Will Litecoin [LTC] be a victim of market tittle-tattle as this investing guru says…

- Analyst declared Litecoin could face market wipeout, along with two other cryptocurrencies

- LTC traders opted for unbias as investor sentiment remained negative

Leader of the CNBC Investing Club, Jim Cramer, categorized Litecoin [LTC] as one of the cryptocurrencies that might not see the light of another day in the coming years. Appearing at an interview with CNBC’s Squawk Box, Cramer also added Ripple [XRP] and Dogecoin [XRP] to the list that could face an eradication.

"I think you should be negative on #crypto. I'm negative on $XRP, $LTC, and $DOGE because I haven't been able to find anyone that takes them," says @jimcramer. "It's like $80 billion worth of non-Bitcoin that's destined to be wiped out." pic.twitter.com/lrFbjtT0Wn

— Squawk Box (@SquawkCNBC) December 16, 2022

Read Litecoin’s [LTC] Price Prediction 2023-24

While speaking to the show host, Becky Quick, the “bull market finder” opined that his negativity was born out of investor disregard for the assets. Cramer’s judgment might, however, sound surprising especially as LTC’s value increased 9.38% in the last 30 days.

Besides, several developments followed Litecoin’s performance in between random social spikes. Nonetheless, it might also not be a shock since the investors had been a constant critic of other cryptocurrencies apart from Bitcoin [BTC] and Ethereum [ETH].

Traders prefer not to take a side

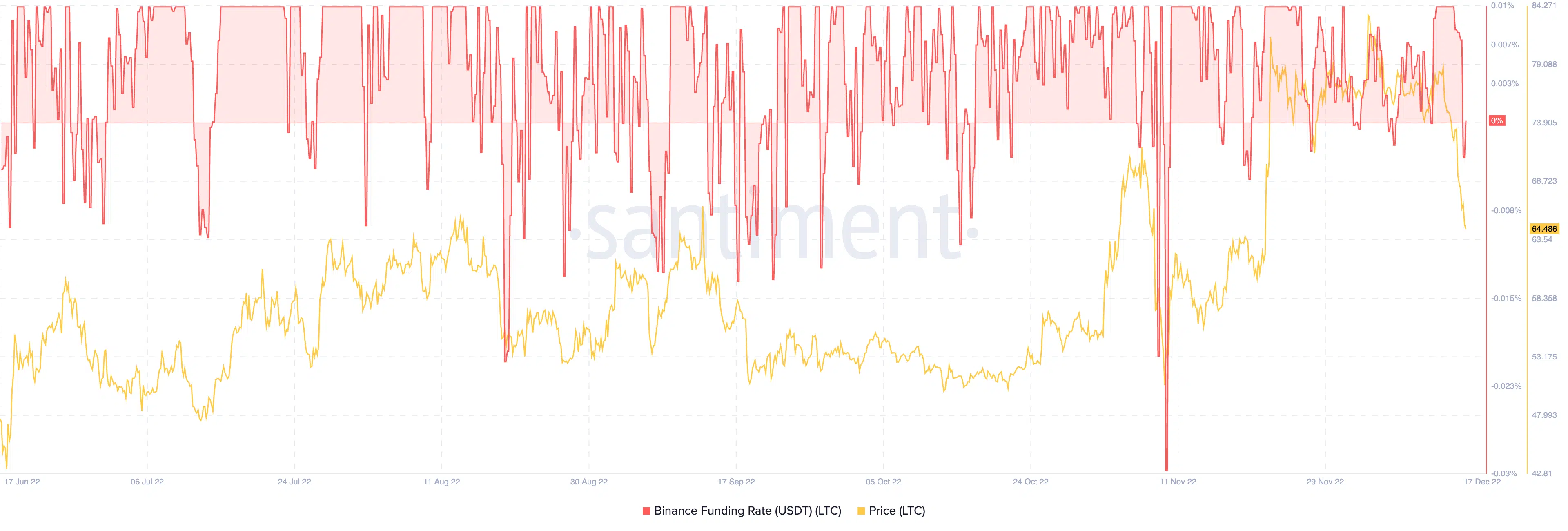

Heedless of the situation, Litecoin traders remained in a neutral position. According to on-chain data, Litecoin’s finding rate on the Binance exchange was 0% as of 17 December. As it was neither positive nor negative, it implied no dominance among short position and long position traders.

