Will Curve [CRV] reclaim its short-term $0.5 high? Assessing…

![Will Curve [CRV] reclaim its short-term $0.5 high? Assessing...](https://ambcrypto.com/wp-content/uploads/2024/08/WEBP-CRV-1200x686.webp)

- Curve breaks out on the higher time frame.

- Why are big holders offloading amid upcoming altseason?

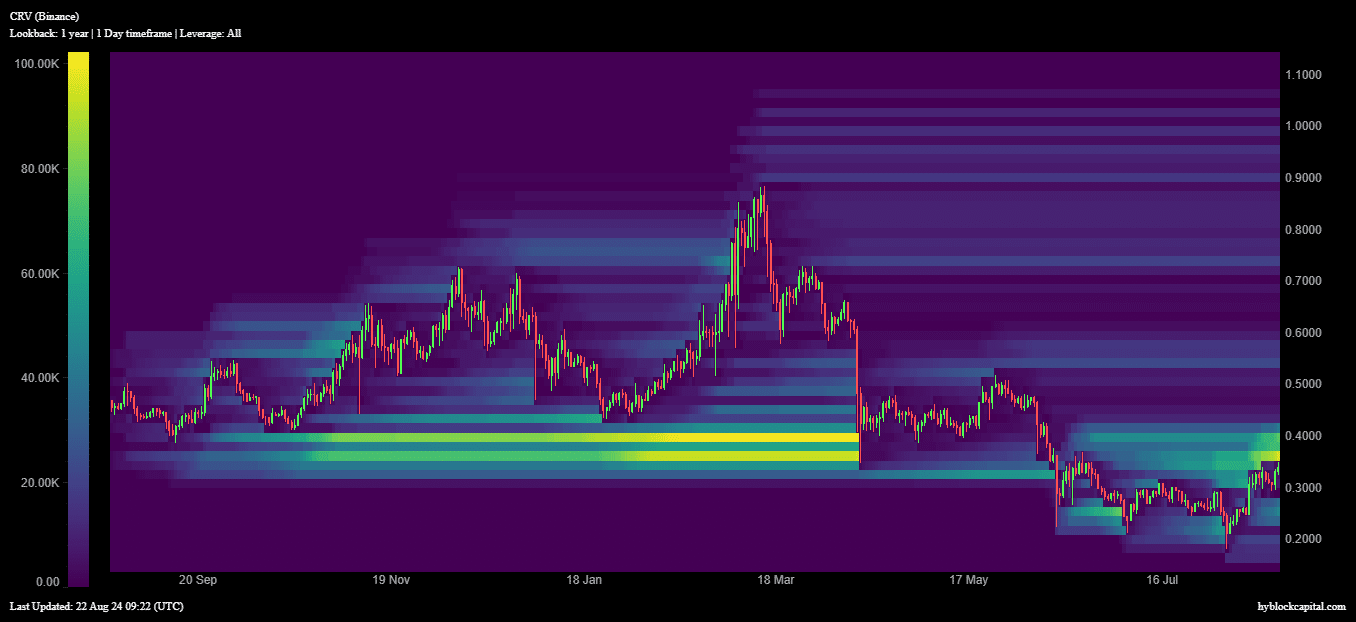

Curve [CRV] has recently broken out on the 2-day timeframe, signaling potential for a price increase. Using the Lux Algo indicator, CRV successfully retested the breakout level and now targets new highs.

After completing a five-wave bottom, CRV established support at $0.30, with resistance identified at $0.42. However, whether CRV will reach its short-term high of $0.50 remains uncertain.

CRV has also broken out of its consolidation at press time as well, with price action suggesting a possible retest of the $0.30 or $0.33 levels.

These levels may provide buying opportunities, though aggressive buying could be psychologically challenging for some investors.

Will altseason boost CRV?

The broader altcoin market is also showing signs of strength. Altcoins are on the brink of breaking out of a nine-month falling wedge on the weekly timeframe, a move that could further boost CRV’s price.

The total market cap of altcoins is currently at levels last seen in 2023, suggesting that a similar surge may be on the horizon. This could attract bullish momentum, potentially driving CRV higher.

Liquidation levels and market cap

CRV is slowly recovering, along with other cryptocurrencies, with liquidity resting at $22.36K around the $0.50 price level at press time. As CRV orders continue to be filled, reaching this level in the near future seems plausible.

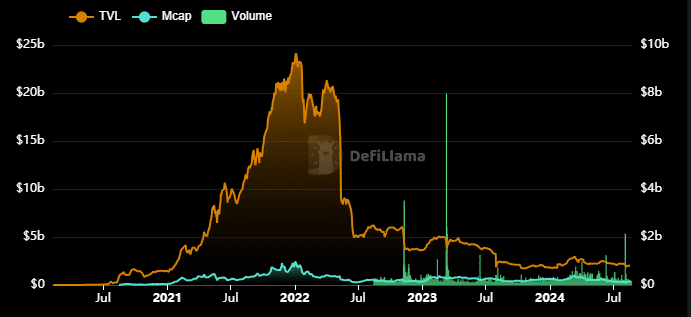

The press time market cap of CRV was $385 million, with a trading volume of $157 million. This resulted in a volume-to-market cap ratio of 42.22%, indicating high liquidity and a stable market with low volatility.

