With DeFi, two coins stand out YFI and Aave…here’s why

The past few months have seen significant growth in the cryptocurrency market. Despite short-term price correction that tends to punctuate the market, the overall price trend has been upward and DeFi tokens too have seen considerable growth in similar timeframes. DeFi’s total value locked illustrates this growth, having surged from over $700 million to close to $55 billion in a year’s time.

Within the DeFi space, two coins tend to stand out and have seen tremendous growth in the past 6 months. YFI and Aave have seen close to 600 percent growth forcing many to wonder how sustainable such price levels are in the long run.

While both tokens are invariably susceptible to the large price action of the crypto market, as evidenced in the past few days, both YFI and Aave how demonstrated considerable resilience in maintaining their current price levels.

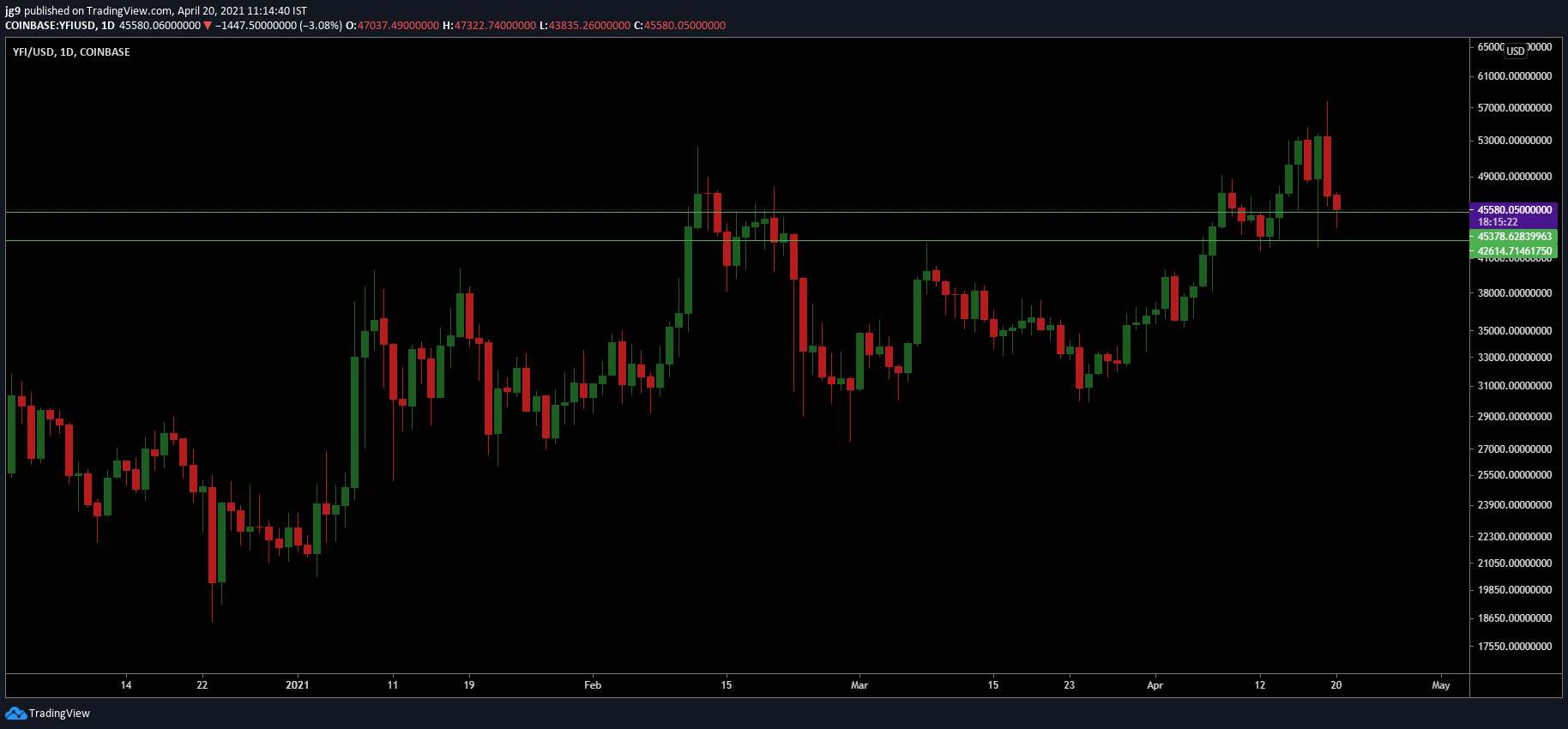

Source: YFI/USD, TradingView

YFI traded closer to the $50k price range in the past week but was victim to the bearish pressure that the entire crypto market felt in the past few days. This has pushed the price to over $45k at the time of writing.