In the case of its open interest, Litecoin traders seemed to have changed their stance. As of 17 December, the 24-hour interest was primarily in decline. Data from Coinglass showed decreased attention towards LTC across several exchanges. Hence, Cramer’s opinion about nobody picking up interest in the coin appeared to have some elements of justification.

On further evaluation of traders’ activity with LTC, the derivatives information portal revealed that longs-shorts ratio was 0.95. The indicator illustrates the amount of Litecoin available for short sell against those literally sold. Additionally, it serves as a measure for projected investors’ expectations.

As of this writing, LTC’s short sell was 51.32% while long buy was 48.68%. Since it turned out to be a low ratio, it indicated negative investor expectations.

Now is the season to endure

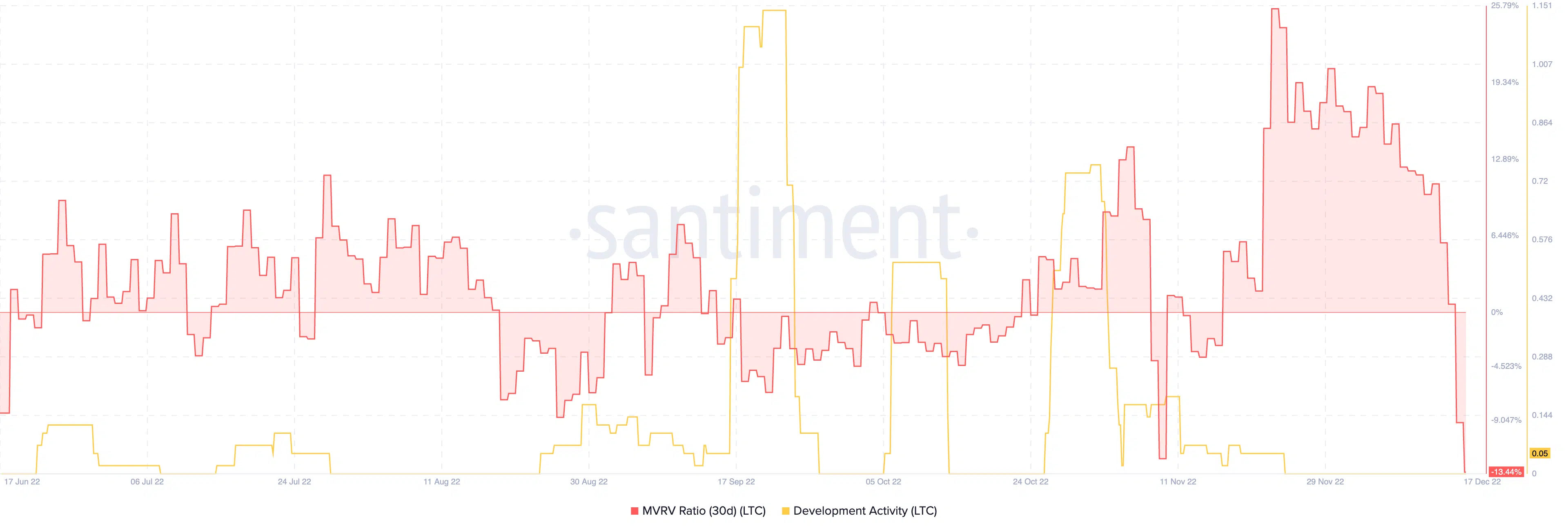

Indications from the 30-day Market Value to Realized Value (MVRV) ratio reflected massive dips in profit for holders since 23 November. Based on Santiment data, the MVRV ratio downhilled to -13.44%. This status implied that Litecoin was in a bubble territory where it did not show certainty with the coin’s value being fair or not.

Per its development activity, Litecoin remained settled in its flatline state since 25 November. Up to the time of writing on 17 December, development activity was 0.05.

Hence, Litecoin had not added any notable upgrades to its network. Nevertheless, the current market could be a bad season to conclude if Litecoin would be wiped out or otherwise.