Will MKR witness a price correction soon?

- MKR was up by more than 5% in the last 24 hours.

- However, metrics suggested that selling pressure on the token was high at press time.

Maker [MKR] had an astounding last week as it registered double-digit gains. This sparked excitement among investors, as they expected the token’s price to pump even further.

Read Maker’s [MKR] Price Prediction 2023-24

However, latest data revealed that the trend might end soon, as selling pressure on the token was increasing as of press time.

Investors are selling MKR

MKR witnessed a major boost in its price recently. According to CoinMarketCap, the token’s price surged by over 20% in the last seven days. Additionally, in the last 24 hours, the token’s price surged by over 5%.

However, the upward trend might end soon, if the latest data is to be believed. Notably, on 30 September, Lookonchain revealed that a smart whale deposited 5,000 MKR, worth more than $7 million, to Binance [BNB].

This smart whale deposited 5,000 $MKR($7.3M) to #Binance again 3 hours ago and still has 5,000 $MKR($7.3M) left.

The total profit is ~$4.77M(+32%).https://t.co/c68Lo8I32p pic.twitter.com/pfeGQaX0X2

— Lookonchain (@lookonchain) September 30, 2023

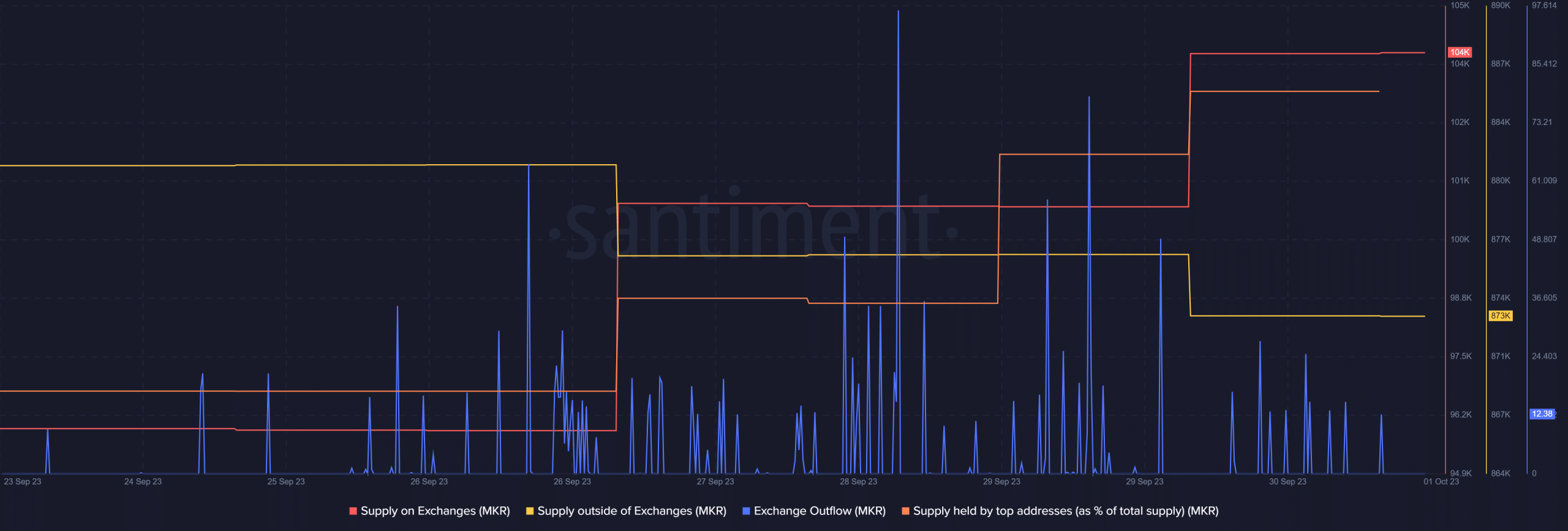

The fact that MKR was under selling pressure was further established with a look at Santiment’s charts. As per the data, MKR’s supply on exchanges rose, while its supply outside of exchanges dropped.

This meant that investors were actually selling their assets at a profit at press time, indicating a market top. Its exchange outflow, after a spike, registered a decline.

However, whale confidence in MKR was high, which was evident from the rise in its supply held by top addresses.

