Will Chainlink’s developments help an overbought LINK preserve its drive?

- Chainlink’s latest collaborations with key players could be a big contributor to its growth

- LINK’s price action rallied by 54% over the last seven days, however, the token was in the overbought zone

Chainlink [LINK] is certainly one of the top blockchain projects with the highest potential for growth once the next bullish wave starts. These expectations are largely driven by the fact that it has strong fundamentals and is among the top networks focused on organic growth.

Realistic or not, here’s Chainlink’s market cap in BTC’s terms

Chainlink’s latest post perfectly sums up multiple reasons why it is currently at the forefront of organic growth pursuits. For starters, the network has been on a collaboration spree.

For example, it has so far collaborated with the likes of Australia’s ANZ bank, Vodafone DAB, the SWIFT banking service, and DTCC, the largest securities settlement system.

#Chainlink is collaborating with key players across the global economy:

1. Swift—Standard messaging network for 11K+ banks

2. DTCC—World’s largest securities settlement system, processing $2+ quadrillion annually

3. ANZ—Leading Australian bank with $1T+ in AUM

4. Vodafone…— Chainlink (@chainlink) October 27, 2023

So, why are these collaborations important? Well, it turns out that these are gateways to systems that handle transactions worth billions of dollars. Such collaborations aim to into the power of blockchain oracle solutions.

Chainlink’s solutions in the cross-chain segment also put the network in a position where it can play a key role in cross-chain asset tokenization. The latter is a segment in the blockchain industry that is expected to drive robust long-term demand and utility.

Do the partnerships reflect on Chainlink’s network growth?

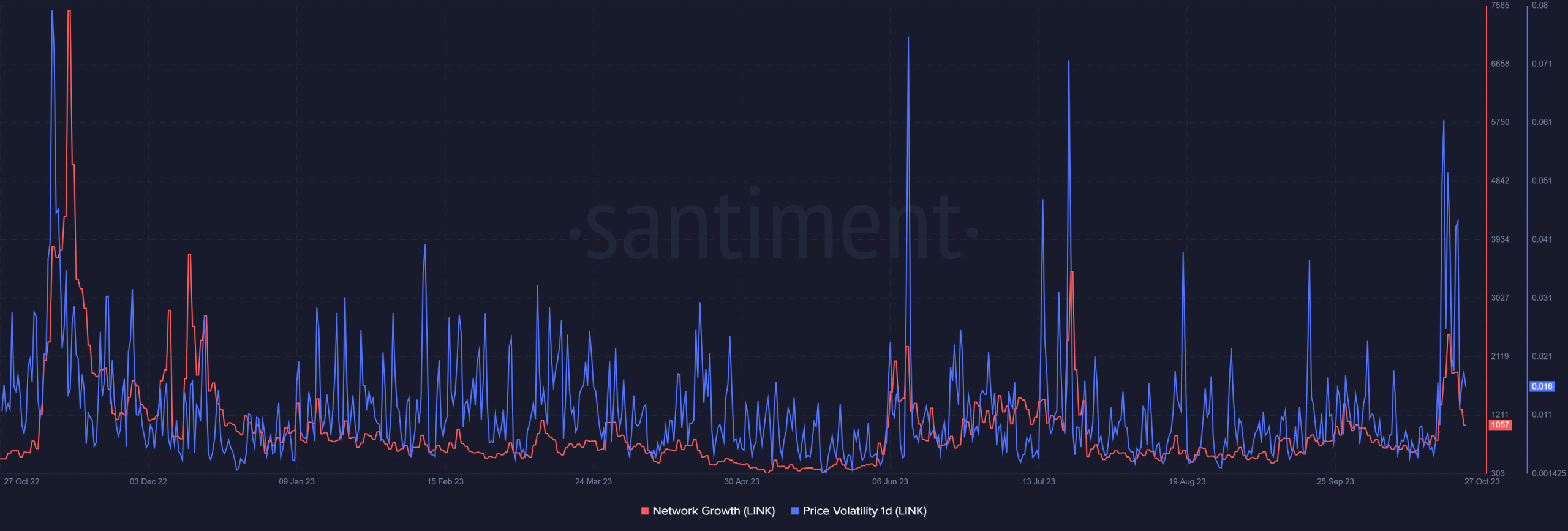

Chainlink’s Network Growth metric revealed that the largest spike in the last 12 hours was observed in November last year. Of course, there have been instances since then where network growth registers significant upside. It particularly occurs during periods in the market that are characterized by higher volatility.

The latest bullish surge in the second half of October resulted in a substantial uptick in Network Growth accompanied by a volatility surge. Meanwhile, the Network Growth is bound to affect LINK demand.

