Will Cardano’s new plans finally push ADA’s price to its $1 prediction?

- The founder noted that Cardano would test the node with its stake pool.

- Some holders retired ADA to self-custody while others liquidated.

On the 12th of March, Cardano’s [ADA] founder Charles Hoskinson posted on X that the project would try out the Hyperfledge Firefly. Hyperfledge Firefly is an open-source node designed to scale blockchains.

However, Hoskinson did say that the test is not a guarantee that Cardano would adopt the Supernode. According to him, the project would test its compatibility with the Stake Pool Operator (SPO), which is responsible for running nodes on the network.

Scaling Cardano might enable more off-chain transactions, and increase user demand. But over the years, the project has not been able to attain the height it desires. This has also affected ADA, its native token.

ADA struggles with traction

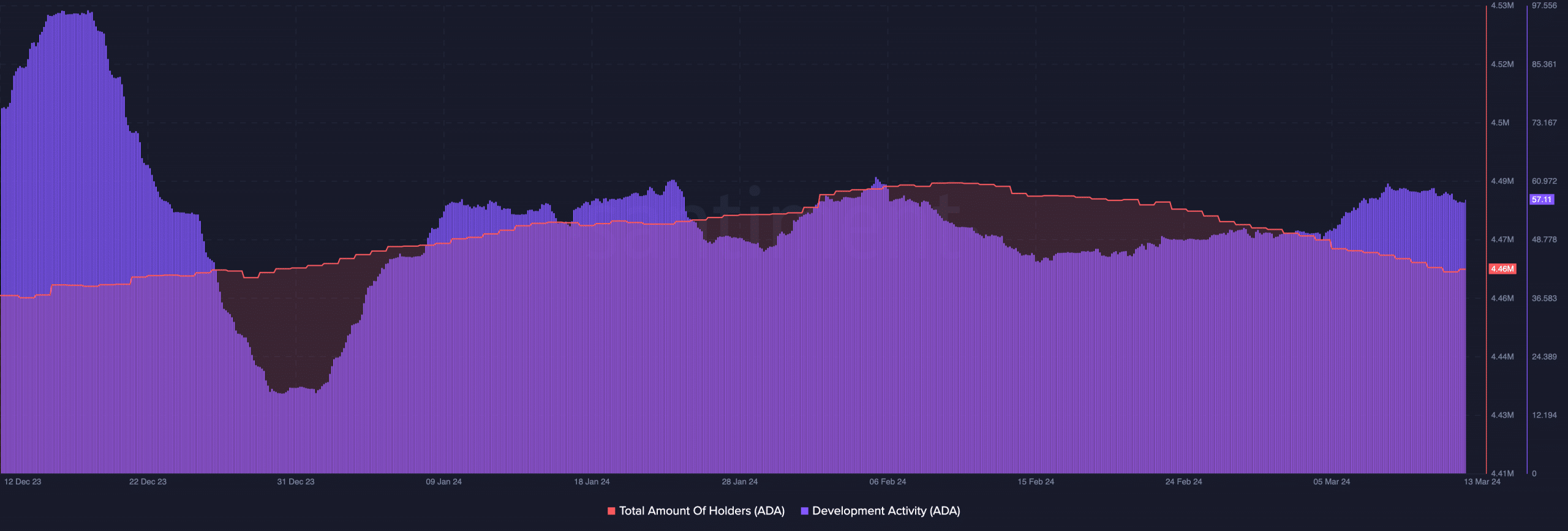

For instance, AMBCrypto evaluated ADA’s on-chain data using Santiment. As of this writing, the total number of ADA holders have dropped from 4.49 million to 4.46 million in the last 30 days.

A decline like this could be attributed to the price performance. In the last month, ADA’s price has increased by 42.39%.

Therefore, the decline in holder count could be because some investors had taken profit. At the same time, the decrease might be becuase some investors no longer trust in the long-term potential.