Going forward

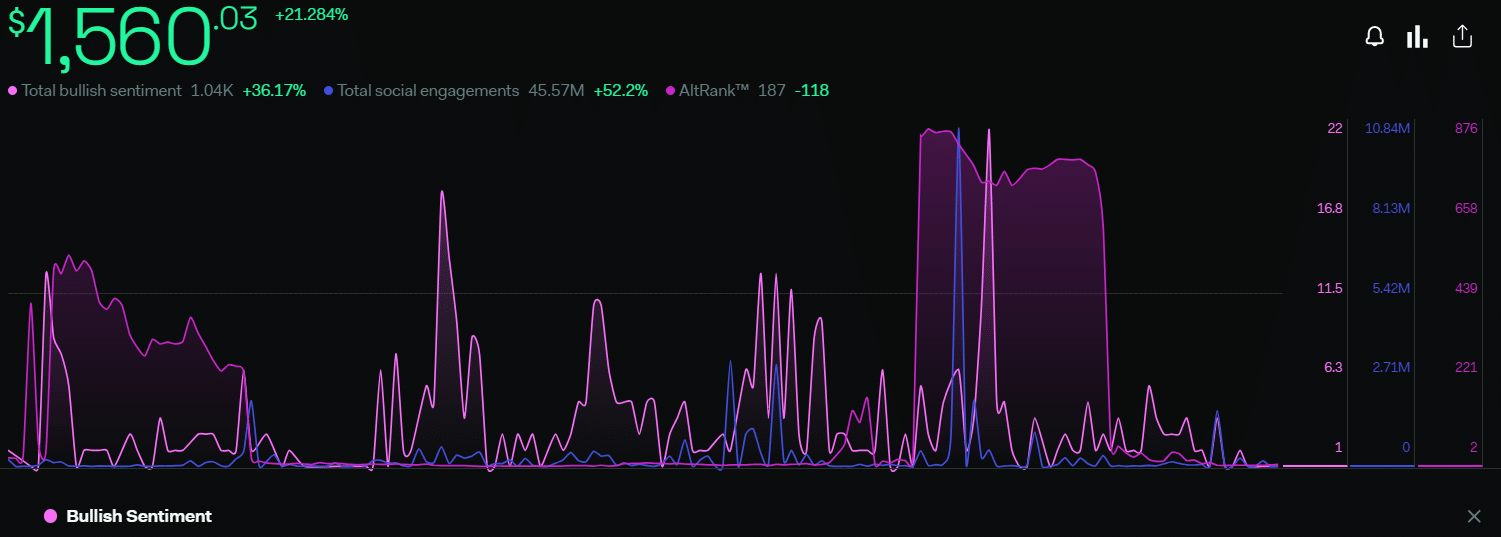

Though metrics looked bearish, market sentiment around MKR remained bullish. LunarCrush’s data revealed that total bullish sentiment around MKR surged by more than 36% over the last seven days. Additionally, its social engagement also spiked by over 50% last week.

Another bullish indicator was MKR’s Altrank, which also improved considerably last week.