LINK has also been experiencing spikes in active addresses during those high-volatility instances. The largest spike in the last three years occurred in January 2023. That was when the market embarked on its first major rally since 2021.

The latest bullish rally in the last two weeks manifested as a relatively small spike in active addresses compared to its January spike. Nevertheless, LINK addresses have been growing. At press time, LINK had over $2.82 million addresses, notably higher than it did at the height of the 2021 bull run.

Is your portfolio green? Check out the LINK Profit Calculator

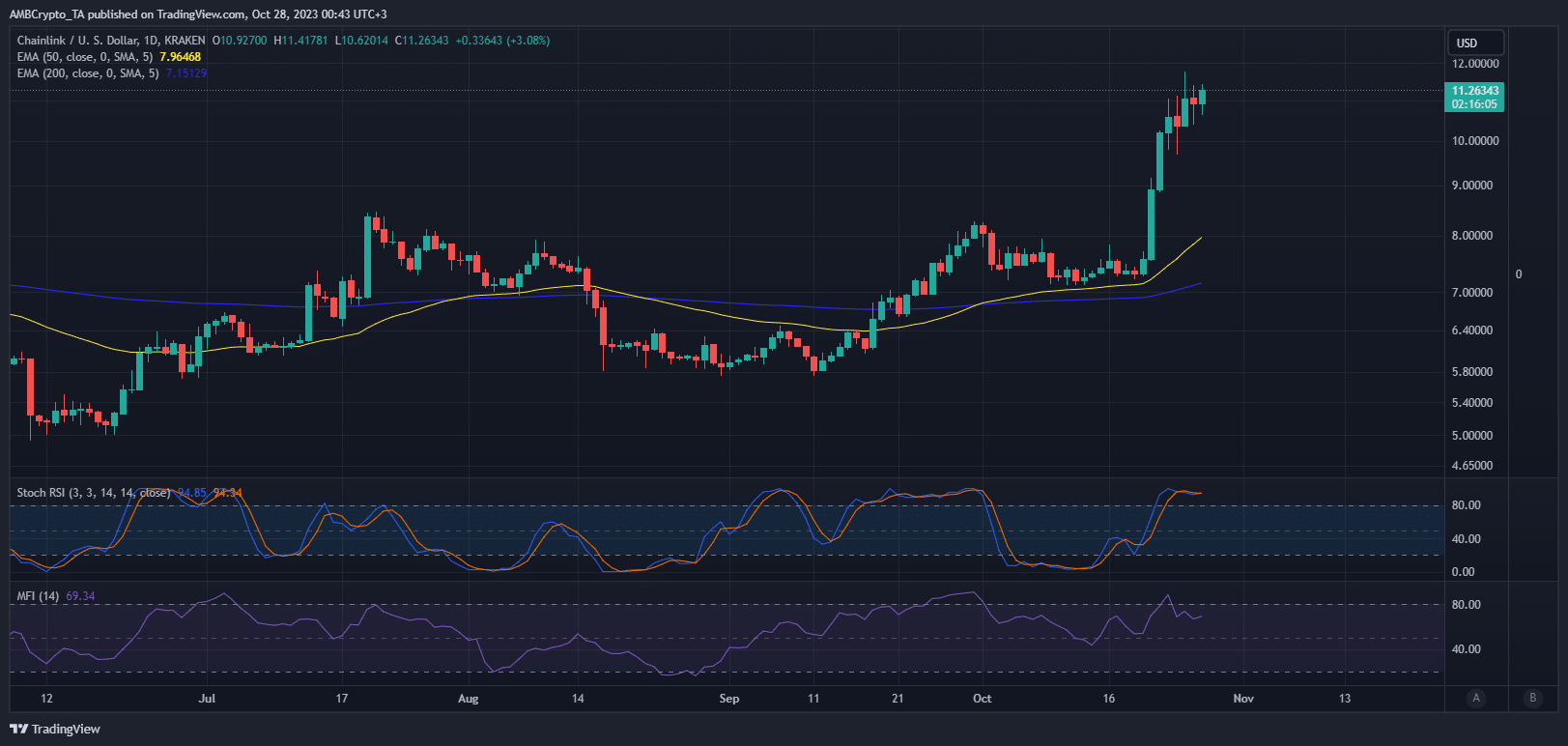

As far as LINK’s price action was concerned, it rallied by roughly 54% during the last seven days. Furthermore, the altcoin exchanged hands at $11.26 at the time of writing and was heavily overbought at that range. LINK’s Money Flow Index (MFI) revealed that some profit-taking manifested as outflows have been taking place in the last five days.

![Algorand [ALGO]](https://ambcrypto.com/wp-content/uploads/2025/05/EE821387-E6C9-4C21-A2AC-84C983248D2F-400x240.webp)