However, the $42k – $45k price range cannot be discounted easily for the coin and is likely to be key in a bounce-back for the coin. This was particularly true even in the second week of February when YFI took a hit to its surging price and underwent a price correction.

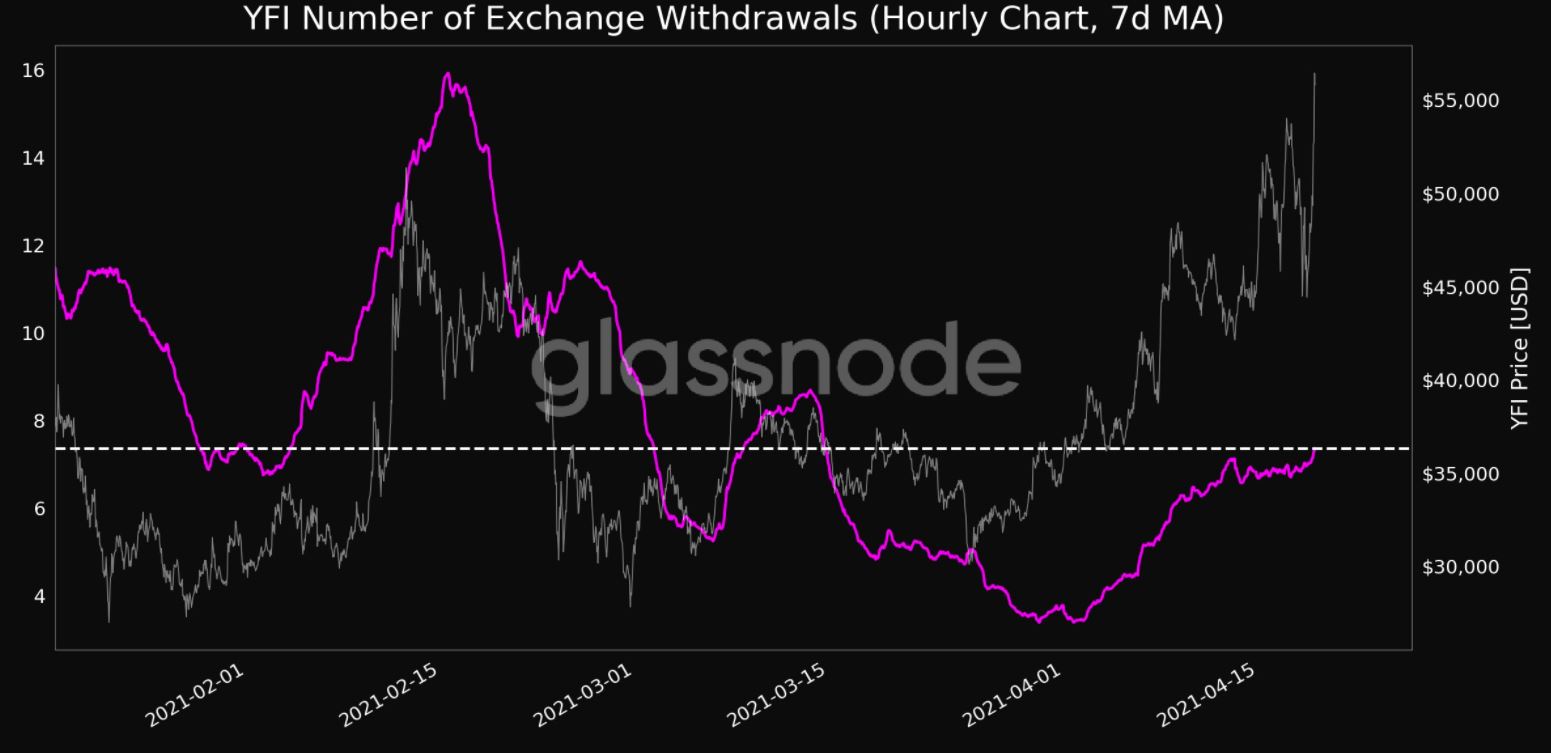

In addition to this data highlighted by Glassnode looks promising with regard to the hodler sentiment for YFI. According to the data, the coin has seen increase outflow from exchanges into non-exchange wallets and addresses.

