What BNB Chain’s latest offering means for investors

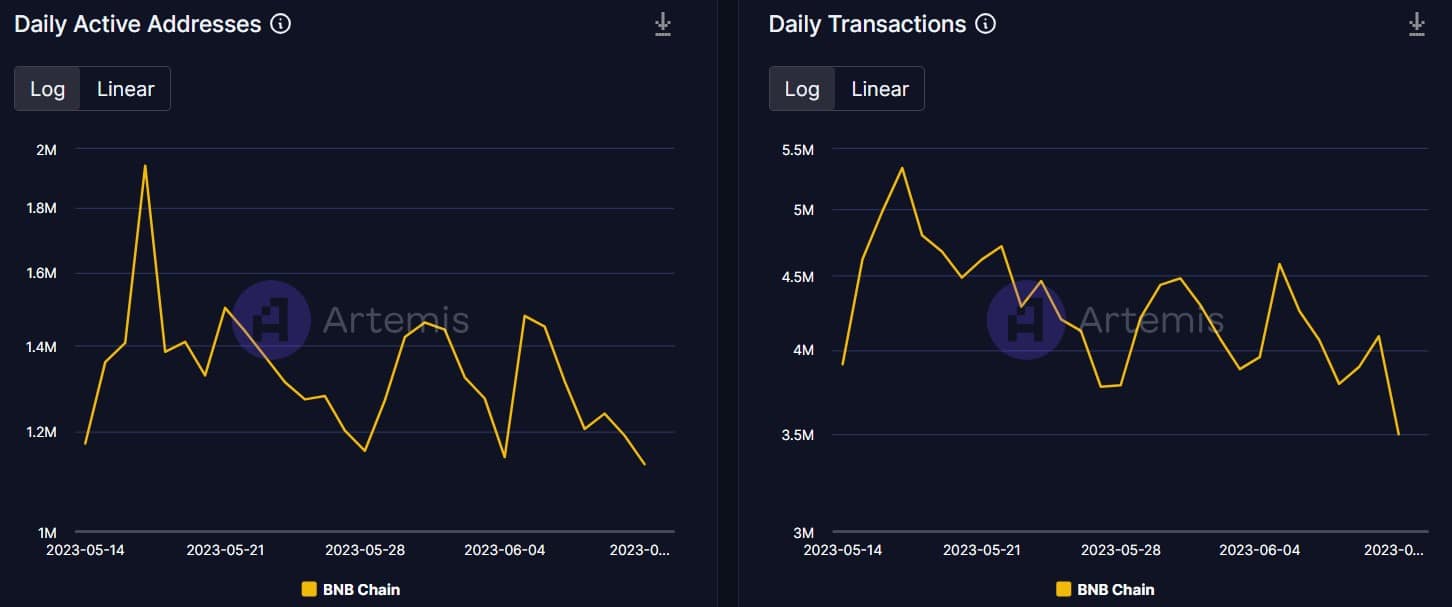

- BNB’s daily active addresses and daily transactions have declined over the last month

- The coin was down by over 16%, and multiple metrics were still bearish

BNB Chain’s [BNB] adoption has been on the rise with the latest one with Polyhedra Network. In a recent tweet, Polyhedra announced that it will support BNB Chain’s Luban upgrade on zkBridge and our zk light client on LayerZero Labs.

Apart from that, BNB also revealed that it had successfully deployed the BEP-126 update.

We are proud to support @BNBChain Luban upgrade on zkBridge and our zk light client on @LayerZero_Labs. Luban upgrade introduces super-fast finality and enhanced security on BNB Chain.

We keep building on BNB Chain with the most secure and efficient interoperability using ZKP.??? pic.twitter.com/jUBvNiPYqH

— Polyhedra Network (@PolyhedraZK) June 12, 2023

Is your portfolio green? Check the BNB Profit Calculator

All about BNB Chain’s BEP-126

BNB Chain’s BEP-126 introduced the Fast Finality feature that boosts the blockchain’s security. Users can ensure that they receive accurate information from the latest finalized block thanks to the fast finality function.

The feature brought with it enhanced security against double-spend and MEV reorg attacks, irreversible transactions once confirmed, and efficient operations for exchanges and DeFi protocols. Although BEP-126 doesn’t increase transaction speed, it significantly improves the security and reliability of the BNB Chain.

BEP-126 can benefit BNB Chain immensely

A look at Artemis’ data revealed that BNB Chain’s usage has been on a declining trend. This was evident from the dip in its daily transactions, which plummeted over the last 30 days. Not only that but after spiking on 17 May, BNB’s daily active addresses also followed the same path.

However, now that the new feature has increased the blockchain’s security, a change in trend can be expected. This seemed likely, as security plays a major role in attracting and retaining users to a blockchain.

BNB is under selling pressure

While BNB Chain users got good news, BNB investors were still struggling. According to CoinMarketCap, BNB was down by more than 16% over the last seven days. At the time of writing, it was trading at $233.89 with a market capitalization of over $36 billion.

