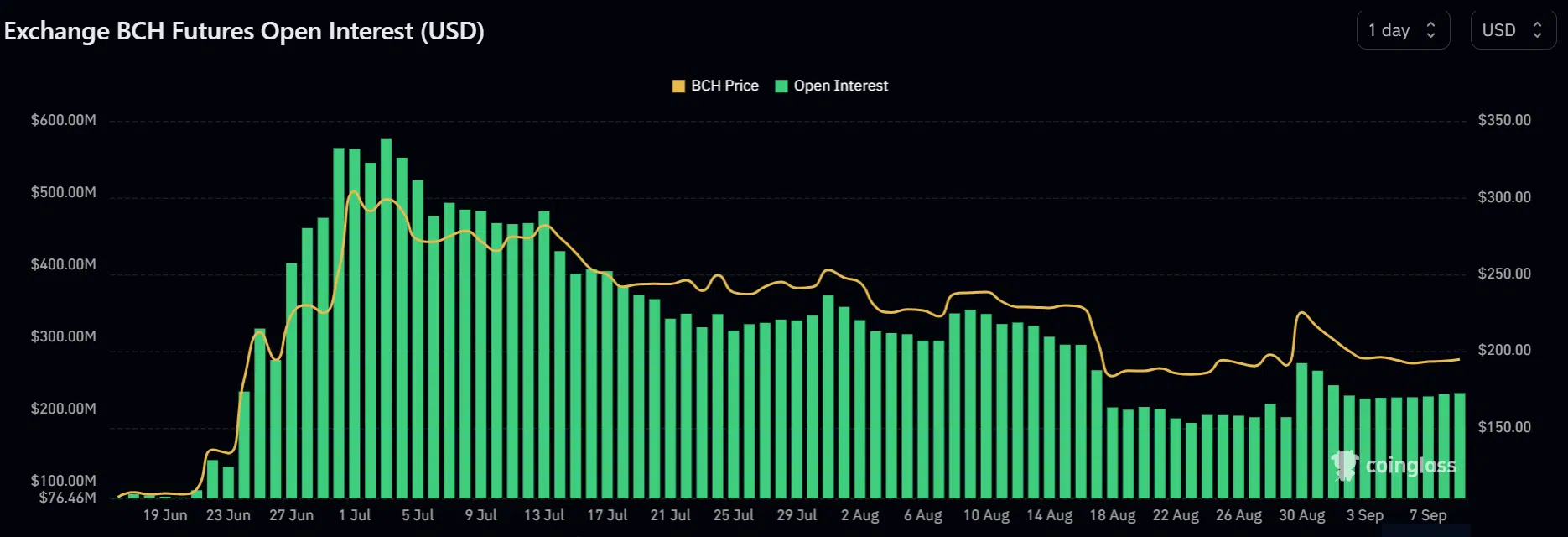

- The Open Interest rates wavered in September – a neutral bias.

Bitcoin Cash [BCH] could extend its early September range formation of $190 – $200 in the short term. Over the same period, the demand in the derivatives market stagnated.

Is your portfolio green? Check out the BCH Profit Calculator

Meanwhile, the 4-hour chart had a double roadblock near $200 and could derail further upside above $200, especially if Bitcoin [BTC] fails to reach the mid-range of $27k.

Will bulls falter at the double roadblock?

BCH bulls have jealously defended the $190 in the last few weeks. The price rejection at $220 at the end of August and subsequent pullback saw the $190 level again come to the bull’s rescue.

The $190 support has remained steady throughout the first week of September. But bulls haven’t been able to exceed $200 due to a double roadblock of 50-EMA (Exponential Moving Average), yellow, and an H12 bearish order block (OB) of $197 – $201 (white).

BCH could falter at the double roadblock if BTC fails to retest the mid-range of $27k. That could extend the short-term range formation of $190 – $200.

On the upside, the immediate target for bulls will be $211 in case of a bullish breakout. On the other hand, a drop to $179 could be feasible if a bearish breakout occurs.

Meanwhile, the RSI and CMF have remained below the threshold levels but fronted a breakout at press time. It shows improved buying pressure and capital inflows in the past few hours before press time. But a reversal could be imminent if sellers exploit the double roadblock.

Open Interest rates fluctuated

According to Coinglass, BCH’s Open Interest rates fluctuated below $250 million in early September. It underscores the wavering demand – a neutral bias in the derivatives market.

How much are 1,10,100 BCHs worth today?

On the liquidations side, more long positions were rekt in the past one and four hours before press time.

It meant short-term bearish bias after BCH hit the roadblock. So, a reversal to the low range ($190) could materialize. Traders should track BTC movement for clear price direction.