Glassnode reported that the number of exchange withdrawals (7d MA) just reached a 1-month high and the move out of exchange wallets can be considered to be a sign of long-term investors displaying confidence not just in a YFI price recovery but also in its long-term prospects. This gives more validity to YFI’s ambitions regarding further price discovery beyond the $50k range.

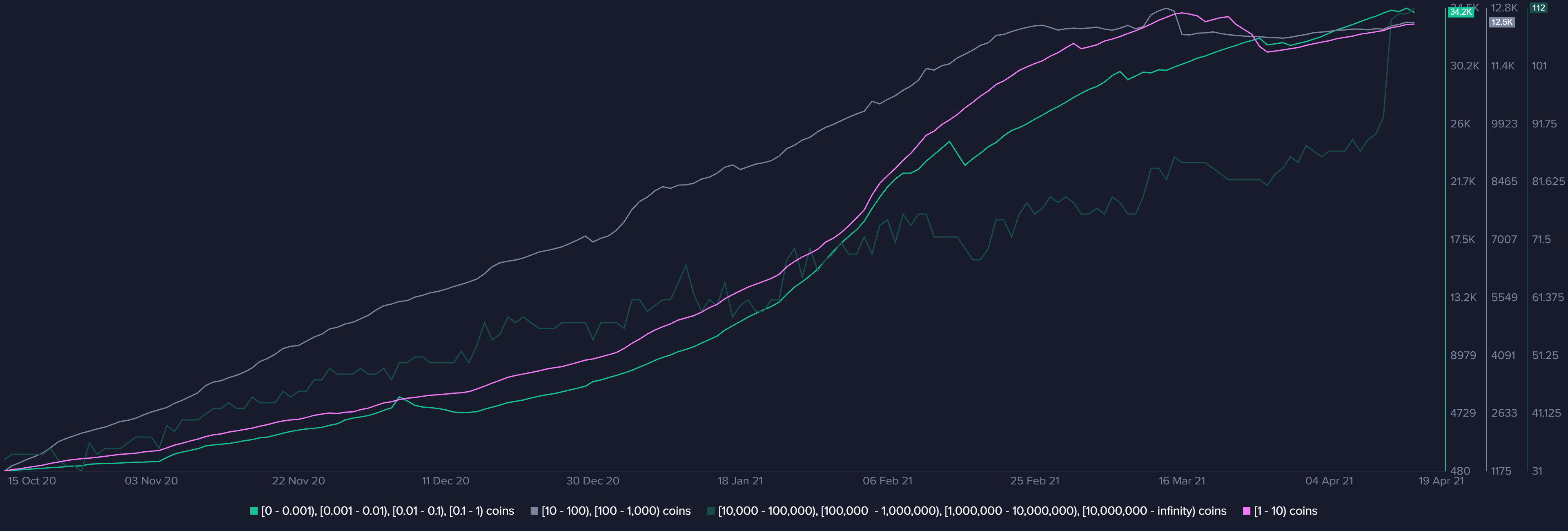

Source: Santiment

The case for Aave is also fairly similar. Aave saw a high of $470 on 16 April and since then began to move downwards and is currently trying to arrest the bearish momentum that has taken over its market.

In a recent report by Santiment, it was pointed out that in the past week that there was a surge in whale activity in the AAVE market. During the second week of April, it was noted that a massive spike of over 25 percent was registered in terms of the number of addresses holding more than 10k coins.

However given how quickly the tides turn in the crypto market, this could have partially backfired for Aave. With bearish pressure increasing in the market, a strong concentration of the asset in the hands of the large accounts could have magnified the implications of a bear market and makes it a bit more challenging for Aave to arrest the bearish moment and recover its losses.