Will Polygon be left behind as other L2 solutions grow?

- Polygon faces growing competition from newcomers, impacting its fee generation and DeFi standing

- Polygon’s Dragon Fruit update bolsters its competitiveness in the L2 scaling solutions arena

The Layer 2 scaling solutions sector has grown increasingly competitive with each passing day. Recent entrants like “BuildOnBase” have not only seen significant growth, but have also amassed substantial fees.

In the last 30 days alone, for instance, Base has led the pack in fee generation, raking in an impressive $4.06 million, surpassing other notable Layer 2 solutions like Starknet, Arbitrum, OP Mainnet, and Polygon.

Realistic or not, here’s MATIC’s market cap in BTC’s terms

No high fees for Polygon

Needless to say, Polygon’s performance in fee generation didn’t quite match up to its counterparts in the Layer 2 ecosystem. Understandably, this discrepancy raised pertinent questions about the future of Polygon in the context of Layer 2 scalability solutions.

Nevertheless, it’s essential to note that while Polygon may trail in fee generation, it excels in terms of overall activity and transaction volumes. In fact, according to data shared by Artemis, Polygon outperformed all other Layer 2 solutions in these crucial aspects, signalling its significant user engagement and network activity.

Despite its strong overall performance, however, Polygon did face particular challenges within the DeFi sector.

In this arena, Arbitrum has established dominance, leading in both Total Value Locked (TVL) and Decentralized Exchange (DEX) volumes. Over the past month, Polygon has also seen a notable decline in both TVL and DEX volumes, sparking concerns about its position and competitiveness within the DeFi landscape.

How is MATIC doing?

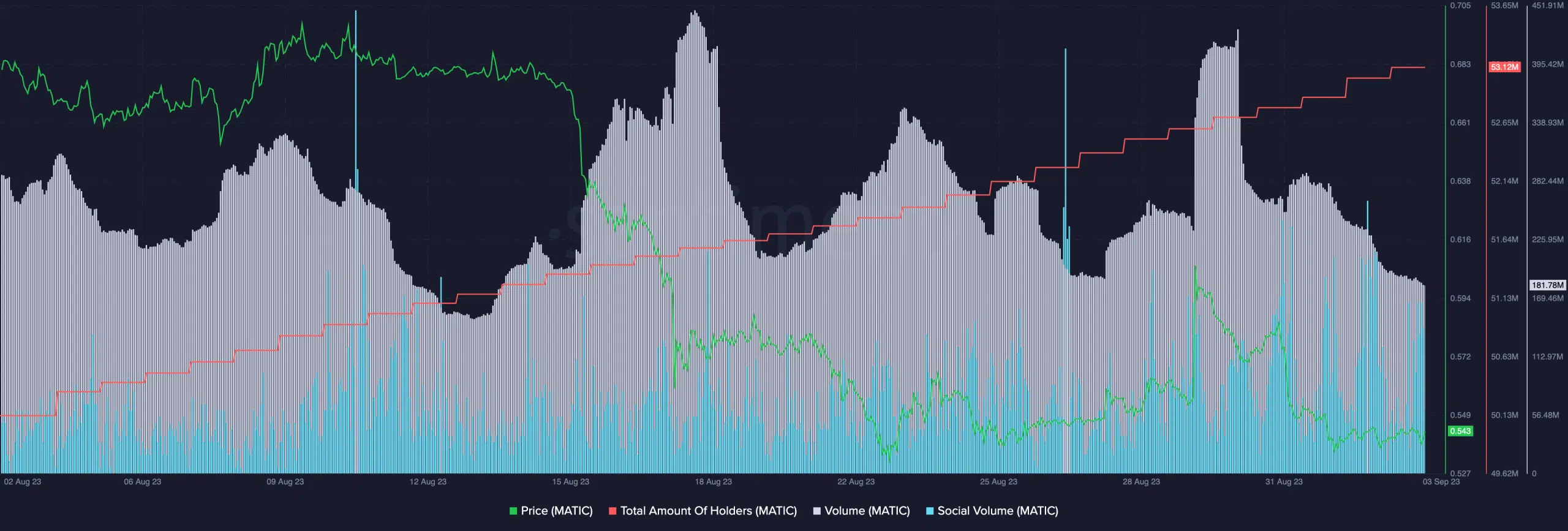

Shifting focus to MATIC, the native token of Polygon, it noted a considerable price decline over the past week, prompting concerns among investors and stakeholders.

Trading volume for MATIC has also dipped, suggesting decreased trading activity. However, amidst these challenges, a glimmer of optimism emerged as the number of MATIC token holders continues to rise.

More developments beckon

To bolster its competitive position and navigate the increasingly fierce Layer 2 landscape effectively, Polygon introduced the Dragon Fruit update, also known as ForkID5. This update incorporates two pivotal features that signify Polygon’s commitment to remaining a robust player in the burgeoning Layer 2 sector.

One of them is the PUSH0 Opcode Integration. Through the integration of the latest EVM opcode, PUSH0, originally included in the Shanghai hard fork, Polygon’s zkEVM Mainnet Beta remains up-to-date with the latest version of Solidity. This ensures Polygon’s continued compatibility with the Ethereum Virtual Machine (EVM) and the broader blockchain ecosystem, offering users a seamless experience.

Is your portfolio green? Check out the Polygon Profit Calculator

Another update is the RLP Parsing Fix. This would address a non-critical bug related to transaction parsing. Also, the Dragon Fruit update enhances the network’s overall reliability and performance. This critical improvement bolsters user confidence in Polygon’s capabilities, ensuring that transactions are processed efficiently and correctly.