Will LINK see a renewed zeal as Chainlink makes this key revelation?

- Chainlink’s CCIP yields favorable results in an experiment on tokenized assets.

- LINK bulls maintain dominance but could be jinxed as it is about to be overbought.

Chainlink [LINK] just announced that a new case study exploring the use of Cross-Chain Interoperability Protocol (CCIP) has yielded favorable results. The results of the study make a strong case for the world to upgrade from traditional settlement solutions such as SWIFT in favor of blockchain-based solutions.

How many are 1,10,100 LINKs worth today

Chainlink’s official statement revealed that the experiment successfully confirmed that CCIP can be used to facilitate cross-chain settlement using tokenized assets. The experiment involved Australia and ANZ Bank, a New Zealand-based bank that is also one of the largest banks in the world.

NEW INDUSTRY REPORT

This new case study showcases how ANZ Bank (@ANZ_AU)—one the world’s largest banks with $1+ trillion in total assets under management—successfully demonstrated cross-chain tokenized asset settlement with #Chainlink CCIP.

— Chainlink (@chainlink) September 28, 2023

The successful case study reportedly demonstrated how financial institutions can provide access to tokenized assets through blockchain technology. More importantly, it underscores a natural path through which banks can conduct cross-border settlements faster and with more efficiency.

The experiment also offered some perspective into how financial institutions can potentially leverage blockchain tech to explore new asset classes. Why is this important? Well, such institutions already have access to millions of potential customers.

Introducing such asset classes would create an on-ramp for billions’ worth of liquidity to flow into blockchain technology. Chainlink is thus at the cross-hairs of such a revolution and would benefit immensely through such an outcome.

Will this newfound Chainlink prospect support LINK’s upside?

Chainlink’s native token LINK maintained a strong bullish performance in September. For perspective, it rallied by almost 40% from its lowest price point to its price peak during the month. However, LINK’s rally could be due for a cooldown in the short run now that it was drawing closer to overbought territory. LINK exchanged hands at $7.80 at press time.

It is worth noting that the CCIP experiment underscores a potentially robust future for Chainlink. As such, news of the successful experiment may end up encouraging many LINK holders to sell and instead shift in favor of long-term hodling.

