Will ONDO slide down to $1.05 soon? Assessing major levels

- ONDO declined by 9.55% over the past 24 hours.

- With strong bearish sentiments, an analyst foresees a drop to $1.05.

Since hitting a local high of $2.1 a week ago, Ondo Finance [ONDO] has struggled to maintain an upward momentum.

Over this period, the altcoin has declined to $1.47. In fact, as of this writing, ONDO was trading at $1.51. This marked a 9.55% decline over the past 24 hours. Equally, the altcoin dipped by 19.70% on weekly charts.

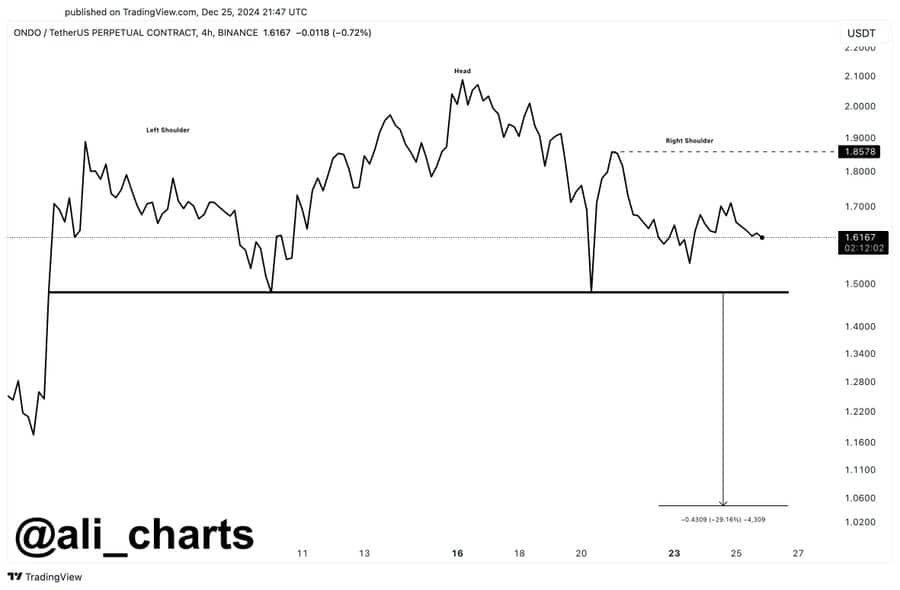

The recent market condition has left the crypto community predicting a further dip. Inasmuch, popular crypto analyst Ali Martinez has suggested a potential decline to $1.05 citing the head and shoulders pattern.

Market sentiment

In his analysis, Martinez posited that ONDO was forming a head and shoulders pattern at press time. Thus, if the altcoin closes below $1.48 it could lead to a 30% price correction to around $1.05.

For context, the head and shoulders pattern is a bearish reversal pattern that signals a potential price decline after making an upward movement.

A price drop below the neckline shows a potential drop equal to the height of the head from the neckline.

Therefore, ONDO must claim $1.86 as support to invalidate the bearish outlook. If it fails to do so, the altcoin will continue to decline.

ONDO: A look at the charts

Though the analysis provided above offered a bearish outlook, it’s essential to determine what other market indicators suggest.

According to AMBCrypto’s analysis, ONDO was in a corrective phase at press time, with strong bearish sentiments.

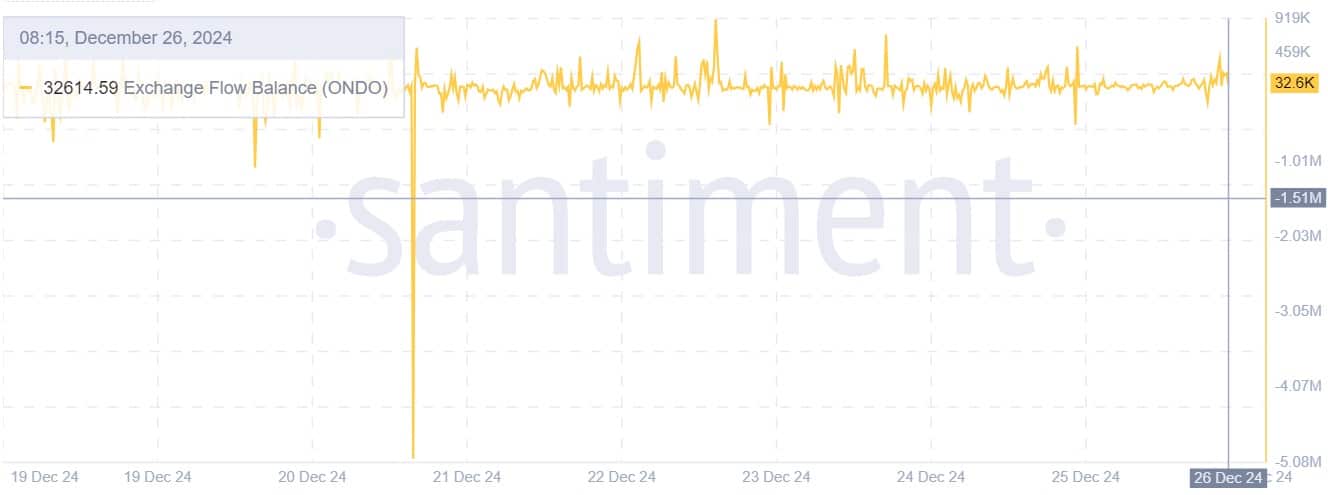

ONDO’s bearishness is evidenced by the rising exchange-to-flow balance. This implies that more traders are transferring more assets into exchanges, either to sell or preparing to sell.