Despite these positives, the total value locked in CRV has remained low.

Are DWF Labs offloading CRV?

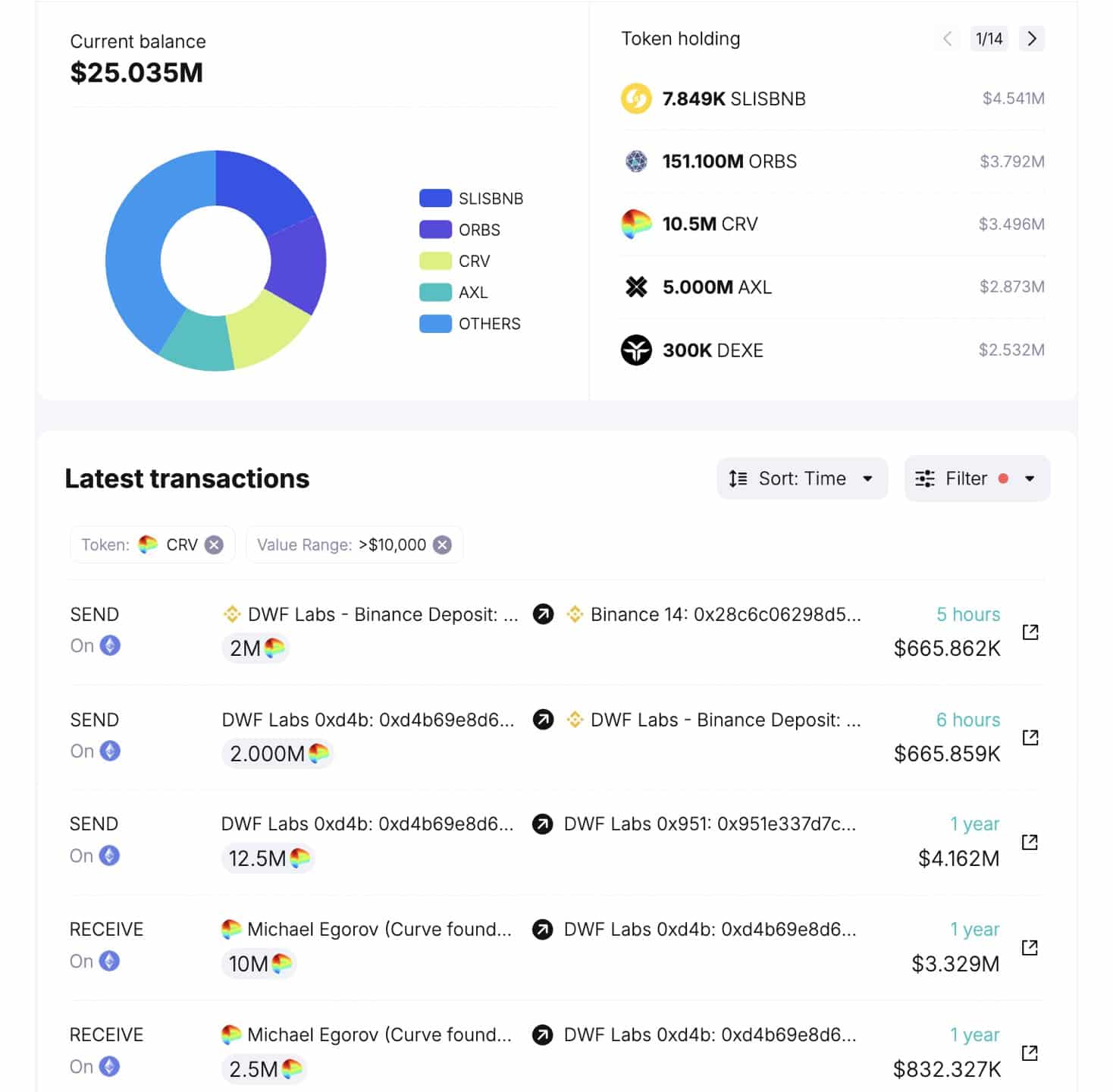

DWF Labs, a significant holder of CRV, recently deposited 2 million CRV ($683K) to Binance.

F0r the uninitiated, DWF Labs had previously purchased 12.5 million CRV from Curve founder Michael Egorov during a liquidation crisis and still holds 10.5 million CRV.

They currently face an estimated total loss of $824K (-16.5%) at the time of writing. It remains to be seen how DWF Labs’ actions will impact CRV’s price, but their potential sale of CRV could influence market sentiment.

Read Curve DAO’s [CRV] Price Prediction 2024 – 2025

While CRV shows promise, particularly with the potential breakout in the broader altcoin market, investors should monitor key support and resistance levels closely.

The next steps for CRV will likely depend on broader market movements and the actions of significant holders like DWF Labs.