However, should Cardano forge ahead in its scaling plans, more investors could be attracted to the token. But that alone might not be able to convince market participants to be part of the ADA cohort.

Concerning development activity, AMBCrypto observed that the metric declined. As of December 2023, the metric was 96.11. However, press time data placed the reading at 57.11.

Hope for those who trust in the project

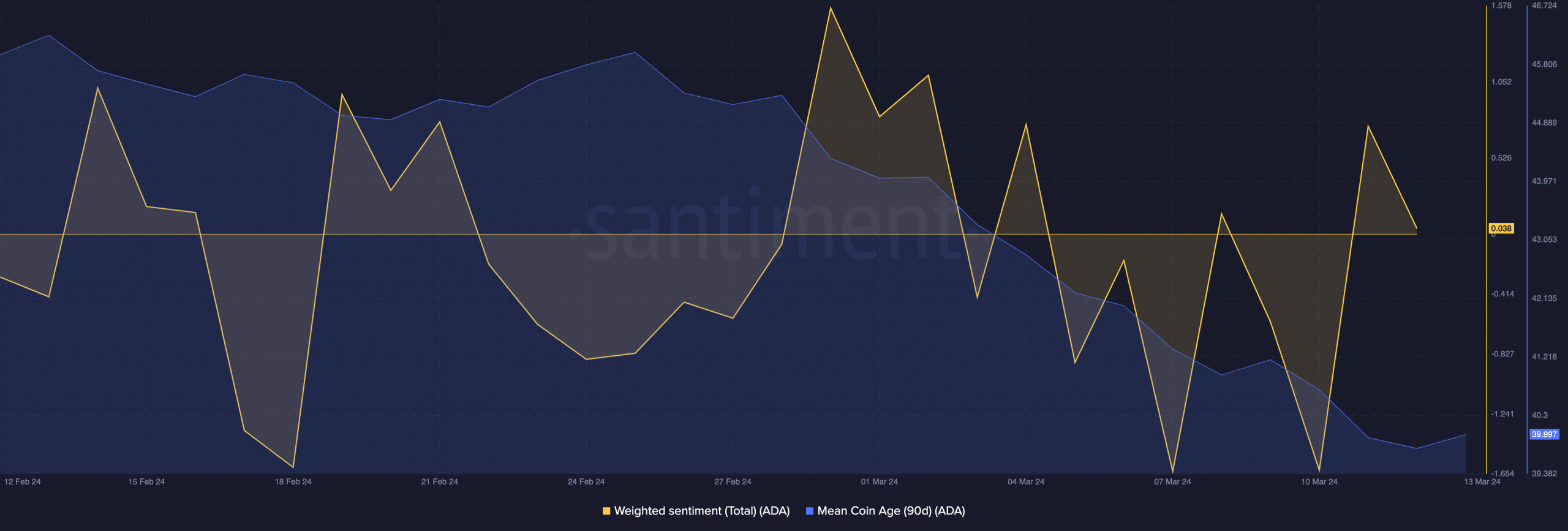

In terms of sentiment, data showed that market participant’s bullish bias has been declining. At press time, the Weighted Sentiment was on the verge of dropping into the negative zone.

If this happens, it would serve as confirmation that the perception had become bearish. If the broader market is bearish on the Cardano native token, then demand might decline further while the price might also drop.

However, another metric that suggested a good long-term view for ADA was the Mean Coin Age (MCA). This metric indicates relative activity between HODLers and short-term quick-profit accounts.

Spikes in the MCA would have indicated a surge in old token movement which could suggest possible sell-offs. However, the 90-day MCA plunged.

This decline infers that some long-term holders are accumulating and retiring the token to cold wallet.

Read Cardano’s [ADA] Price Prediction 2024-2025

With the tokens in self-custody, the chance of selling them might have reduced. However, that does not mean that ADA’s price would increase overnight.

If holders decide to send the tokens into exchanges later, the price might plunge. On the other hand, an increase in cold storage could increase the chance of an exponential growth.