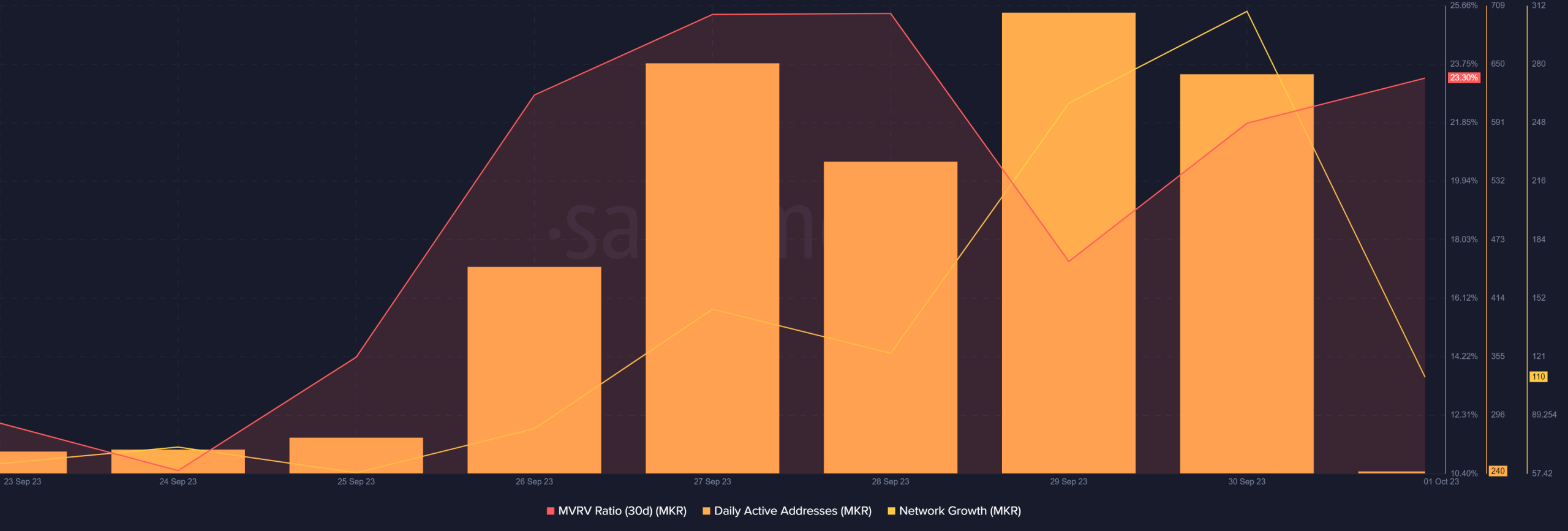

Apart from these, several other metrics also looked optimistic for the token. For example, MKR’s daily active addresses were high, reflecting high usage. The token’s network growth also remained high, meaning that more new addresses were created to transfer the token.

Maker’s MVRV ratio also improved last week, which was by and large a positive signal.

How much are 1,10,100 MKRs worth today?

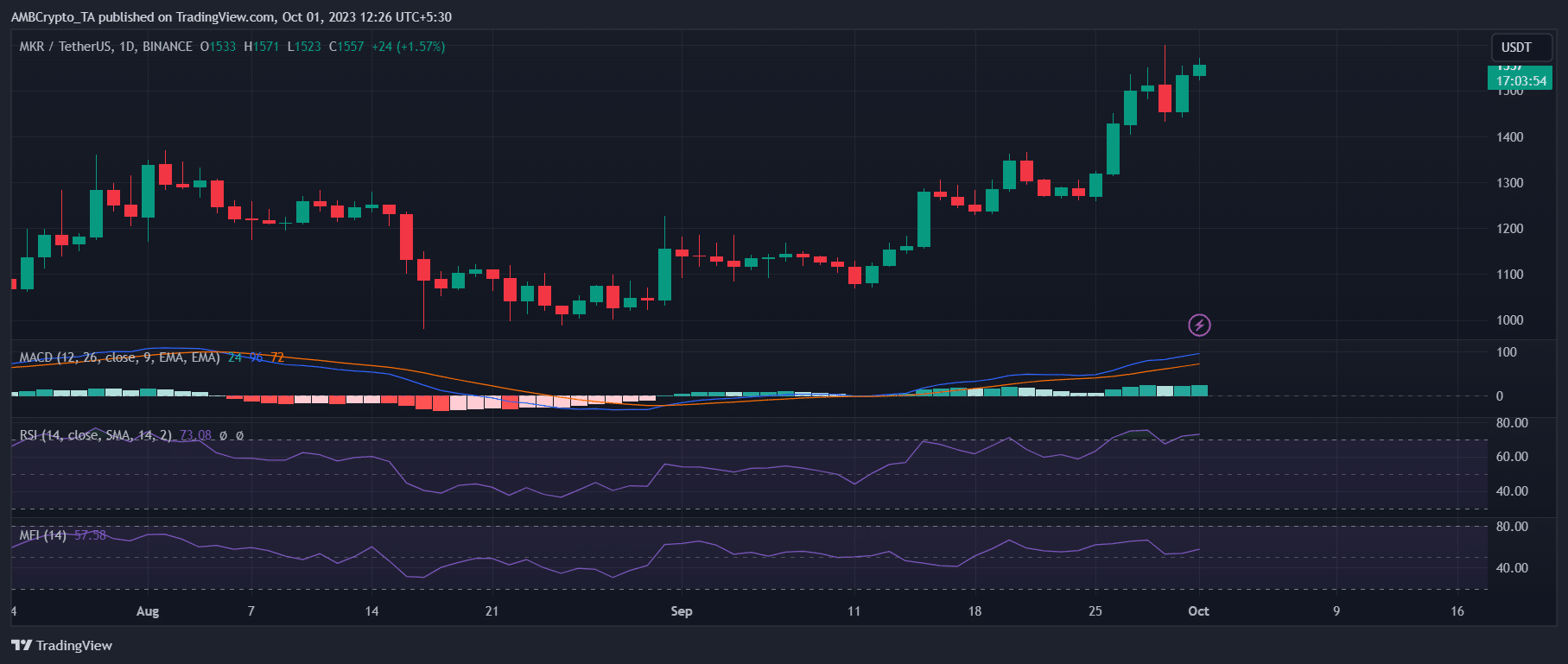

A look at Maker’s daily chart also pointed out a bearish indicator. The token’s Relative Strength Index (RSI) was in the overbought zone, which could increase selling pressure on the token and, in turn, push its price down.

However, a few of the metrics continued to be in the buyers’ favor. The MACD displayed that the bulls were leading the market. MKR’s Money Flow Index (MFI) also registered an uptick from the neutral mark, suggesting that its price might pump further.