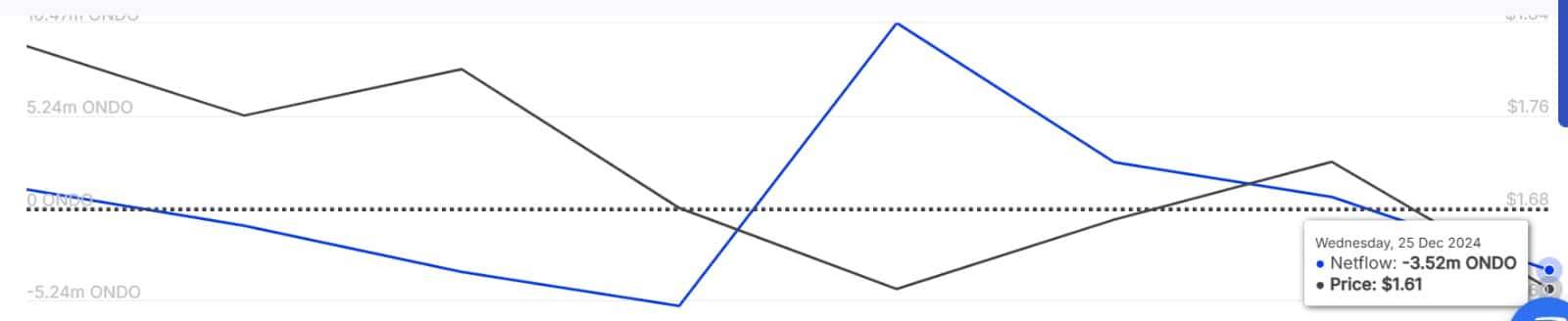

This flow to exchanges is even more prevalent among large holders. According to IntoTheBlock, large holders’ netflow has declined over the past week to -3.52 million.

This shows that there’s more outflows from whales, compared to inflows.

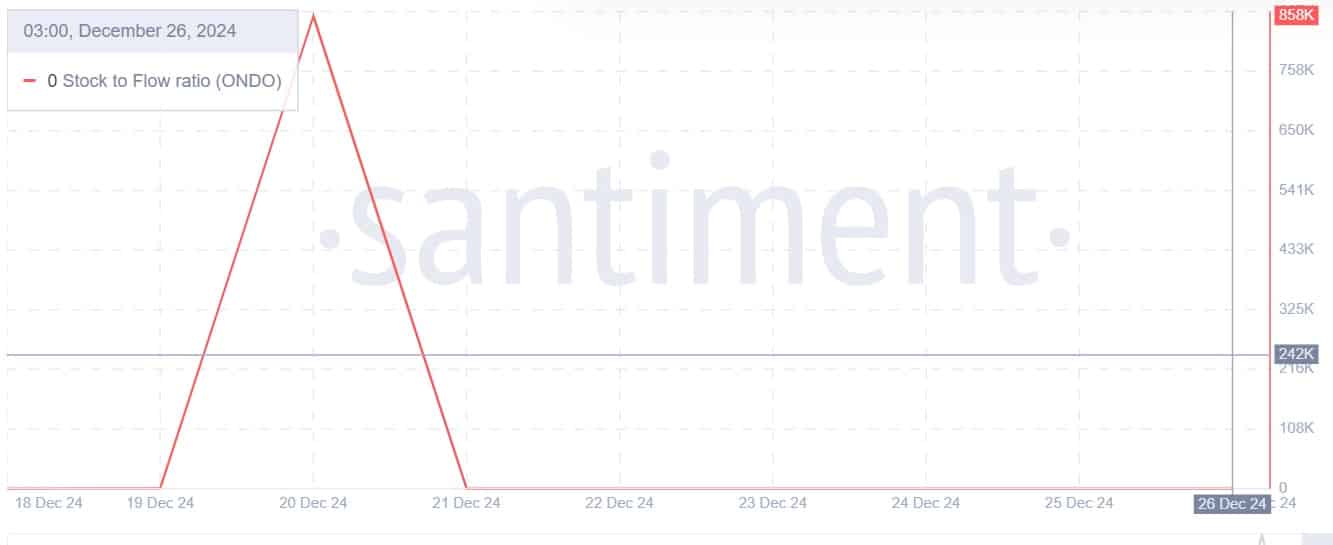

Additionally, ONDO’s NVT ratio with transaction volume has surged over the past days, raising overvaluation concerns.

This shows less participation with the network, with fewer transactions, fewer active addresses, and overall network usage.

Finally, the altcoin’s stock-to-flow ratio has signaled oversupply, further supporting our earlier observation of increased inflow to exchanges.

Read Ondo Finance’s [ONDO]Price Prediction 2025–2026

With ONDO being over-supplied, it risks further decline as it causes selling pressure.

If the current market conditions persist, ONDO will find support around $1.04. However, if the trend reverses, the altcoin will reclaim $1.7 in the short term.