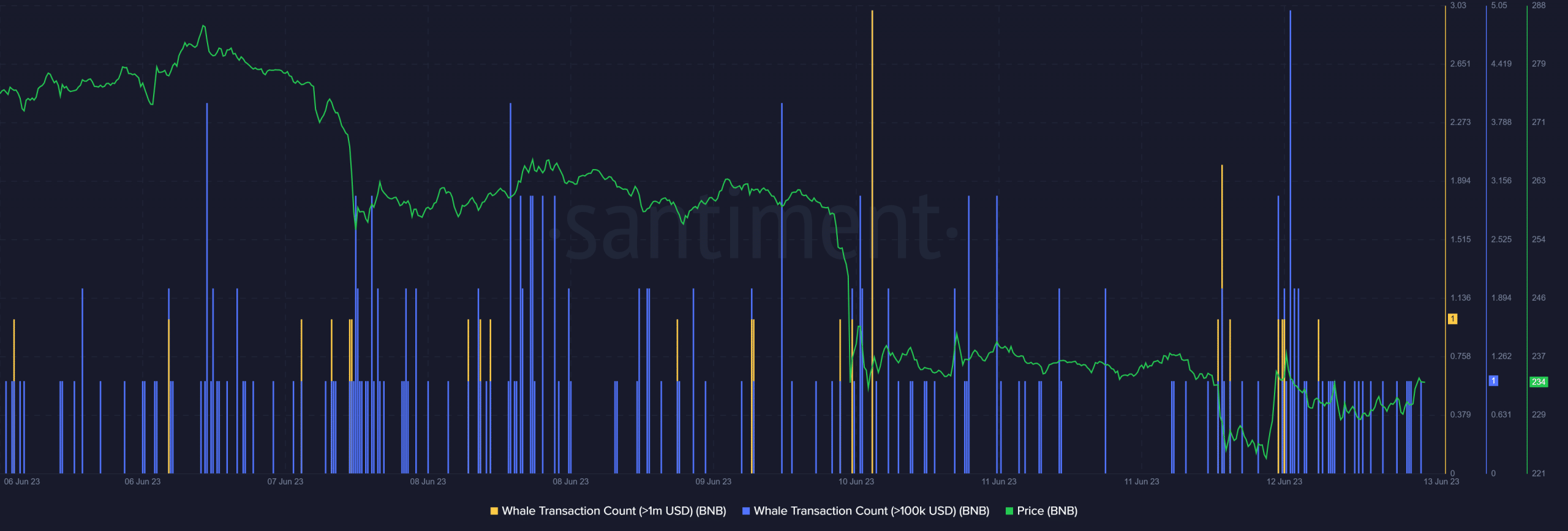

Lookonchain’s tweet revealed that a whale that has been dormant for two years sold 10,000 BNB worth $2.3 million at $230. This suggested that the coin was under selling pressure, increasing the chances of a continued downtrend.

1/ A whale that has been dormant for 2 years sold 10,000 $BNB ($2.3M) at $230 today.

This whale was a #SAFEMOON whale before and made 110K $BNB ($47.5M at that time) with only 10 $BNB($2,400 at that time) on #SAFEMOON. pic.twitter.com/jxuBJBcWad

— Lookonchain (@lookonchain) June 12, 2023

It was interesting to note that the whale transaction count spiked at the time of BNB’s price drop and on 12 June, when it showed a sort of recovery.

How much are 1,10,100 BNBs worth today

Will BNB recover anytime soon?

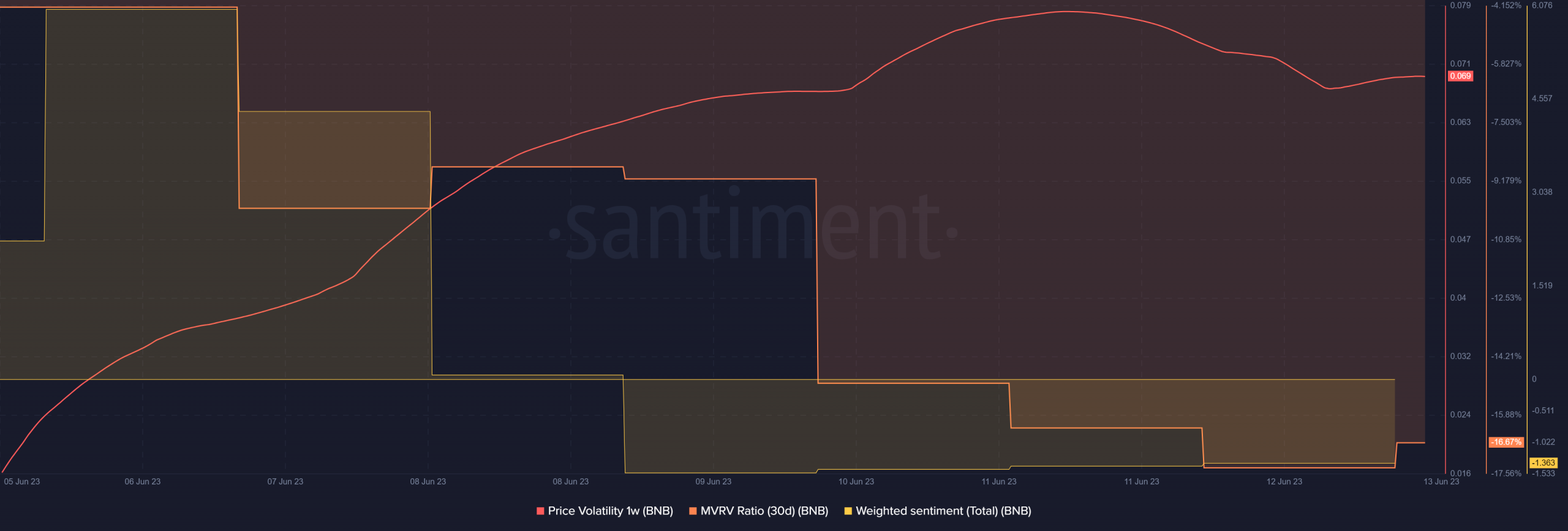

The possibility of a northbound price movement seemed unlikely at press time as several metrics looked bearish. For instance, BNB’s MVRV Ratio was down substantially.

That, coupled with high 1-week price volatility, suggested that the coin’s price could register more declines in the coming days. Santiment’s chart suggested that negative sentiment around BNB was dominant in the market, as evident from the dip in its weighted sentiment.