Read about LINK’s price prediction for 2024

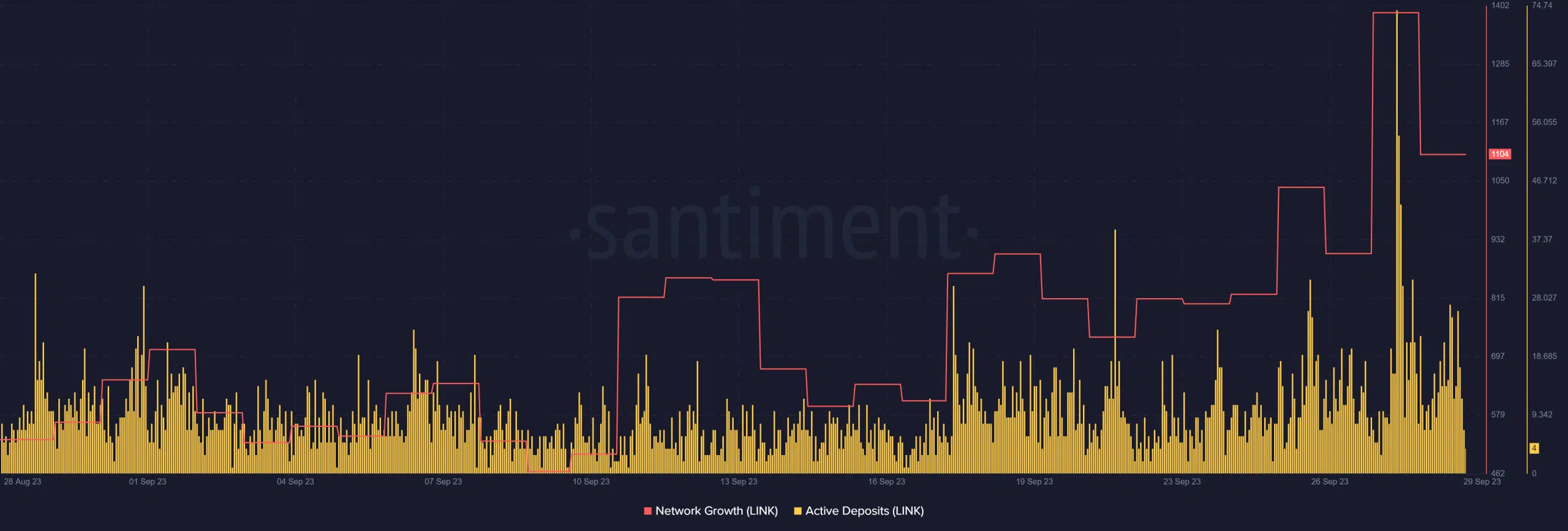

LINK’s bullish performance reflected the significant growth in network growth in the last four weeks. Network growth registered a monthly high on Wednesday, 27 September. That growth was accompanied by a surge in active deposits.

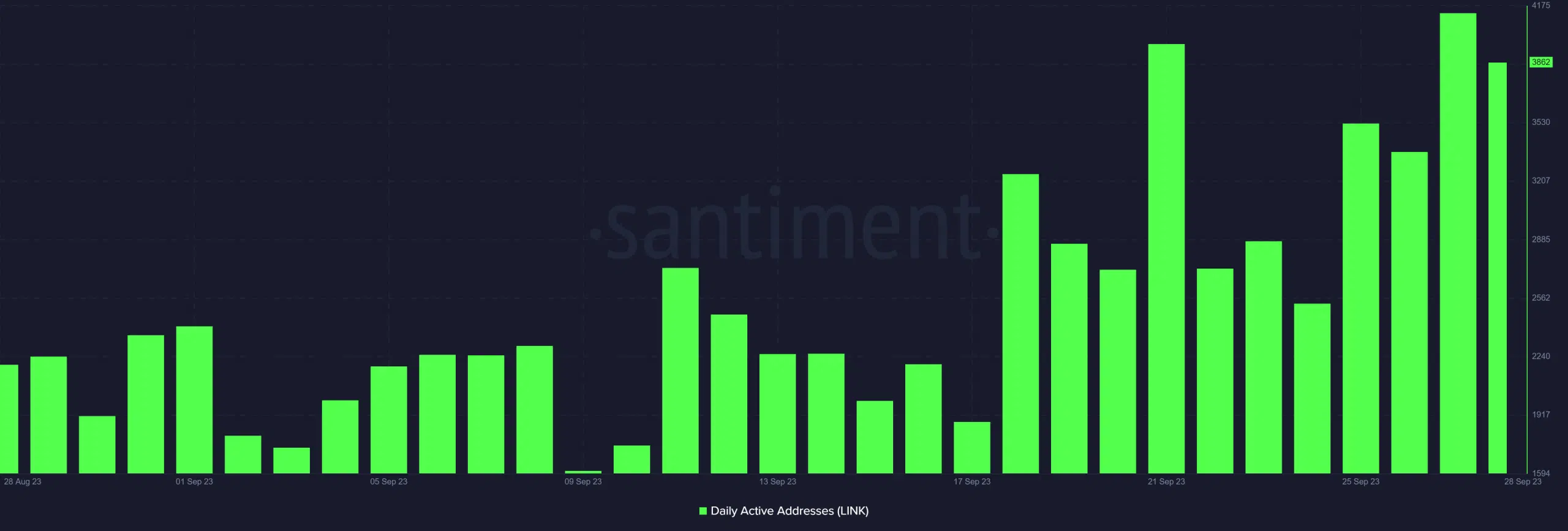

In addition, the number of daily active addresses has been rising during the same period. This underscores the improving level of confidence among LINK holders. The daily active addresses peaked at its current monthly high on 27 September.

The above findings suggested that more traders have been embracing the LINK token. However, most of the attention was centralized in the second half of September.